Amazon Highs and Lows

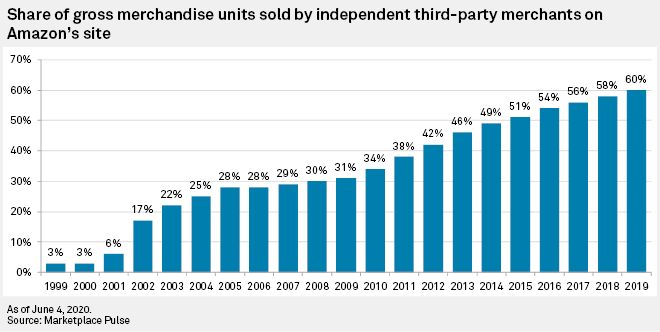

The third-party sellers that contribute to a majority of unit sales on Amazon.com Inc.'s site are diversifying their presence on other e-commerce platforms to reach more customers and capitalize off a coronavirus-induced online shopping boom, according to executives at those companies and analysts.

Many Amazon sellers were already expanding to other e-commerce platforms pre-pandemic. But experts say the crisis has prompted some sellers to accelerate those efforts and showcase goods on the growing third-party marketplaces of retailers including Walmart Inc., Target Corp. and eBay Inc. Others are looking to form new partnerships with shipping companies and e-commerce infrastructure providers like Shopify Inc.

An Amazon-J.C. Penney Deal Could Reinvent Retail Real Estate – Experts

Amazon.com Inc.'s quest to grow its real estate footprint and resolve the enduring last-mile delivery problem may lead it to the most troubled corner of retail real estate — the department store.

Read the Full ArticleAmazon Shares Could Reach New Highs if Q2 Revenue Jumps – Experts

Amazon.com Inc.'s already sky-high share price could rise even higher if the company delivers on expectations that its second-quarter revenue will surge on coronavirus-induced online shopping and a recent boom in cloud computing, experts say.

Read the Full Article

E-commerce Expansion

The surge in online spending during national lockdowns enforced to delay the spread of the COVID-19 virus will have a lasting impact on consumer behavior, according to the CEO of Europe's largest listed warehouse landlord.

David Sleath, CEO of Segro PLC, said during a first-half earnings call that the levels of online spending reached in recent months are unlikely to hold as lockdown measures are lifted, but that shoppers' recent increased exposure to e-commerce would rapidly accelerate its growth.

Scrambled Holiday Sales Calendar, E-Commerce Boom Await Retailers

The holidays are nearly four months away, but it is already clear that the coronavirus is forcing retailers to plan for a holiday season ruled by e-commerce, a shifted sales timeline and more conservative spending habits among consumers.

Read the Full Article

Sector Impacts

The COVID-19 pandemic forced consumer products companies to adapt to sudden changes in demand and periodic supply chain disruptions, but large branded staple companies were prepared and benefitted from the crisis.

The industry has dealt with a faster-paced environment for at least the past decade because digital platforms and the availability of co-packers lowered barriers to entry. That enabled small to midsize, agile, and digital savvy competitors to take share. At the same time, consumer tastes and preferences changed more rapidly. Large branded goods companies responded by investing heavily into digital capacities and logistics to serve customers both online and offline, and to become more nimble.

Moreover, they shifted their focus from cost cutting to top-line growth, and repositioned their portfolios for faster growth through investing more in innovation, renovating products, and acquisitions.

Apparel Brands Cut Back Orders, Portending Slow Holiday Season After COVID-19

Apparel companies are preparing for a slower end-of-year holiday season in the wake of the coronavirus, and they are managing their inventory accordingly.

Read the Full ArticleBank of America, Wells Fargo among US banks with high retail exposure

U.S. banks continued to disclose exposure to commercial retail borrowers as distress mounts in the space. Among reporting banks, Bank of America Corp., Wells Fargo & Co. and U.S. Bancorp remain the three with the highest nominal value of loans in the segment as of the end of the second quarter, even after their respective lending totals in various retail categories mostly declined from the first quarter, according to filings.

Read the Full Article

Looking at the Future

Nike Inc. is doubling down on efforts to grow online operations in the wake of the coronavirus crisis, with plans to strengthen its own e-commerce platforms while intensifying partnerships with leading retailers such as Foot Locker Inc. and Nordstrom Inc. to drive digital sales.

The efforts are poised to create a more agile, digitally oriented Nike amid a pandemic and forced store closures across North America, Europe and China that led to a drop in revenue and a net loss in the company's most recent quarter, experts say.

Even before the pandemic, the global athletic apparel giant benefited from a robust online business that surged as consumers moved online while stores were closed for months.

Unilever Adapts Product Mix, Supply Chain to Deliver Surprise H1'20 Results

The Unilever Group's strong revenue and profit performance in the second quarter of 2020 is a sign that it has nimbly adapted key parts of its product portfolio to meet new consumer demands while adjusting its supply chain and employee workflow to cope with the disruption triggered by the COVID-19 pandemic.

Read the Full Article

Sector Signs

The retail and restaurant sectors have been under stress for years. The default rate of speculative-grade issuers in these sectors has been 10% since 2017, when the U.S. and Canadian economy was still in its expansionary period. This compares to a more typical default rate of 2%-3% in the corporate sector during such benign times. Secular pressures from the growth of e-commerce, increasing competition for share of wallet, and the generational shift of spending on experiences have weighed on the retail sector. In restaurants, competition from grocers' prepared food offerings, changing millennial dining preferences, and delivery cost pressures have challenged the traditional casual dining and quick service restaurant (QSR) models. These pressures and private equity piling on debt have driven many restaurant ratings down over the past several years.

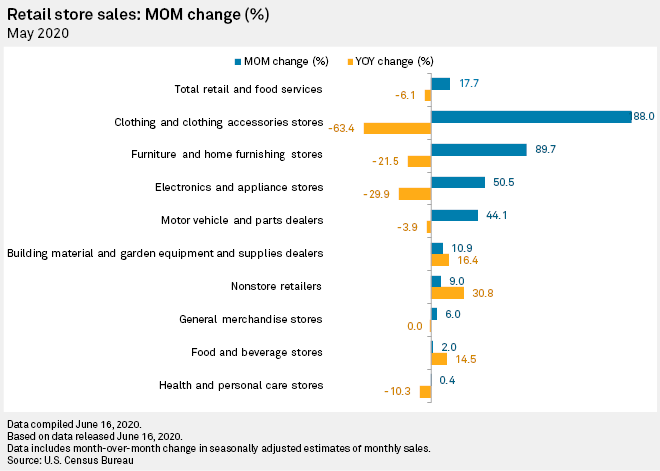

June Retail Market: US Sales Rebound in May; 6 Retailers Go Bankrupt

U.S. retail sales rebounded in May after three consecutive months of decline as the coronavirus lockdowns eased, but experts say the path to economic recovery would be long and full of uncertainties.

"The economy kicked off in May as retailers and other businesses reopened and both stimulus money and supplemental unemployment checks fueled spending driven by pent-up demand from two months of shutdowns," Jack Kleinhenz, chief economist at the National Retail Federation, said in a June 16 statement. "But full recovery is still a long way off."

Ratings in the global retail industry have a moderate exposure to environmental and social factors. Consumer behavior is a key facet in the impact of environmental and social factors (whether favorable or not). Customers' preferences, perception of brands, and demographics are risks because most products in the retail industry are discretionary.

Read More on this TopicU.S. Retail Property

If there was any doubt that a retail apocalypse was taking place before the coronavirus-related economic shutdown, it is now impossible to deny the retail space is facing profound change.

"Things are extremely fluid right now in the retail sector as a whole, and that covers all retail property types," Tom Dobrowski, vice chairman of Newmark Knight Frank's capital markets group, told S&P Global Market Intelligence.

The nation's malls and shopping centers are beginning to reopen after a weekslong closure to stem the spread of the coronavirus, but there will be many vacant shops and department stores, and there is no telling how long it will take for foot traffic to return. The last three years have already seen plenty of retailer bankruptcies as outmoded concepts shriveled, and analysts expect many more in the coming months.

US Banks Disclose Retail Exposure as Distress Mounts in the Space

The inventory of distressed retail assets is increasing as the COVID-19 pandemic deepens, and many banks are disclosing their exposure to the industry.

By nominal amount, Bank of America Corp., Wells Fargo & Co. and U.S. Bancorp are among the U.S. banks with the most exposure to commercial retail borrowers. And there are signs the sector is struggling.

EMEA Retail Property

European retail landlord Klépierre will not allow a turnover-rent business model to be forced on the company despite growing pressure from the retail industry, Chairman Jean-Marc Jestin said during a first-half earnings call.

The France-based landlord, which owns a portfolio of retail assets worth €22.83 billion across Europe has been severely impacted by the COVID-19 pandemic, which forced the lockdown of many of its properties. Many of its tenants have been unable to pay rent for the second and third quarters of 2020 due to the loss of income.

UK Retail Property Faces Bleak Future as Occupiers Emerge from COVID-19 Rubble

If the recent behavior of shoppers on London's Oxford Street is anything to go by, one could be forgiven for thinking that business has never been better for U.K. retailers. In scenes reminiscent of the now-annual Black Friday rush in the U.S., scores of bargain hunters crowded through store entrances June 15 as retailers reopened after a three-month closure to combat the spread of COVID-19.

Read the Full Article

Re-Openings Look Unpromising

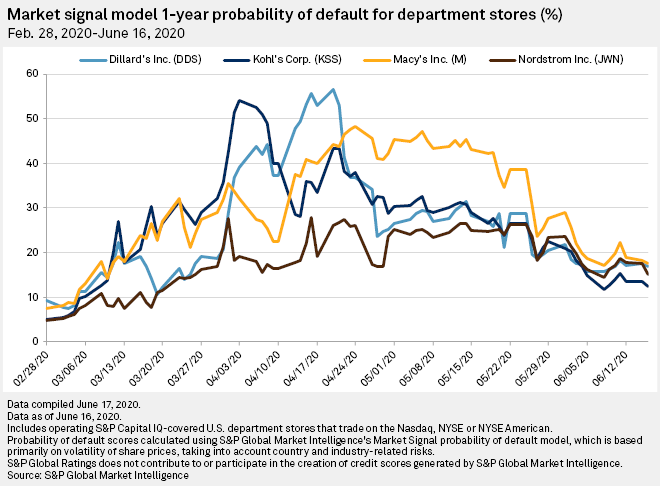

Department stores' probability of default has declined since the height of coronavirus-prompted store closures in April and after multiple bankruptcy filings in the industry.

The one-year median probability of default for department stores fell to 15.96% as of June 16. This was down from 43.85% on April 20 — the highest point for the sector since the start of the coronavirus pandemic. Yet the probability of default for department stores remains higher than the probability for the consumer discretionary sector writ large.

As Stores Reopen, US Retailers Retool Their Workforces in Coronavirus Era

U.S. retailers will be retooling their workforces as they reopen stores in the coronavirus era, adding new roles to advance online operations and altering customer-facing positions to accommodate social distancing measures, experts say.

Pre-pandemic, many e-commerce companies and big-box retailers were taking steps to enhance digital operations by adding jobs focused on contactless curbside pickup and buy online, pick up in-store services. Amazon.com Inc. and Walmart Inc., for example, have been collectively adding thousands of workers to fulfill online demand and enhance their distribution networks.

But experts say the COVID-19 pandemic will likely accelerate efforts among a greater number of brick-and-mortar retailers, from department stores to boutiques, to add workers to support digital operations while ensuring a safe shopping experience in reopened physical stores.

Recovery

The 2020 global corporate default tally has reached 134, after two issuers defaulted since our last report. The defaulters included Orlando, Florida-based consumer products manufacturer Tupperware Brands Corp. and Houston, Texas-based frac sand mining company Hi- Crush Inc.

With the default of Tupperware, the U.S. and Europe consumer product default tally has eclipsed the numbers of each of the last six years with 21 defaults in 2020 so far. Prior to the COVID-19 pandemic, consumer durables and apparel companies were already facing challenges due to changing consumer preferences and greater price transparency amid a growing online marketplace. There will likely be additional pressure, and we will likely see defaults among speculative-grade issuers, especially those with sizable near-term maturities due to limited access to the debt markets.

Retail REITs Will Contend with Retail Distress Until at Least 2021

Retail REIT-specific rating actions thus far in 2020 have largely been downgrades on issuers with immediate liquidity, covenant, or credit protection measure issues, as well as several outlook revisions--mostly negative. We now have negative outlooks on 29% of our rated North American retail-focused REITs (up from 10% in December 2019), largely attributable to U.S. mall and outlet centers exposed to non-essential and distressed retailers.

Read the Full ArticleConsumers Positive on Economy in June, but COVID-19 Resurgence Looms – Survey

Consumers were optimistic about the U.S. economy's recovery prospects heading into the summer but most of them plan to keep pulling back their spending for the near-term, according to a poll conducted by 451 Research, an offering of S&P Global Market Intelligence.

Read the Full ArticleConsumer Edge is a weekly collection of critical developments across the automotive; retail; and food, beverage, and tobacco industries that draws on exclusive analysis and value-added content from the Consumer News team at S&P Global Market Intelligence.

Subscribe to the NewsletterConsumer Changes

China's swift rebound from the economic disruption caused by the COVID-19 pandemic and continuing global travel restrictions look set to further increase both the level of spending on luxury goods taking place on the mainland and the country's importance to the industry's major companies.

Chinese consumers accounted for about 35% of the global personal luxury market in 2019, yet just 11% of the purchases were made on the mainland, according to consultancy Bain & Co. and Italian industry body Altagamma. Much of Chinese citizens' luxury spending has typically taken place in Hong Kong and various European cities during vacations.

Tencent Targets China's 'Live Shopping' Trend with Platform Changes

As livestream shopping gains popularity in China, local internet company Tencent Holdings Ltd. is looking to take a larger slice of the action by integrating its video and e-commerce platforms.

Read the Full ArticleConsumers Want to Get Back to Shopping in Stores but are Wary on Travel – Survey

Consumers are still scaling back on their spending, but they are eager to head back to hair salons and physical stores as coronavirus-inspired restrictions on movement start to ease, according to a new survey.

Read the Full Article