Discover more about S&P Global’s offerings

The closest area of similarity between President Trump and former Vice President Biden is in the two candidates’ focus on employment and geopolitics as drivers of trade policy.

Both Biden and Trump have clearly stated tough-on-China stances.

While much of the focus has been on the Executive, the makeup of the House and Senate will also have a critical impact on the direction of trade policy.

The results of the U.S. elections on November 3 could radically alter trade policies and their impact on supply chains no matter who wins, with both the up- and down-ticket races making a difference. This report summarizes 20 previous Panjiva research articles comparing the two presidential candidates’ positions and identifies the issues and relationships to watch in the coming months.

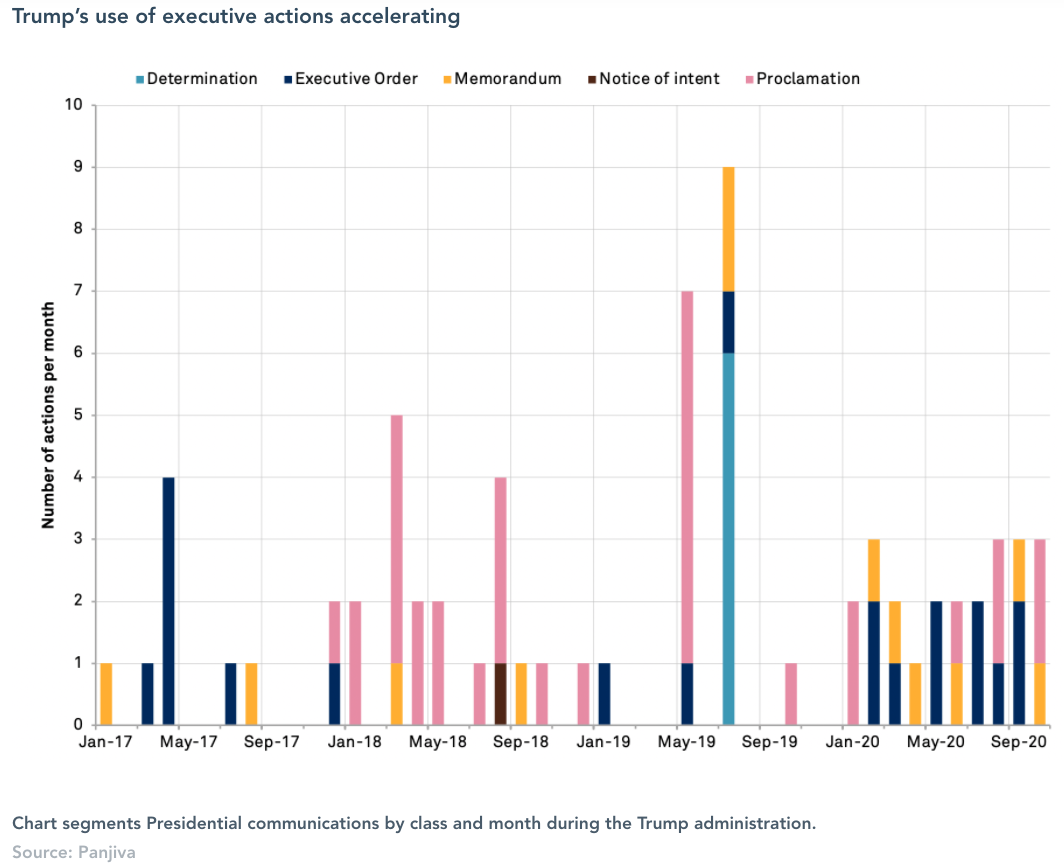

Like many Presidents faced with a split House and Senate, President Trump has widely utilized independent actions. That’s been particularly relevant in the trade arena where Congress has delegated authorities over tariffs and trade negotiations to the President. A second Trump administration would likely continue the use of independent powers to apply tariffs and implement “mini” trade deals that have not had Congressional approval.

A Biden administration could rapidly overturn a wide range of existing measures. The Trump administration’s “special” tariff programs, discussed in Panjiva’s research of Oct. 8, have been the major trade policy vector and include: section 201, safeguarding, measures in solar panels and washing machines; section 232, national security, measures in steel and aluminum; and section 301 duties applied against China and held in abeyance against France.

Ongoing investigations in other areas, such as the section 301 review of Vietnam, could also be abandoned, while trade negotiations – see below – could also be reviewed, continued or abandoned.

Panjiva’s analysis of Presidential filings shows the Trump administration has applied 70 Executive Orders, Presidential Memoranda, Notices of Intent, Proclamations and Determinations to apply trade policy.

Those range from the initial notice to leave TPP through the adaptation of steel and aluminum tariffs to securing critical minerals and have been used with increasing frequency in 2020 in part to manage sourcing during the pandemic. The President’s decision to withdraw from the Paris Agreement on climate change has also precluded a wide-ranging trade deal with the EU.

All those decisions could be rapidly unpicked, where deemed necessary, by a Biden administration.

The closest area of similarity between President Trump and former Vice President Biden is in the two candidates’ focus on employment and geopolitics as drivers of trade policy. Proclamations by either on those topics may have implications for supply chains and are likely to be focused towards (a) tackling relations with China, as noted below and (b) encouraging onshoring of manufacturing.

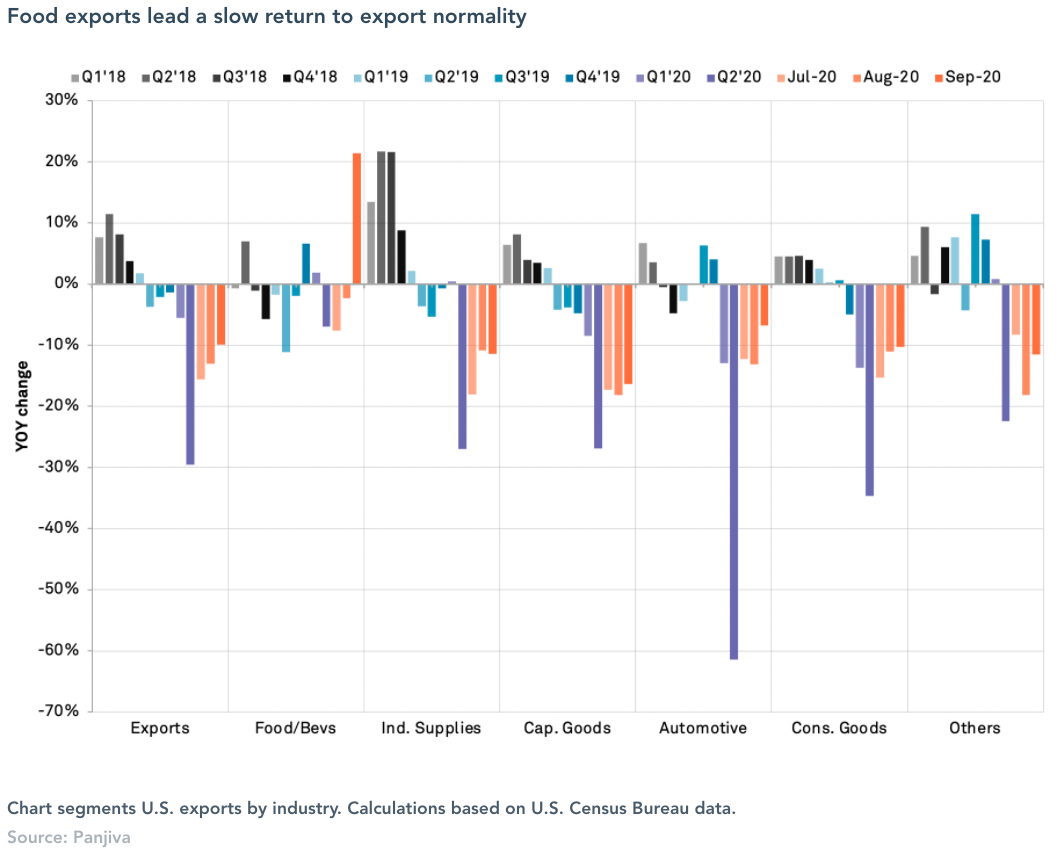

Early action may be needed given U.S. exports have remained weak in the wake of the pandemic. Panjiva’s analysis of official data shows that U.S. international trade activity continued to wane in September, with total merchandise trade having dropped by 5.4% year over year after a 7.6% drop in August.

While imports returned close to recovery with a drip of just 2.5% year over year, exports remained depressed with shipments down by 9.9%.

In the export mix food and beverages surged 21.4% higher, reversing a 2.3% dip a month earlier, suggesting that China’s purchases of farm goods, flagged in Panjiva’s Oct. 27 research, are having a material effect. Most other export lines continued to decline by a double digit amount, however, though the downturn in autos exports slowed to just 6.8%.

Both Biden and Trump have clearly stated tough-on-China stances, as documented in length in Panjiva research of Sept. 30. Further confirmation has come from Biden campaign officials that, as President, the U.S. would not “lock into any premature position before we see exactly what we’re inheriting, but consulting with allies is going to be a central part of that. An early round of action on China could be expected even if early action on tariffs isn’t taken.

A second Trump administration has the unfinished business of a phase 2 trade deal with China to negotiate, though tightening sanctions regarding Huawei, Hong Kong and Xinjiang make such a move less likely in the near term.

There are signs in the meantime though that the day-to-day impact on electronics supply chains may be mitigated by careful licensing with both Sony and Samsung Display receiving approvals to supply image sensors and phone screens to Huawei respectively.

The period between election day and inauguration will carry a series of events that could lead to reactions from the U.S. The details of the 14th Five Year plan, based on a set of 12 principles agreed at the Communist Party Plenum on Oct. 30, will emerge covering industries to be supported. A new WTO complaint from Hong Kong comes with a 100 day consultation period running through the first week of February.

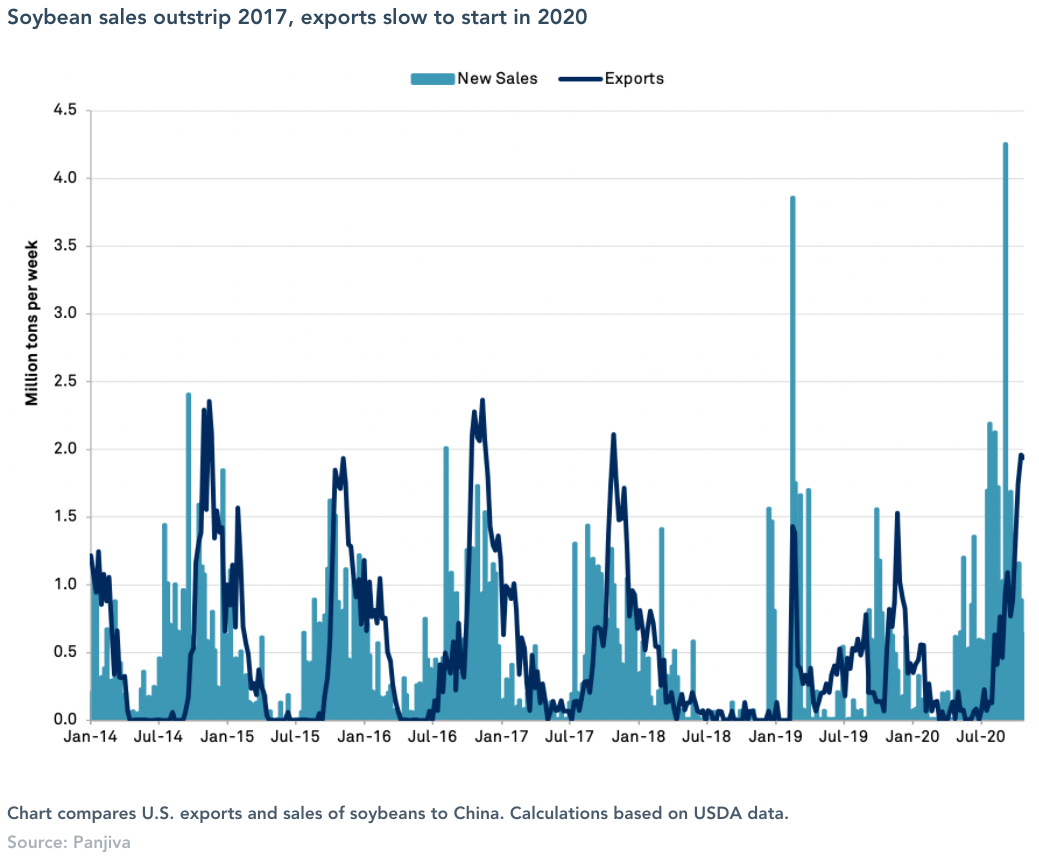

The period also coincides with the peak export season for U.S. farm goods. That may prove out USTR assertions that the agricultural part of the phase 1 trade deal is on track, though that has included the purchase of goods for delivery in 2021. While soybeans are only a fraction of the deal, a surge in shipments is necessary for any part of the phase 1 deal to be delivered anf for a worsening of relations before inauguration to be avoided.

Panjiva’s analysis of USDA data shows there may be serious doubts about delivery, with exports of soybeans in week 43 (to Oct. 22) being 8.0% lower than the same week in 2017 while the first seven weeks of the farm year shipments were just 24.9% higher than the same level of 2017.

That’s despite total forward sales being 256% higher in 2020 than in 2017, suggesting a backend loading to exports in the farm year that may cross over the election-to-inauguration period. In prior years the peak weeks for exports have been between week 45 and 49. The scheduling may make either candidate reticent about taking action against China in the remainder of 2020.

Exports of pork have also surged as a consequence of a Chinese shortage following the swine flu epidemic. Panjiva’s data shows that shipments to China from the U.S. of pork climbed 397% in the first nine months of 2020 versus the same period of 2017, including a 273% rise in shipments linked to WH Group, a 254% rise in shipments associated with Tyson Foods and a 50x jump in shipments linked to JBS. It’s worth noting, however, the exports in Q3 were 28.3% lower than in Q2 due to a drop in shipments linked to WH Group.

While much of the focus has been on the Executive, the makeup of the House and Senate will also have a critical impact on the direction of trade policy. A divided House and Senate has not prevented the Trump administration from enacting most of its trade policies, using a mix of executive action (see above) as well as limited large scale trade deals (USMCA, KORUS) with careful negotiations and mini-deals that skirt the need for Congressional approval.

That could all change in four ways.

First, the renewal of Trade Promotion Authority ( TPA) is needed by July 1, 2021 in order for the administration to negotiate free trade deals with a simple yes/no vote in Congress. A split Congress may not be willing to do so – even an aligned House and Senate may change the rules – greatly limiting the ability of the administration to complete trade deals.

Second, there have been several bills presented but not executed upon that call for limits on the President’s powers to conduct trade policy, including tariffs. Those may return anyway, particularly in relation to use of the section 232, national security, elements of trade law.

Third, the passage of deals will also depend on the complexion of Congress. The Democrat-led House effectively spent 12 months of the Trump administration adapting the labor and environmental chapters of USMCA before approving it. The width of either parties’ majority in each house will also be a factor.

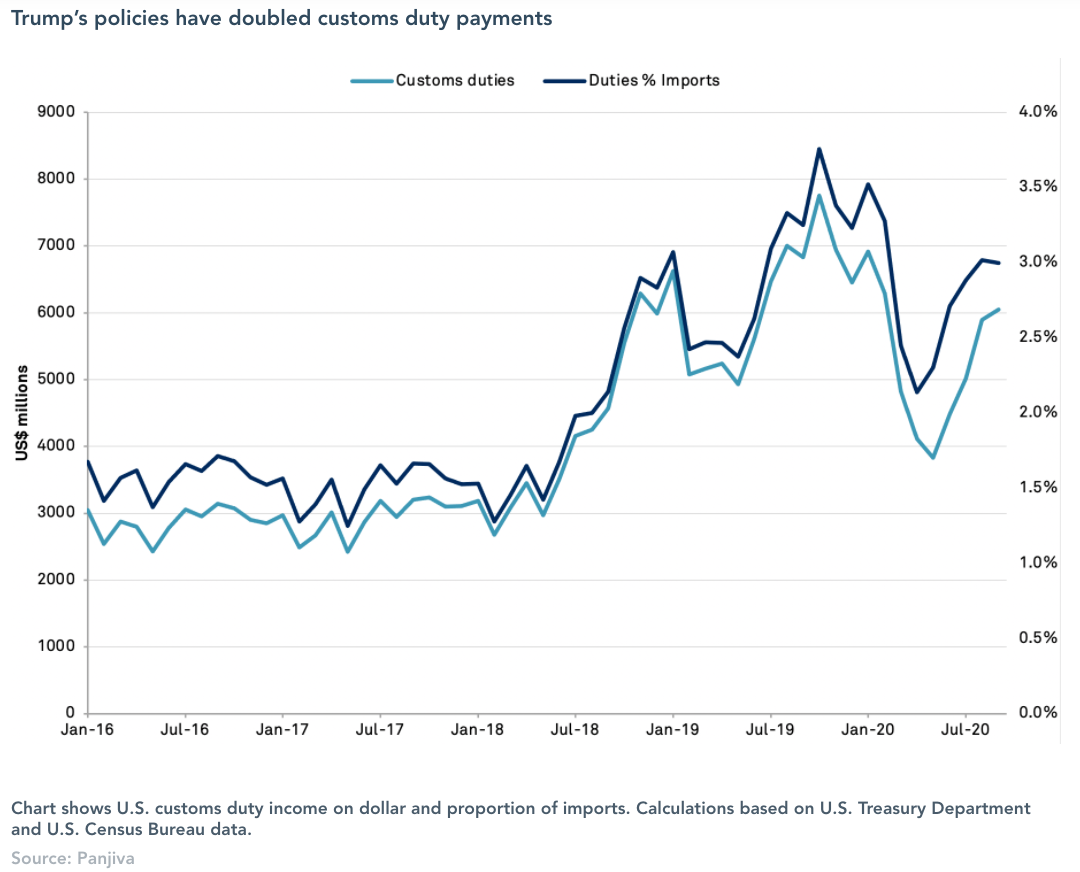

The fourth and arguably less important element is the leadership of the various Congressional committees, particularly Senate Finance which oversees trade deals and tariffs. If nothing else, the Trump administration’s tariff policies have brought $68.5 billion of revenue for the Treasury in the 12 months to Sept. 30 compared to $34.5 billion during 2016, Panjiva’s analysis of official data shows. Similarly the President’s picks for trade related roles including the Treasury and Commerce secretaries as well as USTR will color the direction of policy.

With a Biden administration having committed to sorting out domestic economic matters before turning to trade deals, aside from China there’s unlikely to be rapid changes in policy to key trade partners.

In any event, key relationships to watch include:

– European Union: Characterized as a rival by the Trump administration despite the recent pico-deal and as a potential trade deal ally by Biden, there are major issues around aerospace subsidies, carbon border taxes, digital services taxes and section 232 national security tariffs on metals to be addressed.

– United Kingdom: The Trump and Johnson administrations are in the midst of negotiating a wide-ranging trade deal. The Biden campaign has indicated the Internal Markets Bill – due to be voted on by the House of Lords on Nov. 7 – could be a sticking point for future relations in the event that a hard border between Ireland and Northern Ireland. The U.K. digital services tax is also a potential running sore for the Trump administration.

– Russia: Relations have chilled somewhat in the past two years as a result of U.S. sanctions against the Nordstream 2 gas pipeline, which has also caused friction with Germany. The pipeline is technically a competitor with U.S. LNG exports and the sanctions are tied up with Russia’s position with Ukraine. A change to the status quo seems unlikely.

– Canada: The renegotiated NAFTA trade deal, implemented as USMCA (or CUSMA and T-MEC in Canada and Mexico) settled many of the large-scale policy uncertainties. Attention may turn to implementation of the agreement’s labor rules, which were upgraded at the behest of House Democrats. There are also several smaller brush-fires to be addressed. That includes softwood lumber tariffs and the approval or otherwise of the Keystone XL pipeline and resulting impact on energy trade.

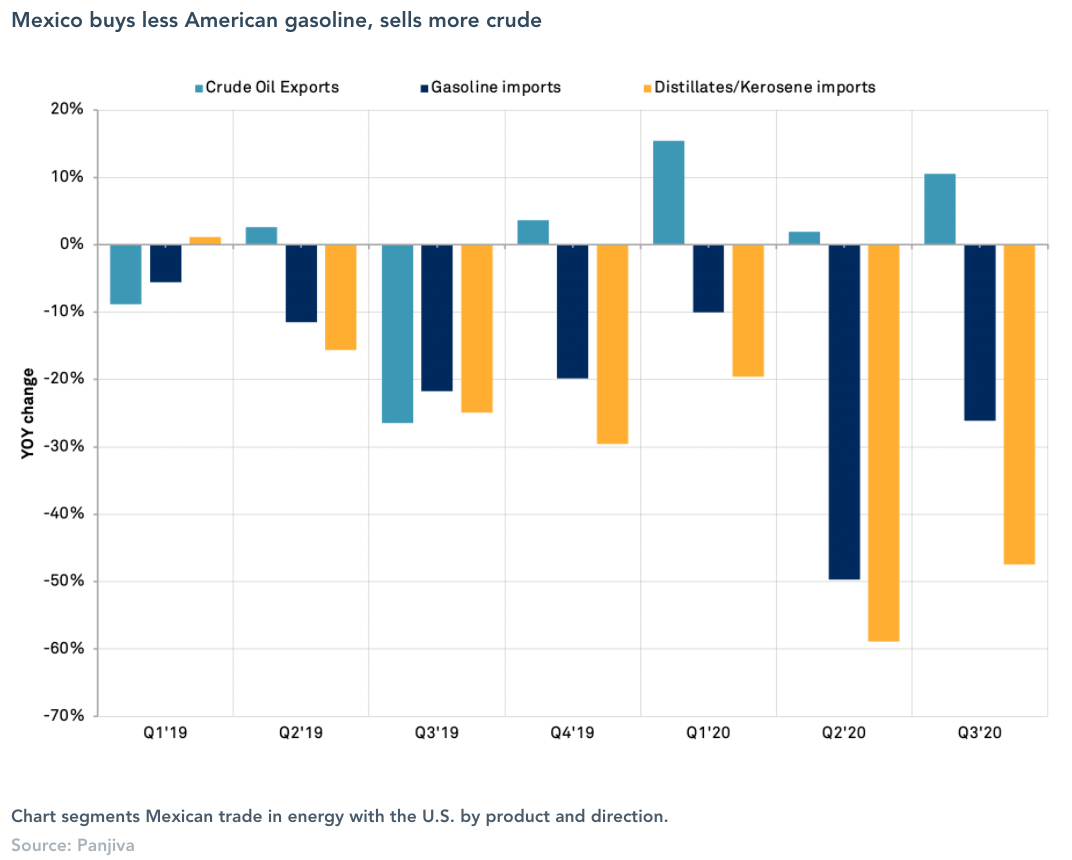

– Mexico: Aside from a focus on the implementation of USMCA / T-MEC, U.S. Senate and House members have complained that the Mexican government has been “delaying or cancelling outright permits for U.S. energy companies“. That comes as Mexican exports of crude oil to the U.S. have surged, rising 10.5% year over year in Q3, while it’s purchase of U.S. gasoline and distillates dropped by 26.1% and 47.5% respectively over the same period. Complaints will run both ways – a U.S. investigation of seasonal fruit imports from Mexico appears to run contrary to the USMCA’s mechanisms.

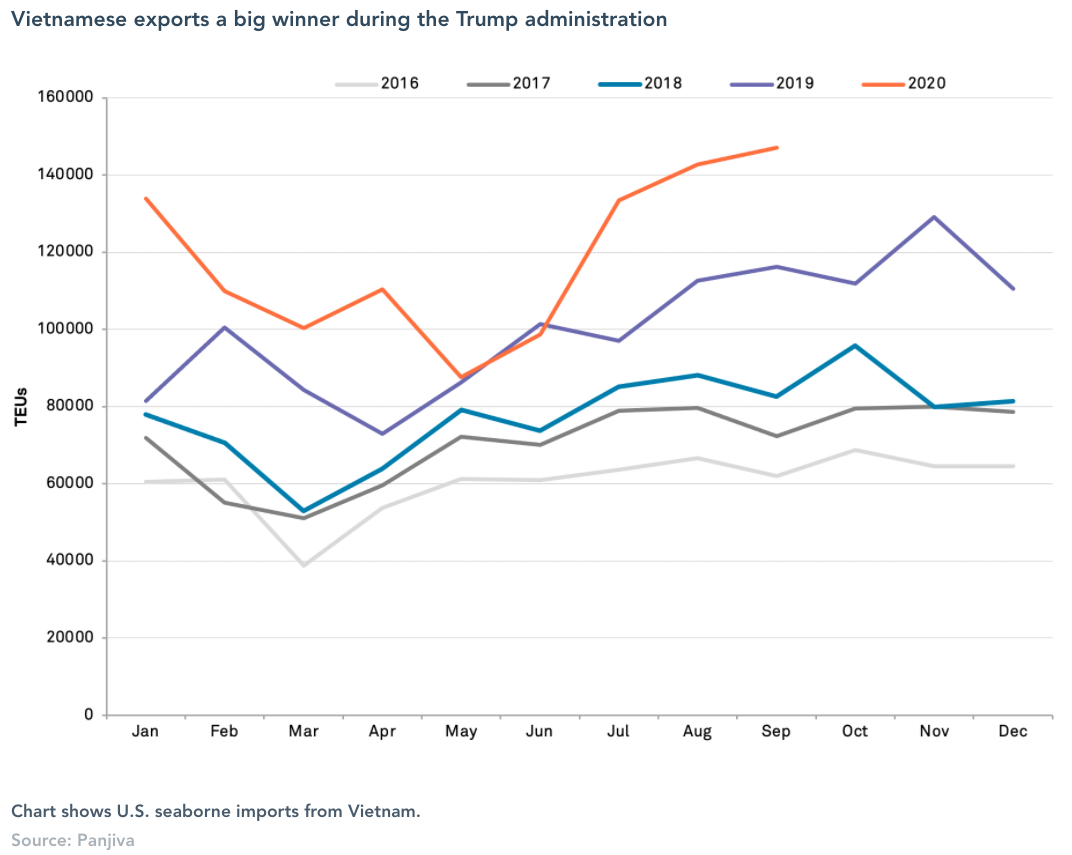

– Vietnam: Arguably one of the countries with the most to lose from a Trump administration and gain from a Biden Presidency is Vietnam. The Trump administration’s section 301 review of Vietnam’s currency practices raises the risk of widespread tariffs or the need for phase-1 type trade deal. Biden’s position is less clear but is unlikely to be as hostile. Vietnamese exports to the U.S. have continued to surge, with seaborne imports to the U.S. linked to firm’s in Vietnam having soared 29.9% higher in Q3 and by a 19.6% on a compound annual basis across the Trump presidency so far.

– Taiwan: The future of Taiwan will depend crucially on how hawkish the next administration chooses to be. The recent sale of arms and visits by Trump administration diplomats has drawn sanctions from China and will likely be drawn into the wider geopolitical rivalry between the two great powers.

– Rest of the world: The Trump administration’s trade negotiations with Kenya are designed to provide a framework for deals with the rest of Africa but are unlikely to reach rapid fruition. A Biden administration may want to revisit key elements. A solution to the deadlock at the World Trade Organization is vital for global supply chain rule maintenance but is unlikely to be priority for either candidate. Finally, there are the trade aspects of sanctions against Iran, North Korea and others to be considered, though again short-term changes seem unlikely.

Further research on the candidates’ positions

Panjiva Research has published over 20 reports since July that examine the candidates’ positions and their impact on industrial supply chains available at our dedicated microsite. Key reports include:

#1 Wide-ranging comparison of the candidates policies on trade including relations with China, Europe and multilateral organizations (Sept.30)

#2 The impact of the election on global supply chains (Oct. 4)

#3 Assessments of Trump’s track record on the trade activity, the phase 1 trade deal with China and use of tariffs (Oct. 7)

#4 Medical supply chain policy is similar between the two candidates (Oct. 16)

#5 Both candidates want to onshore sourcing of critical minerals in similar ways (Oct. 27)

#6 Trump administration positioning on tariffs and tax breaks (Aug. 26)

Finally, we held a webinar on Oct. 22 to address the election in the context of wider supply chain developments (Oct.22)