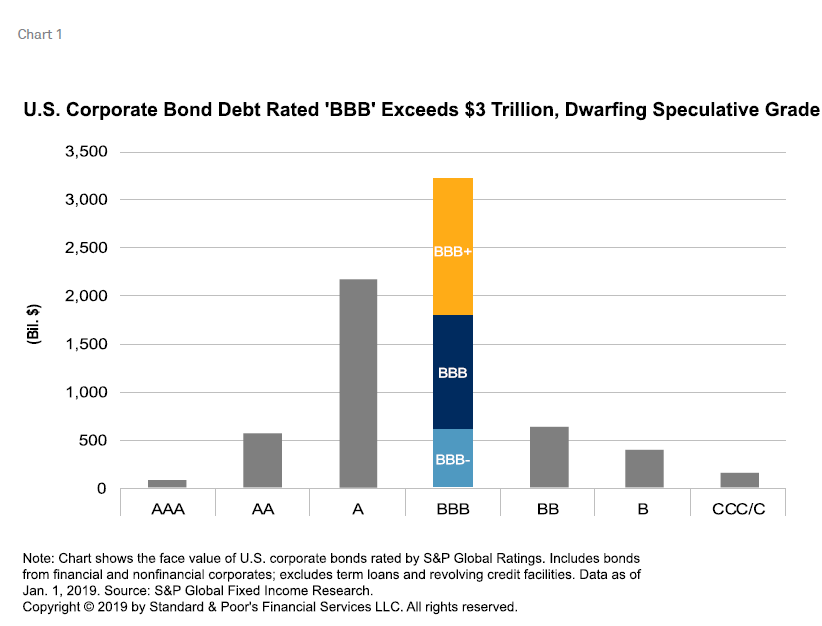

May. 29 2019 — The 'BBB' rating category is the largest among currently outstanding U.S. corporate debt instruments rated by S&P Global Ratings. Investors have increasingly focused on the growth of this category, the lowest within investment grade ('BBB-' or above), because of the risk that this debt could be downgraded to speculative grade ('BB+' or lower). With nearly $3.2 trillion in bonds and notes, the 'BBB' category accounts for the majority (53%) of investment-grade bonds in the U.S. The amount of debt in 'BBB' category bonds is more than two and a half times the size of the speculative-grade bond market. Retail investors are broadly exposed to these bonds through diversified mutual funds, exchange-traded funds, insurance, and pensions.

For this report, we looked at the size and structure of the 'BBB' corporate credit market in 2019. Below are the highlights of our research.

Downgrades

The average one-year downgrade rate for 'BBB-' companies in the U.S. is 9.4%. However, only 19% of 'BBB' category bonds are rated 'BBB-' (by dollar amount). Multinotch downgrades from 'BBB+' or 'BBB' are much less common than downgrades from 'BBB-'. The one-year average transition rate to speculative grade is 3% for 'BBB' and 1.4% for 'BBB+'. Although individual funding costs for a company rise after a downgrade to speculative grade, the speculative-grade bond market has shown the ability to accommodate large downgrades from the 'BBB' category in prior periods. For more information, please see "The U.S. Speculative-Grade Market Can Withstand 'BBB' Downgrades," published April 24, 2019.

Composition

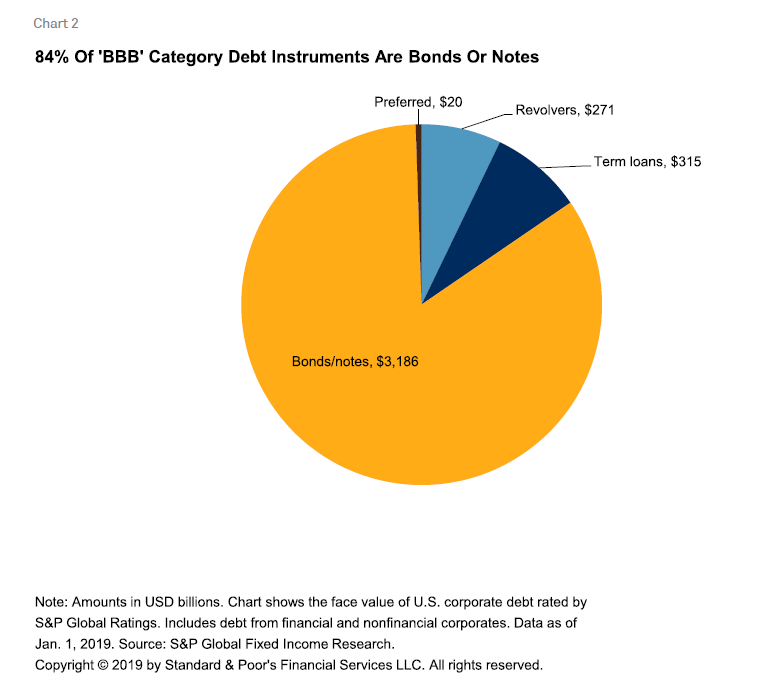

Bonds and notes account for the lion's share of 'BBB' category debt instruments, with 84% of the U.S. total. In addition to bonds, the 'BBB' corporate debt market in the U.S. includes $315 billion in term loans and $271 billion in revolving credit facilities (see chart 2).

Global Distribution

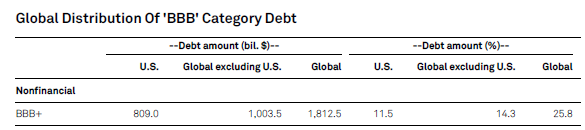

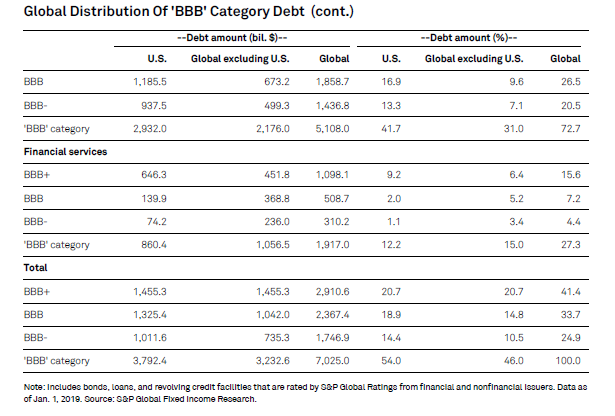

The majority of 'BBB' category debt globally is from U.S. companies, which account for 54% of the $7.0 trillion total. Globally, 73% of this debt is from nonfinancial companies, while 27% is from financial services (see table).

The 'BBB+' rating is the largest within the category, accounting for more than 41% of 'BBB' debt globally. While the level of 'BBB' category debt is high, only about 25% of this debt globally is at the lowest investment-grade rating of 'BBB-'. Just over $1.0 trillion in 'BBB-' debt is from U.S. companies (including $606 billion in bonds and $405 billion in term loans and revolving credit facilities).

Sector Distribution

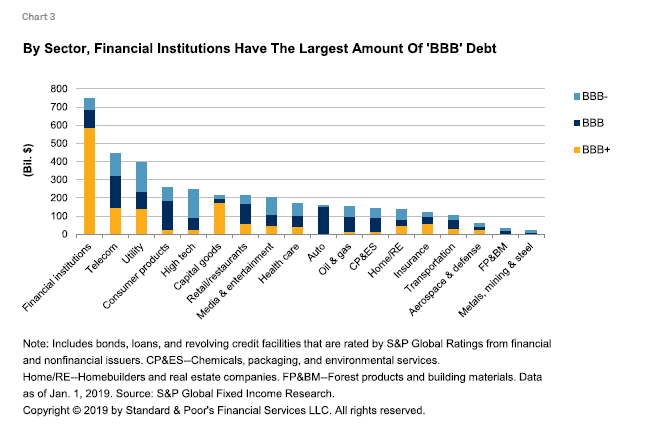

By sector, financial institutions account for $744 billion of 'BBB' category debt in the U.S. The majority (79%) of this debt is rated 'BBB+'. Much of this financial institutions debt is from the bank holding companies of large, systemically important financial institutions, including Citigroup Inc., The Goldman Sachs Group Inc., and Morgan Stanley.

Of the nonfinancial sectors, the telecommunications and utility sectors have the largest amounts of 'BBB' debt, with $445 and $394 billion, respectively. Meanwhile, the largest concentrations of 'BBB-' debt are found in the utilities sector (with $158 billion) and the high technology sector (with $152 billion) (see chart 3).

Upcoming Maturities

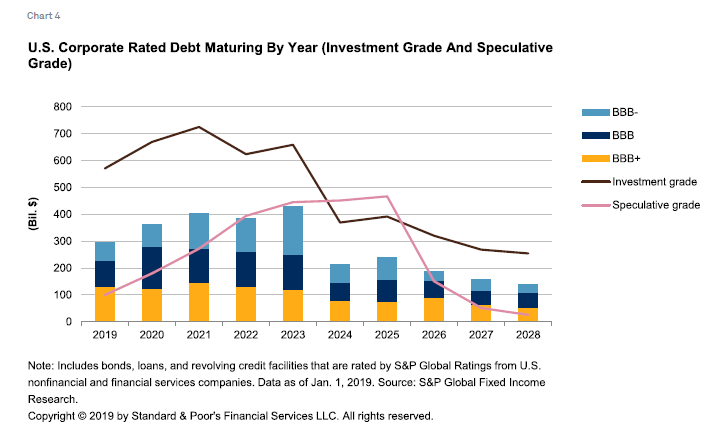

Nearly $1.9 trillion in 'BBB' category U.S. corporate debt is scheduled to mature through 2023. 'BBB' debt represents 58% of the total investment-grade debt set to mature in 2019-2023. Annual maturities for 'BBB' category U.S. corporate debt are scheduled to rise to a peak of $428.5 billion in 2023. Instruments rated 'BBB-' account for the smallest share of 'BBB' category debt maturing over this period, with $585 billion (see chart 4).

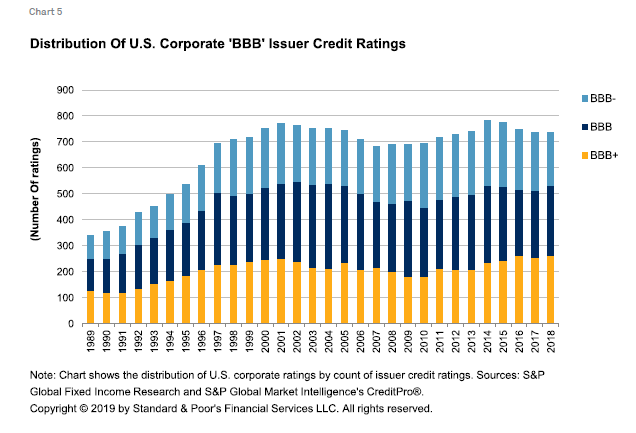

Rating Distribution

By issuer count, the majority of investment-grade corporate issuers in the U.S. are rated in the 'BBB' category (which consists of 737 issuers). Most of these companies are rated at least two notches above speculative grade, at either 'BBB+' or 'BBB'. With 206 issuers, 'BBB-' accounts for the smallest share of the 'BBB' category in the U.S., while the 'BBB+' and 'BBB' ratings together account for 72% of the category (see chart 5).