Sep. 30 2019 — Continued trade tensions between the U.S. and China have raised uncertainty amid signs that U.S. economic momentum is slowing, although American consumers seem poised to continue propping up the world’s biggest economy. Also, U.S. financing conditions have generally improved over the course of the year—particularly for borrowers with solid credit quality.

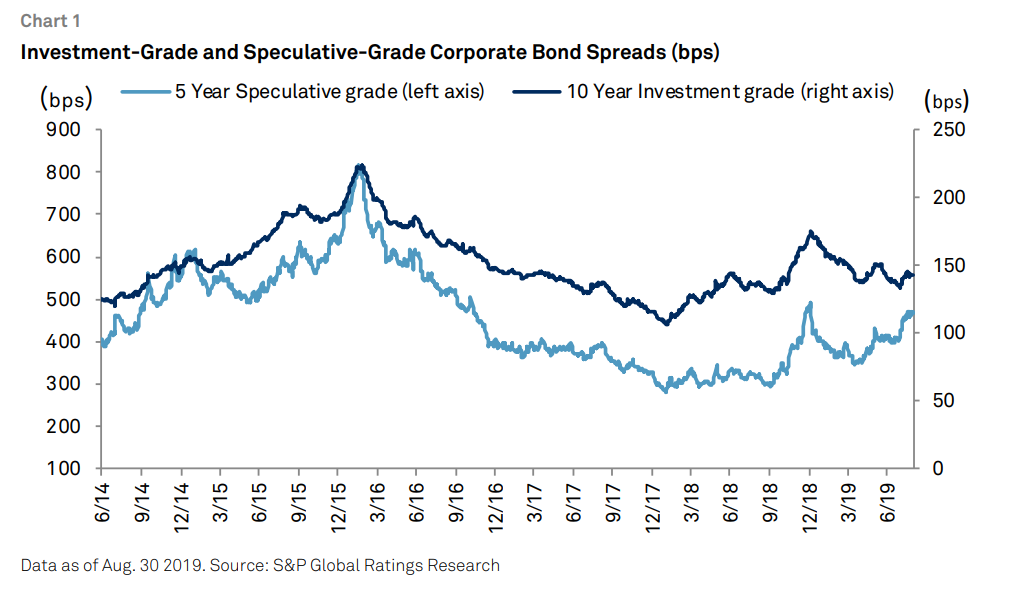

Financing conditions. A clear divergence has emerged between borrowers of higher credit quality and the lowest-rated issuers. Yields on investment-grade corporate bonds are near their postrecession lows in primary markets, and secondary-market yields on all investment-grade categories of industrial issuers hit all-time lows in August. Meanwhile, yields remain volatile and generally elevated for lower-rated borrowers.

Economic conditions. Of the 10 leading indicators of near-term U.S. economic growth we look at, three are now negative, while just three are positive and four are neutral. While the U.S. expansion is now the longest in history, the economy is showing signs of slowing. Our qualitative assessment combined with calculated odds now puts the risk of a recession to start in the next 12 months at 30%-35%—more than twice what it was a year ago. At the same time, American consumers, whose spending accounts for roughly 70% of the U.S. economy, continue to prove willing to open their wallets. For this reason, we still think a downturn to be unlikely to start in the next 12 months.

Sector trends. The stalemate in trade negotiations has hurt business confidence among nonfinancial corporates, as evidenced by minimal capital expenditure growth and a contraction in manufacturing. Meanwhile, declining borrowing costs are pressuring lenders’ net interest margins and weighing on profitability.

Regional credit conditions

What’s changed?

Continued trade tensions between the U.S. and China have raised uncertainty amid signs that U.S. economic momentum is slowing. We now put the chance of a U.S. recession in the next 12 months at 30%-35%—more than twice what it was a year ago. At the same time, American consumers seem poised to continue propping up the world’s biggest economy, and so we think a downturn in the near term remains unlikely. Also, U.S. financing conditions have generally improved over the course of the year—particularly for borrowers with solid credit quality.

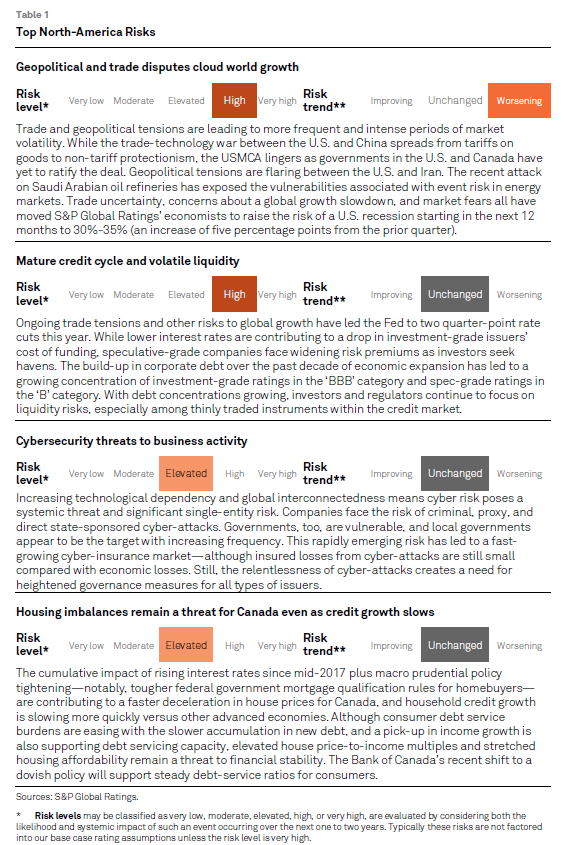

Assessment of key risks

Trade and geopolitical tensions are leading to more frequent and intense bouts of market volatility. The stalemate in trade negotiations has also hurt business confidence among nonfinancial corporates, as evidenced by a sharp deterioration in capital expenditure growth and a contraction in manufacturing. Meanwhile, declining borrowing costs are pressuring lenders’ net interest margins and weighing on profitability.

Trade and geopolitical concerns: Amid prospects that the U.S.-China trade dispute will evolve from tariffs to non-tariff protectionism, the U.S. and Canada have yet to ratify the USMCA. Meanwhile, tensions between the U.S. and Iran are flaring, and the recent attack on Saudi oilfields has exposed vulnerabilities to “low-cost, high-impact” terrorism. All this comes as the OECD forecasts global economic growth of just 2.9% this year, the weakest since the Great Recession.

Debt: Lower interest rates have brightened borrowing conditions for investment-grade borrowers, but speculative-grade companies face widening risk premiums as investors seek havens. The build-up in corporate debt in the past decade has led to a concentration of investment-grade ratings in the ‘BBB’ category and speculative-grade ratings in the ‘B’ category.

Cybersecurity: Increasing technological dependency and global interconnectedness means cyber risk poses a systemic threat and significant single-entity risk.

Canada housing: The cumulative effects of rising interest rates since mid-2017 plus macro prudential policy tightening are contributing to a deceleration in house prices in Canada. Although consumer debt burdens are easing, and a pick-up in income growth is supporting debt-paying capacity, elevated house price-to-income ratios and stretched housing affordability remain risks.

Financing conditions

U.S. financing conditions have generally improved this year—especially in light of limited yields around the globe. However, a clear divergence has been underway between borrowers of higher credit quality and the lowest-rated issuers. Yields on investment-grade corporate bonds are near their post-recession lows in primary markets, and secondary-market yields on every investmentgrade category of industrial issuers hit all-time lows in August. And yields on debt in the ‘BB’ category have fallen, but not to the same extent. Meanwhile, yields remain volatile and generally elevated for lower-rated borrowers. Interestingly, despite the whipsawing of geopolitical stressors this year, most of the relative divergence in the spec-grade segment came in August.

Because the ‘B’ category is the largest spec-grade segment—both by number of issuers and nonfinancial debt outstanding—it tends to drive the spec-grade spread, which finished August at 470 basis points (bps). That’s close to where it began the year, at 481 bps (see chart 1). Investmentgrade spreads also increased in August, up to 143 bps, from 133 bps at the end of July; but as mentioned, yields have fallen to all-time lows. The demand for Treasuries in August was particularly strong, with the 10-year yield finishing the month at only 1.5%—a low not seen in nearly three years.

The Federal Reserve’s interest-rate cuts this year will likely continue to support lending conditions. But economic growth is expected to slow, and markets seem to have already priced in rate cuts, likely limiting their benefits.

Market volatility increased markedly in August as the U.S.-China trade dispute heated up. The closely watched VIX reached nearly 25—the high point last seen at the end of 2018 during an otherwise abysmal quarter for financial markets. At the end of the month, China said it wouldn’t retaliate against President Trump’s desire to increase tariffs on all Chinese goods, and since then, both sides have taken steps to reduce tensions ahead of talks scheduled for October in Washington. Markets have responded favorably, although perhaps short of enthusiastically.

Through it all, the Fed’s monetary easing seems to have overpowered fears of a global economic slowdown and rising trade tensions. Bond issuance is up year-to-date through August, with investment-grade gaining 2%, to $646 billion, and spec-grade up 28%, to $142 billion. Still, falling rates have dented issuance of leveraged loans, which has tumbled 40%, to just under $320 billion.

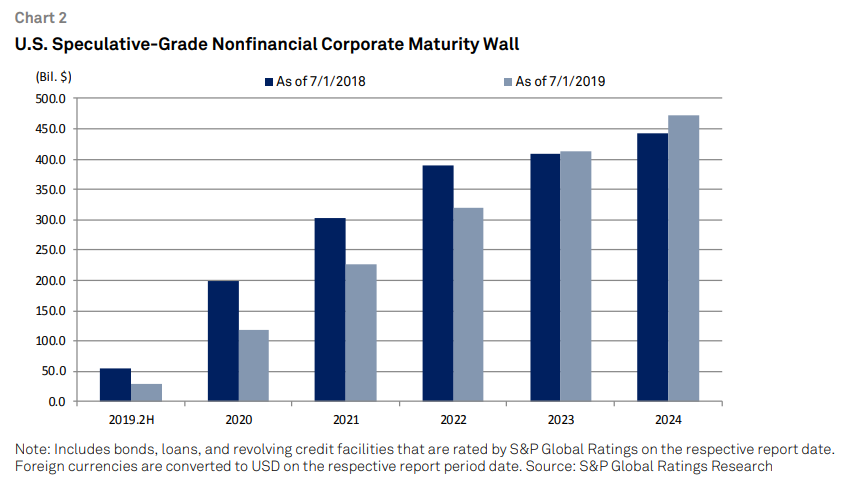

Despite the widening in corporate spreads in August, we estimate the spec-grade spread should have finished the month more than 112 bps wider, based on various economic and financial indicators. Since the start of last year, the implied spread has exceeded the actual in 14 of the past 20 months. This could imply that despite the spread’s increase, financial markets are overly optimistic in the face of sustained pressures. That said, the upcoming maturity profile for U.S. spec-grade issuers appears largely manageable (see chart 2). Issuers have been paying down debt at a steady pace, and after a rough patch to start the year, issuance has remained well ahead of maturities in the next 12 months.

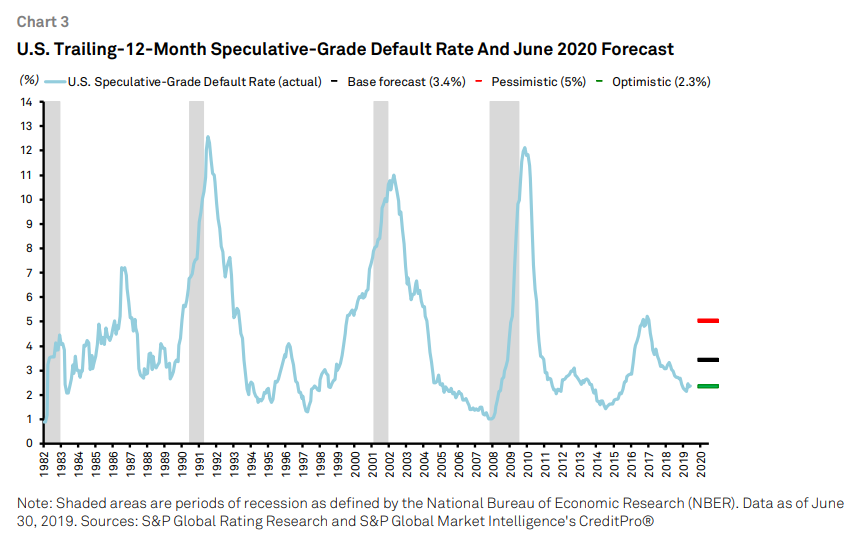

S&P Global Ratings Research projects the spec-grade default rate to come in at 3.4% through June 2020 (see chart 3). This is up from 2.36% at the end of June of this year, but still lower than the long-term average of 4.2%. The expected slowdown in corporate profits continues, and global risks remain elevated. Economic growth remains positive, but slowing. By sector, we still expect energy and consumer-reliant sectors (such as retailers and consumer products) to lead in terms of defaults, given their ongoing external stressors and structural changes.

Macroeconomic developments and assumptions

U.S.

State of Play: Of the 10 leading indicators of near-term U.S. economic growth we look at, three are now negative, while just three are positive and four are neutral. The term spread has turned negative from neutral, and both freight transportation and a key manufacturing index have turned neutral from positive. While the U.S. expansion is now the longest in history, the world’s biggest economy is showing signs of slowing down. Our qualitative assessment combined with calculated odds now puts the risk of a recession to start in the next 12 months at 30%-35%—more than twice what it was a year ago. Still, fundamental domestic strength—in particular from American consumers—is helping to extend the economy’s record run.

Along with increasing headwinds from the U.S.-China trade dispute, the waning effects of last year’s fiscal stimulus, and a marked slowdown in growth abroad (with the OECD forecasting global economic growth of just 2.9% this year, the slowest since the Great Recession), it’s fair to say that risks to U.S. GDP growth are building.

Against this backdrop, the Fed lowered its benchmark interest rate for the second time this year— and financial markets are betting that central bank policy makers will do so at least one more time before the calendar changes.

At the same time, American consumers, whose spending accounts for roughly 70% of the U.S. economy, continue to prove willing to open their wallets. For this reason, we still think it’s unlikely a downturn will start in the next 12 months—short of an exogenous shock that all but ends companies’ already cautious capital spending and causes consumers to tighten their purse strings.

Outlook: S&P Global Ratings now forecasts full-year U.S. GDP growth of just 2.3% this year and 1.7% next year, followed by 1.8% for 2021. We expect unemployment to drift higher, after reaching a low of 3.6% in April-May, with core inflation eventually rising (perhaps spurred by higher oil prices). We expect weakening growth momentum and a benign inflation outlook will result in one more Fed rate cut this year. Depending on the data, we see policymakers then remaining on the sidelines through next year.

Risks: The escalation of trade disputes—and the secondary effects they can have on consumer spending—remains the largest downside risk to our forecast. The U.S.-China dispute has had only minimal direct macroeconomic effects on either country, but the longer-term consequences for global supply chains, U.S. business sentiment, and consumers’ purchasing power are growing.

Canada

State of Play: Real GDP increased a stronger-than-expected 3.7% (annualized) in the second quarter, after two consecutive quarters of near stagnation. However, an unsustainable surge in net exports masked underlying weakness in domestic demand. The housing market has shown signs of stabilizing, with stronger housing starts. Jobs growth was strong in August (3.7% year-over-year), which is an encouraging bounce after two consecutive monthly declines—though most job gains were part-time. Yet, consumer spending was tepid 0.5% in the second quarter. Credit growth has picked up, but business investment continues to remain soft.

Outlook: We raised our full-year estimate for real GDP growth to 1.5%, from 1.2%, following the second-quarter rebound. Owing to our expectations for weaker global growth environment and persistent underlying domestic challenges, we forecast below-potential real GDP growth of 1.4% in 2020. Although global trade frictions and the possibility of an investment-led slowdown remain a threat, we see the recovery in domestic spending positioning Canada for a return to trend growth closer to 2% in 2021-2022.

Measures of financial leverage have begun to stabilize with the pickup in household incomes, and debt-service ratios are steadier. Still, household debt affordability remains stretched, and heavy consumer debt burdens will likely limit growth in consumer spending. Vulnerabilities are likely to diminish only gradually.

Canada will likely ratify the USMCA as soon as the U.S. Congress approves it, and the U.S.’s removal of tariffs on Canadian steel and aluminium are easing uncertainty around the country’s relations with its largest trading partner. On the one hand, this could lift capital spending, but we see business investment struggling to regain lost ground amid weaker global demand and trade uncertainties.

Risks: The ordinary risks surrounding our baseline growth forecast are balanced. Recent U.S. auto sector labor disruptions present a near-term growth risk, absent a timely resolution. A weaker profile for investment could emerge if rising volatility in the commodity markets deteriorate Canada’s terms of trade. Volatility in oil prices and transportation constraints could delay business investments in the energy sector. On the other hand, a sustained higher oil price on balance could lead to higher investment spending and net export income in Canada, given that Canada is a net exporter of oil. Also, tighter labor market and decisive policy actions could lead to stronger-thanexpected household spending and business investment.

Non-Financial Corporates

|

What’s changed?

Transitioning Toward A Late-Stage Credit Cycle:

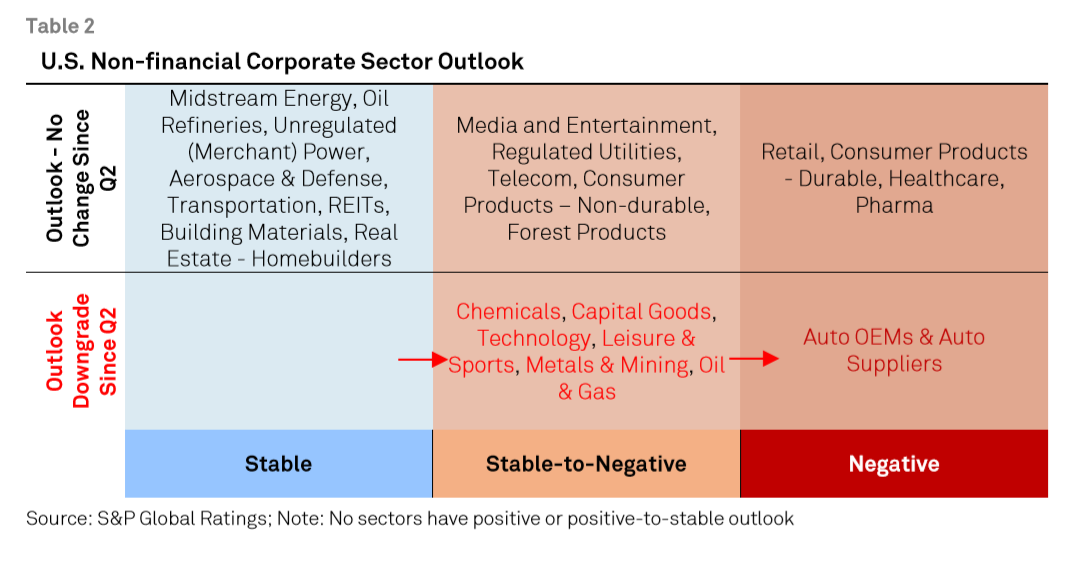

Corporate borrowers are bracing for the latter stages of the credit cycle (see table 2), with persistent trade tensions and early signs of slowing economic growth beginning to hurt businesses. The stalemate in trade negotiations has hurt business confidence, as evidenced by minimal capital expenditure growth and a contraction in manufacturing in August. While U.S. consumers remain remarkably resilient, the prospects for slower economic growth in the next few quarters could drive them to pull back on spending.

Meanwhile, uncertainty lingers with regard to: trade policy; global growth prospects; geopolitical vulnerabilities (such as the recent attack on Saudi Arabia, disrupting its oil-producing capabilities); and the 2020 presidential election.

In this landscape, we believe entities operating in the consumer durables, retail, autos, and healthcare sectors have heightened credit risk vulnerabilities, given continued pressure to reduce prices while absorbing additional costs. Furthermore, defaults and downgrades are on the rise— suggesting that outlooks could turn negative for a few more sectors in the next few months.

Key assumptions

High-Tier Noninvestment-Grade Borrowers Seem Safe For Now: While central bank policies remain accommodative, the prospects for slower global growth have become a reality. Though additional outlook revisions could turn negative for a few sectors, refinancing risks are minimal, with new financing needs being the primary concern should the capital markets experience a similar disruption to what transpired late last year.

Key risks

Curtailed Access To Debt Could Add To Complexities:

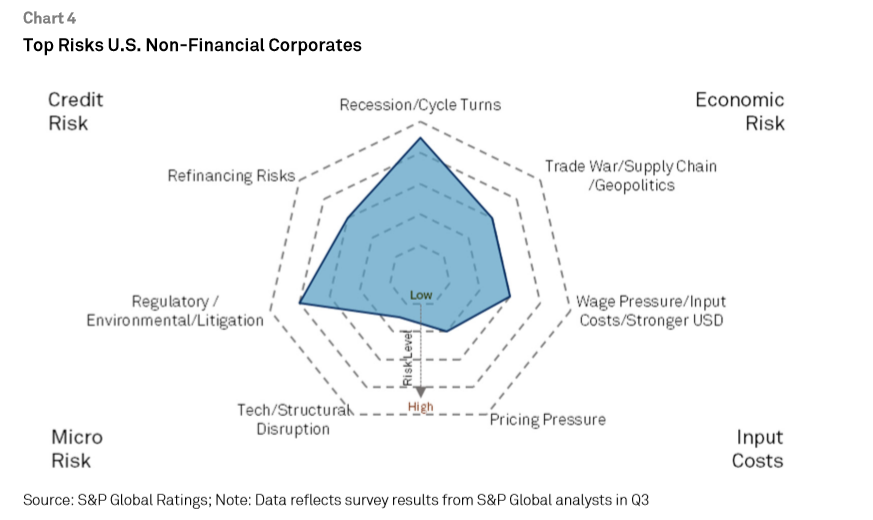

The U.S.-China trade dispute and the prospects for a recession remain the biggest risks for corporates (see chart 4). We believe stresses in the next quarter will be particularly pronounced for companies in autos, capital goods, and semiconductors, where the effects of retaliatory tariffs and slower growth around the world (including China) begin to take effect.

Borrower-friendly financing conditions can’t be taken for granted, as evidenced by last year’s “December freeze”. In the event of a curtailed access to debt markets, entities rated ‘B’ or lower in chemicals, consumer products, oil and gas, and the retail sector are most vulnerable to refinancing risks. Entities rated ‘BB’ and above have made the most of favorable borrowing conditions to extend maturities. Still, there are a few high-profile ‘BBB’-category companies vulnerable to downgrades; given limited cushions, a sharp fall in earnings could nudge them into the spec-grade market.

What to look for in the next quarter

Will A Weak Start Persist?

Fear of a recession poses a bigger threat than the current state of affairs. For instance, a shrinkage in demand for chemicals is a result of firms’ holding lower inventories amid fears of a slowdown. Similarly, low levels of capital spending across sectors illustrates the prevailing caution. This conservative approach is particularly detrimental for capital goods, chemicals, and leisure and sports services, where outlooks could fall to negative from negative-to-stable. Meanwhile, internal sector dynamics such as elevated leverage, competitive pressures, and the threat of further disruption in media, healthcare, and telecom firms pose challenges to the outlooks of these sectors. Lower commodity prices could further hurt the prospects of forest products, and metals and mining firms.

The supply chain remains another area of focus. Some capital goods and toy manufacturers moved production outside China in the second quarter, but this wasn’t widespread among manufacturers. Also, costs involved in moving production lines could far outweigh the savings from tariffs for manufacturers with sizable market share in China. Meanwhile, consumer durables firms and retailers have mitigated their headwinds by passing on costs to suppliers. While we don’t expect American corporations to entirely move supply channels away from China, they will be swayed to diversify in the long run.

Financial Institutions

|

What’s changed?

The most important change for North American financial institutions is the outlook for interest rates, particularly in the U.S., which is gradually pulling down banks’ net interest margins (NIMs) and weighing on profitability. We now expect the Fed to lower borrowing costs once more this year, for a total of three cuts. Strong asset quality has, so far, mitigated the profitability drag from weak NIMs.

Key assumptions

- We expect the Fed to cut its benchmark rate once more, with the Bank of Canada on hold, and for full-year GDP growth to slow to about 2.5% and 1.2%, respectively, in those countries.

- U.S. loan growth is likely to continue at a low- to mid-single-digit pace.

- Credit losses have likely bottomed out and will gradually increase this year, although monetary loosening may delay this.

- The current expected credit loss (CECL) standard will be implemented on Jan. 1.

- The USMCA will remain on a slow path toward U.S. ratification.

Key risks

- An inverted yield curve will increasingly pressure bank profitability, as both assets and liabilities increasingly reset to current rates.

- Asset prices, already driven higher by (among other factors) an extended period of low interest rates, may rise further with the recent revision in the expected path of rates, risking a sharper eventual correction with associated capital-market volatility.

- Corporate credit quality, particularly in leveraged lending, could deteriorate after several years of significant loan growth.

- Asset quality may also worsen in auto, student, and commercial real estate (CRE) lending.

- In Canada, a negative employment shock could trigger a substantial sudden decline in home prices, given still elevated (although moderating) prices. This could be accompanied by noticeably higher losses on consumer loans. We believe such a result unlikely outside a significant recession—which isn’t our base case.

What to look for in the next quarter

For U.S. banks, we expect single-digit earnings growth with declining NIMs. Banks will continue to contain costs by consolidating branches, containing headcount, and growing digitization. The Fed may finalize its 2018 proposal to tailor regulation for large banking organizations based on their risk profiles. It may also finalize a separate proposal to simplify its capital rules for large banks, most notably with the introduction of a stress capital buffer. Either would influence capital management at the global systemically important banks (GSIBs).

Canadian banks face similar NIM pressure to their U.S. peers, and loan-growth opportunities in Canada will be more-constrained by weak growth in domestic credit demand. Because exports account for about one-third of Canada’s GDP (substantially more than the equivalent measure for the U.S. and for most developed economies) sentiment is being hurt by the delay in U.S. ratification of the USMCA, in particular, and a generally less-certain outlook for global trade. Combined with an already-high household debt-to-income ratio, this will likely constrain Canadian demand for both household and corporate credit.

Insurance

|

What’s changed?

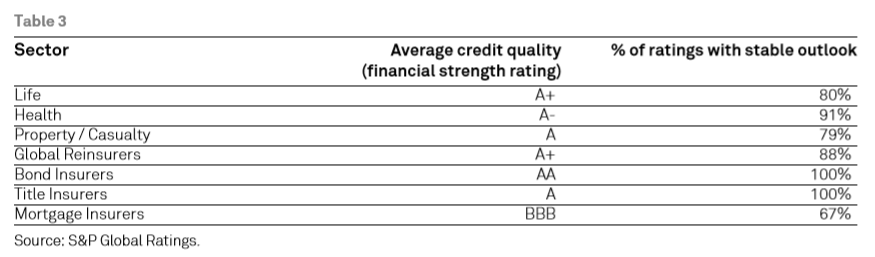

Rating activity year-to-date through September 2019 has been strongly affirmation-oriented. Overall, the average financial strength rating for the insurance portfolio continues to reside just inside the upper half of the strong (‘A’) category, essentially unchanged from the prior quarter.

Key assumptions

Balance-sheet strength remains a pillar of credit-quality support, providing a measure of protection from risks related to downside economic development broadly, and the expansion or increase in the magnitude of specific current and emerging subsector challenges more specifically.

Key risks

Factors related to pricing adequacy, profitability, portfolio yield, disciplined growth, regulation, policy risk, and slowing economic growth reflect areas of ongoing concern and analytical focus for the remainder of the year.

What to look for in the next quarter

For life insurers, we expect top-line growth, especially through group/voluntary insurance and pension risk-transfer businesses. Traditional life insurance will remain a low-single-digit growth line, whereas products that provide long-term care benefits within a life insurance or annuity chassis will continue to see higher growth. Annuities will remain in demand, driven by strong sales in indexed variable annuities and fixed-indexed annuities.

Block mergers and acquisitions (M&A) by traditional insurers and nontraditional capital investors will remain a key part of this market, whereas large-scale M&A (companies buying each other) remains less likely. Life insurers’ spec-grade exposure is contained, but insurers have increased their exposure to the 'BBB' category. Amid tight credit spreads, insurers have pushed their bond investments toward the lower end of investment-grade. From 2008-2018, 'BBB' category bonds held by life insurers increased about 75%, far outpacing the 35% growth in overall bond portfolios.

For health insurers, political/regulatory risks are emerging ahead of the 2020 elections. Multiple Medicare-For-All proposals have been floated that incorporate varying levels of government involvement, but we see a restructuring of the industry as a low-probability/high-risk issue. In the interim, the federal government has backtracked from a proposal to remove drug rebates in the Medicare/Medicaid markets. However, a number of bills are advancing in Congress that attempt to tackle a wide range of issues (price transparency, drug costs, surprise billing, etc.).

The U.S. property/casualty (P/C) insurance industry has enjoyed a good build-up of excess capital, mostly attributable to solid earnings, dwindling share buybacks, and asset appreciation. Even though ample capitalization exists, P/C insurers are still demonstrating restraint through underwriting discipline, effective enterprise risk management (ERM) programs, and conservative investment strategies, which collectively support our stable outlook on the sector.

Pricing increases continue to accelerate after a slow start last year. Pricing is increasing despite climbing capital levels and the continuation of favorable reserve development, albeit at lower levels, which makes this hardening rate cycle unique. Pricing hikes within the excess and surplus market stand out after the withdrawal of capacity by larger underwriters. Pricing increases are also evident within property, commercial auto, and directors’ and officers’ lines. We expect underwriting profitability to benefit from sustained improvements in personal auto lines, which constitutes onethird of overall industry premiums, although pricing is bottoming out for this business line.

Reinsurers are battling the commoditization of their business and the rise of alternative capital nibbling at their margins. This has led many to pursue M&A, divest nonperforming businesses, diversify into less-commoditized lines of business, and embrace the permanence of alternative capital. They've also adjusted risk exposures, and are actively managing their capital structures through buybacks, special dividends, and refinancing. Alternative capital continues to challenge reinsurers’ business models and exert influence on both retrocession and reinsurance pricing. In the face of ongoing competitive pressures in the industry, robust capitalization, sophisticated enterprise risk management, and still-rational underwriting practices remain a strength for the sector. Moreover, P/C reinsurance prices hardened during 2019 renewals in reaction to record back-to-back catastrophe years in 2017-2018, and maintain positive momentum heading into 2020. These factors will continue to push the sector to evolve, forcing market consolidation, product and service innovation, and the expansion of product offerings.

With the decline in interest rates, the limiting effect of spread compression on new business volume is likely to reappear in the bond insurance market as investors are unwilling to give up yield for premiums. However, a decline in issuance is unlikely to hurt the operating performance of the bond insurers. Bond insurers typically collect premiums associated with the U.S. public finance business up front and earn them over the life of the underlying transaction (20 years on average). The more important trend in underwriting is the uptick in insured secondary-market issues as institutional investors use insurance to manage investment-portfolio risk. From a risk perspective, the insurers are insuring issues in the lower-risk city, county, and school sectors.

We see modest revenue growth for title insurers in the next two years. Supply still somewhat lags demand for home purchases, but the recent decline in interest rates has led to an increase in refinancing. With the potential for further rate cuts, refinancings could rise. Low rates have also led to an uptick in commercial mortgages and an increase in property values, both of which are likely to result in a meaningful rise in commercial premiums for title insurers. Overall profitability depends on their ability to manage operations throughout the mortgage cycle. Continued industry efforts to monitor operating efficiency closely, combined with higher investment income, have helped to maintain profitability and strengthen capital.

Private mortgage insurers (PMIs) continue to benefit from favorable trends in employment and housing. Millennials are entering the housing market, which should strengthen demand across the U.S. With tight affordability, buyers—especially first-timers—could increasingly need mortgage insurance to acquire homes. The industry’s adoption of risk-based pricing allows for granular pricing; however, it could also pressure rates. Nevertheless, we expect strong earnings to continue.

Structured Finance

|

What’s changed?

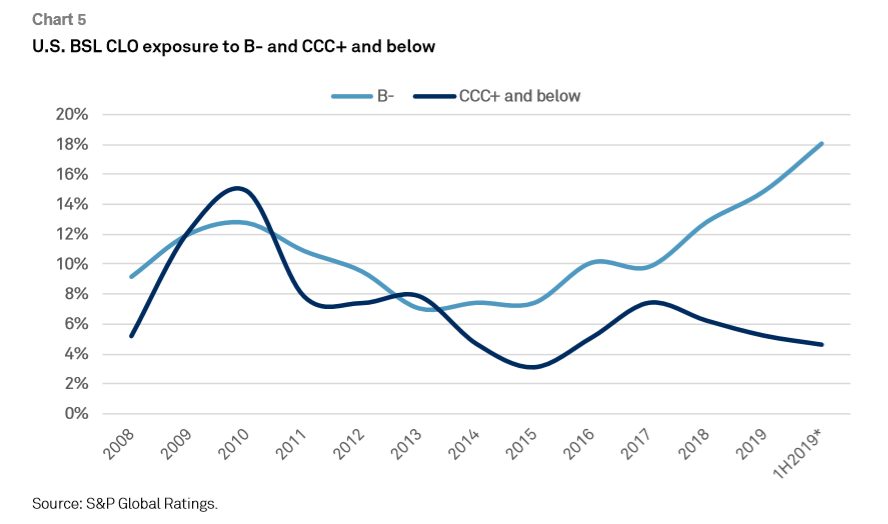

Structured finance sector fundamentals remain generally stable overall. Our 12-month outlook on collateralized loan obligations (CLOs) has deteriorated somewhat, although we believe that most of the downgrade risk remains with spec-grade rated tranches in the case of a potential downturn.

Key assumptions

Our base case is for continued moderate economic growth, and generally stable interest rates. That said, the risk of recession appears to be rising.

Key risks

For CLOs, we see increasing risks for downgrades in junior classes, as obligor credit and recovery ratings have trended downward. Some low-investment-grade tranches, on a less widespread basis, could be at risk as well. One reason for this is that since 2017, U.S. broadly syndicated loan (BSL) CLO exposure to ‘B-‘ obligors has almost doubled to 18%, which is a new high (see Chart 5).

With asset-backed securities (ABS), the focus remains on auto loan deals, especially those backed by subprime receivables. Our latest available data (June) showed some deterioration in collateral performance. Losses increased and recoveries declined month-over-month across both the prime and subprime segments, which is typical beginning at this time of the year due to seasonality. Further, subprime 60+day delinquencies were at their highest June level since we have started tracking them due to a greater presence of deep subprime auto loan ABS. Delinquencies for the “adjusted” index (which doesn’t include the deep subprime component) were up moderately (about 30bps) on a year-over-year basis, while losses were up very modestly, increasing just 4 bps.

Our outlook for residential mortgage-backed securities (RMBS) is stable, amid a growing economy and low unemployment. The pace of home-price growth is slowing steadily and is starting to move more in line with historical norms. This should ease affordability problems in some major markets, especially with the 30-year fixed-rate mortgage sitting near a three-year low. However, new home supply remains constrained due to labor shortages and rising cost of materials. Among the various private-label RMBS market segments, non-qualified mortgage (non-QM) is the fastest-growing, with new issuers and originators entering the space regularly. Delinquencies are low in the sector and will likely remain so as the pool concentrations of borrowers with prior credit events and high debt-to-income ratios diminish.

The main property types of interest backing U.S. commercial mortgage-backed securities (CMBS) are retail, lodging, and suburban office. Notwithstanding continued stress on retailers in general from e-commerce and peer competition, retail sales and consumer confidence appear to be holding up for now. Lodging revenue per available room is growing at a lower rate this year—but still growing, albeit with some underperformance in several larger markets. Suburban office is a perennial topic because of the lower number of available tenants to back-fill space in the case of a departure, relative to larger central business districts. Overall, delinquencies for the sector remain low, at just over 2% as of August, down 100 bps year-over-year.

What to look for in the next quarter

With recession risks rising, we have contemplated a scenario in which U.S. GDP contracts and stays negative for six quarters, with unemployment exceeding 6%. Under this scenario, we believe that downgrade and default risks for most structured finance sectors and regions would broadly be contained to spec-grade classes, albeit with some risk in low investment-grade credits for CLOs.

U.S. Public Finance

|

What’s changed?

Despite growing signs of an economic slowdown, state credit quality has remained strong with most states indicating positive operating results for fiscal 2019 and continued growth for fiscal 2020. As such, fiscal 2020 is on track to be the 10th year of steady revenue and expenditure increases. Provided these good times have been met with good saving habits, this puts states in a solid position to withstand an economic downturn, at least in the short run.

With wages and household balance sheets high, and unemployment and interest rates low, the conditions are ripe for new home buyers. However, dwindling housing supply—due in part to the challenge of finding labor—has pushed the dream of home buying off indefinitely for a segment of the market. This demand keeps property tax revenues strong for local governments who depend on them, although higher prices could also have further to fall in a housing downturn.

Supported by a solid financial backdrop from states, local government credit quality remains stable. Should the economy start to weaken, it will hurt states first and then move on to locals. Currently there are limited signs that state governments intend to cut aid or otherwise hamstring local government operations. However, rising expenditures for local governments have continued to drive a wedge in operational balance, and those who were unable to build up reserves over this very long economic expansion will be at a distinct disadvantage in maintaining structural balance.

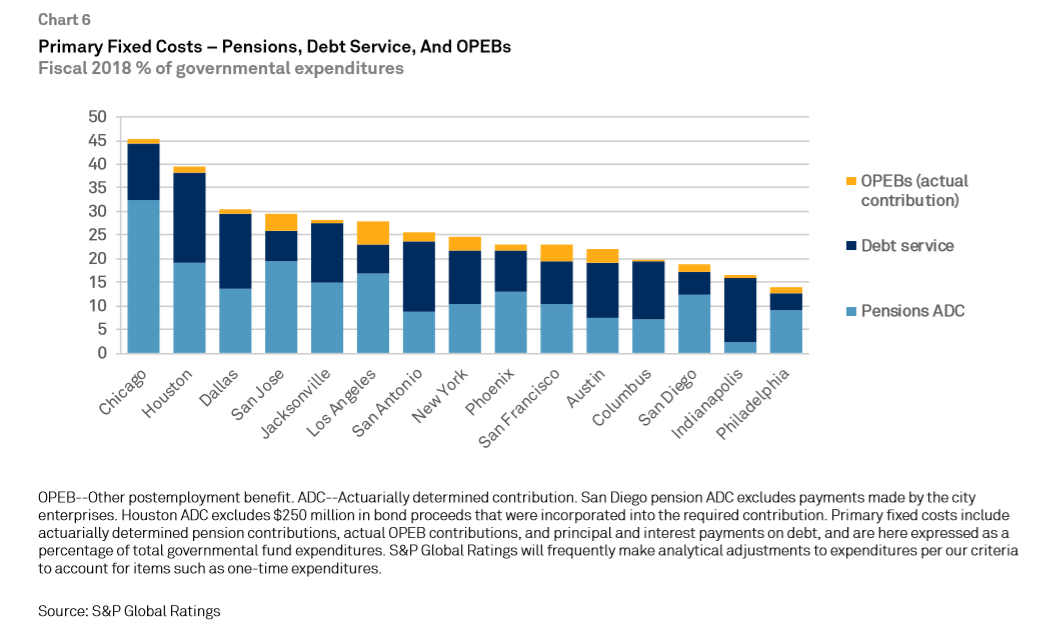

While both cities and states are on good footing for the time being, fixed costs continue to rise, creating longer term pressures. If revenues start to fall, higher fixed costs could further crowd out other demands such as infrastructure spending. In some extreme cases, this could extend to service delivery. The gradual growth of these costs—particularly pension and other postemployment benefit funding—threatens to upset operational balance. In some cities the problem is more acute than in others (See Chart 6).

Key assumptions

Although the potential for a slowdown looms and may be picking up steam, at the state and local level low unemployment, strong wage growth, and advantageous interest rates continue to support stable credit quality.

Despite signs of a slowing economy, our credit views incorporate limited disruption from equity market volatility, but uncertain and uneven impacts from the ongoing trade dispute. Accumulated reserves will help most state and local governments cushion any immediate blows that come from economic softness

Key risks

Tariffs and other policy changes remain important factors that could weigh on credit quality. When more retail goods enter tariff territory this fall, the extent to which this starts to hurt consumption could have an impact on both spending habits, and therefore sales tax collections. This would be an issue particularly for sales tax-supported governments.

While ESG (environmental, social, and governance) factors have always been important to the operation of state and local governments, a growing focus in recent years has started to shine a brighter light. An inability to identify and/or address ESG issues will create deterioration in credit quality over time, weakening a government's ability to provide core services to its constituents in the long term. A recent uptick in cyber-attacks—especially coordinated attacks on local governments—heightens the concerns. When these attacks hit an unprepared government, the risk of an impact to credit quality increases sharply.

Underfunded pensions and OPEBs (other post-employment benefits) remain a perennial problem for both state and local governments that will play out over a longer period (see chart 6). For those plans with without good funding discipline (e.g., without realistic discount rates; amortization periods of 20 years or less; or other assumptions that keep in step with changing demographics), the pressures from unfunded liabilities are more likely to spike and create budgetary disruption.

Underlying all long- and short-term risks for state and local governments is political uncertainty created by policy changes at the federal level. Major shifts in the equity markets following policy announcements can drive losses from capital gains tax and pension fund earnings, and if changes to Medicaid reimbursements (a significant state budget driver) come again to the fore, the potential for credit disruption heightens.

What to look for in the next quarter

Although state revenues remain strong to date, those unprepared to face an economic slowdown will be disproportionately affected. Any trends of weakening state revenues would indicate potential credit deterioration for both the effected state and its local governments.

Heightened ESG issues for states and locals, such as cyberattacks and storms, are particularly concerning for any credits where issues haven't been met with a commensurate level of planning.

Possible population shifts as residents of high-tax states absorb changes related to the Tax Cuts and Jobs Act of 2018 are an issue. While the news has primarily been anecdotal to date, an uptick in relocations could lead to more credit pressures for credits in those areas left behind.

Public Finance - Canada

|

What’s changed?

In October, federal elections will occur in Canada, which will likely delay rectification of the trade agreement with the U.S. and Mexico. Our base case is that Canada will sign the agreement after the U.S., and this will largely preserve existing cross-border production chains and capital flows.

Key assumptions

- We see real growth in Canada’s economy below 2% this year and next.

- We consider that Canadian provinces and cities continue to benefit from the very predictable institutional framework in which they operate.

- Borrowing conditions are still benign for provinces, and they keep concentrating the majority of the borrowing needs this year and next.

- Canada, the U.S, and Mexico will continue with a trade deal, but it is uncertain if it would be ratified by all countries before the end of the year.

- In case of a U.S. economic slowdown, some provinces are more resilient than others as some of the Canadian provinces are more tied to U.S. trade than others.

Key risks

We think the main risks that could affect Canadian provinces and cities are: increasing trade tensions between the U.S. and China; the higher risk of recession in the U.S.; and a lack of planning in certain provinces for a more uncertain future in terms of economic growth and high debt.

What to look for in the next quarter

- Provincial governments’ effectiveness at managing budgetary pressures in fiscal 2019, overreliance on debt issuance to cover operating deficits, and the effect of lower economic growth in provincial budgets, especially in those provinces where growth would be below Canadian’s.

- Demographic trends could also pose some public finance challenges, but are more an ongoing and medium-term concern.