Sep. 30 2019 — It is a bumpy outlook for credit conditions in the Asia-Pacific going into the last quarter of 2019. While official interest rates are expected to be lower in line with the Fed, investors are worried about the global economic slowdown narrative especially about China's GDP trend and the exchange of trade tariffs between the U.S. and China.

Financing conditions. Improved lending conditions, vis-à-vis central bank actions, have supported issuance growth (through lower debt-servicing costs) in the region. However, this is juxtaposed against economic slowdown which prompted the stimulus in the first place.

Economic conditions. U.S.-China trade-tech tensions have intensified and the path remains highly unpredictable. Growth in the region has continued to come in below our expectations. This has been mainly due to weak investment, which suggests that trade-tech war uncertainty is encouraging firms to delay their capital expenditure (capex) plans. Yet consumption and services remain resilient. A key question is for how long consumers and the services sector can remain insulated from the rest of the economy.

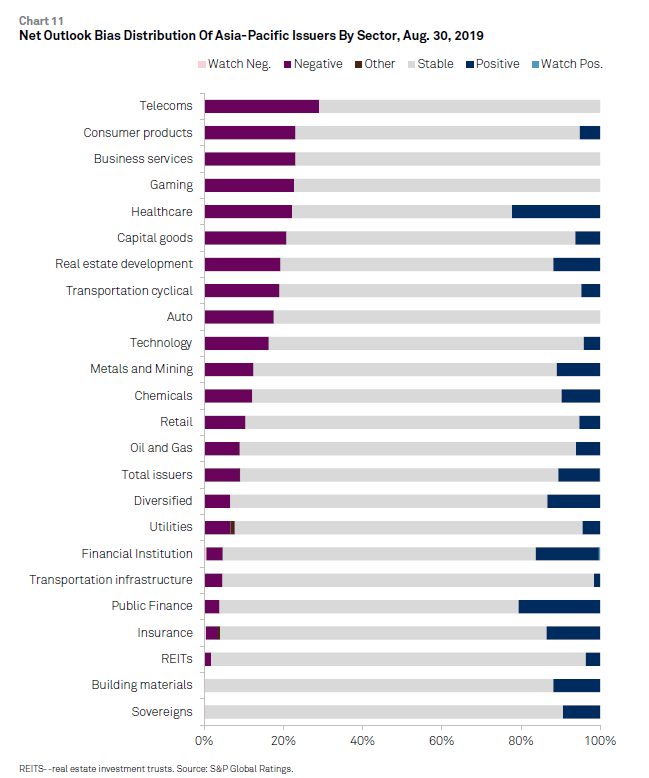

Sector trends. The overall net rating outlook bias is largely flat at positive 1.5% as of August 2019 from +1.4% in May 2019. There is a slight improvement in Australian banks' credit profiles and favorable momentum in some government credit profiles that helped raise the bias ratio for financial services and governments to +12% from +8%. However, slowing economic prospects, uncertainty over business conditions, tight sales margins, and tariffs are challenging nonfinancial corporate sectors. This is especially so for autos, capital goods, consumer products, technology and telecoms. The corporate net ratings outlook bias has declined to negative 7% from -4% since May 2019.

Regional Credit Conditions

Lower growth, lower rates

What's changed?

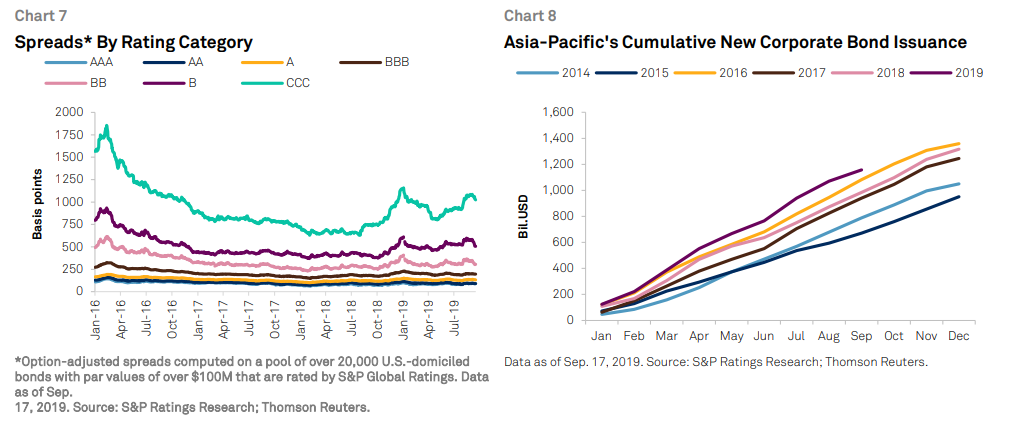

While official interest rates are expected to be lower in line with the Fed, investors are worried about the global economic slowdown narrative especially, in this region, about China's slowdown and the trade and technology dispute with the U.S. (the new "Great Game"). We would describe credit conditions as bumpy going to the next quarter.

Assessment of key risks

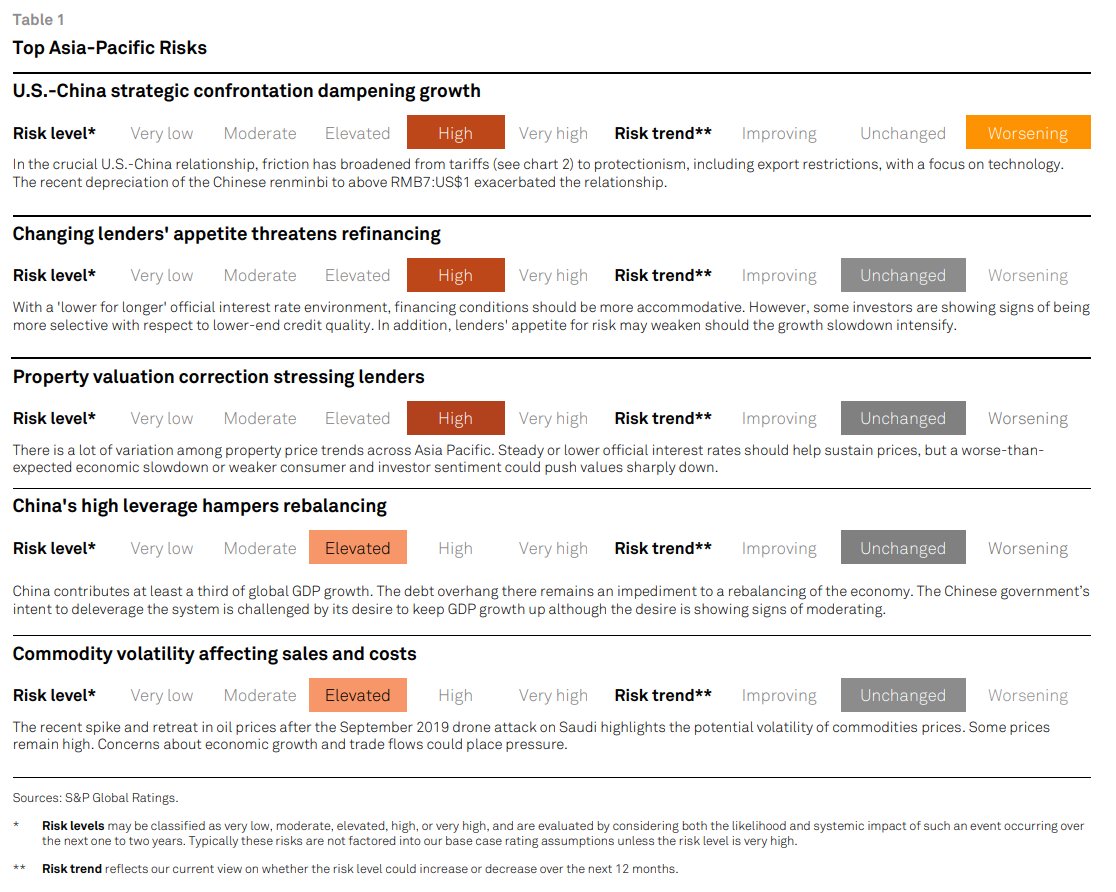

Our top Asia-Pacific risks (see chart 1) have some overlap with our top global risks.

1. U.S.-China strategic confrontation dampening growth (high, worsening)

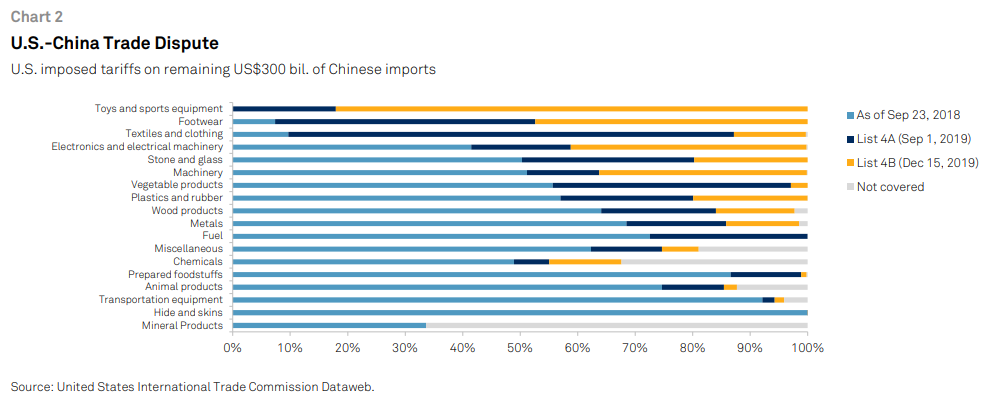

In the crucial U.S.-China relationship, friction has broadened from tariffs (see chart 2) to protectionism, including export restrictions, with a focus on technology. The recent depreciation of the Chinese renminbi to above RMB7:US$1 exacerbated the relationship.

2. Changing lenders' appetite threatens refinancing (high, unchanged)

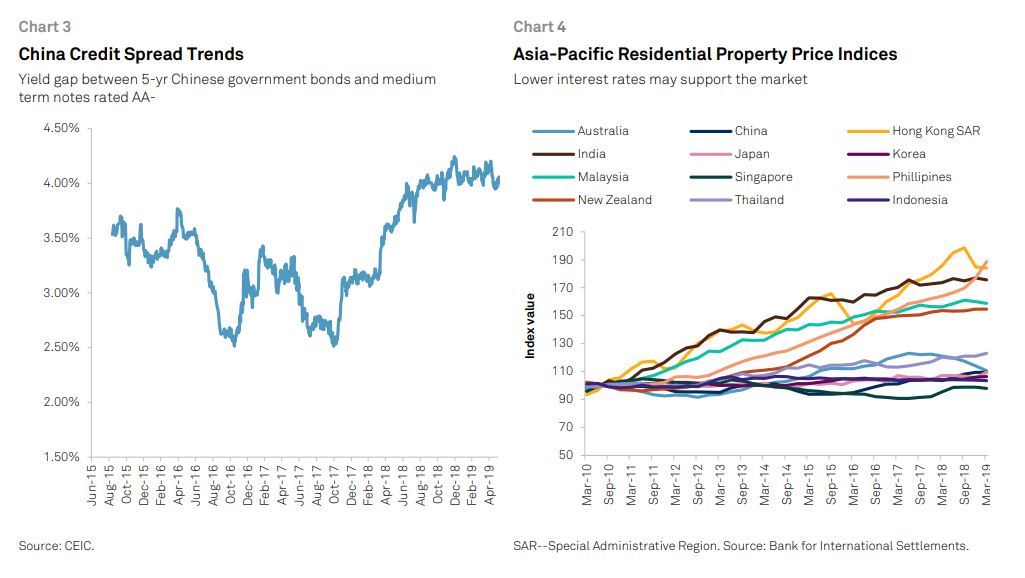

With a 'lower for longer' official interest rate environment, financing conditions should be more accommodative. However, some investors are showing signs of being more selective in respect of lower-end credit quality. In addition, lenders' appetite for risk may weaken should the growth slowdown intensify. Smaller, weaker, and more cyclically exposed companies may find it challenging to refinance. Indeed, credit spreads in some parts of the market remain high (for example, China--see chart 3).

3. Property valuation correction stressing lenders (high, unchanged)

There is a lot of variation among property price trends across Asia-Pacific (see chart 4). While steady or lower official interest rates should help sustain prices, a worse-than-expected economic slowdown or weaker consumer and investor sentiment could push values sharply down.

4. China's high leverage hampers rebalancing (elevated, unchanged)

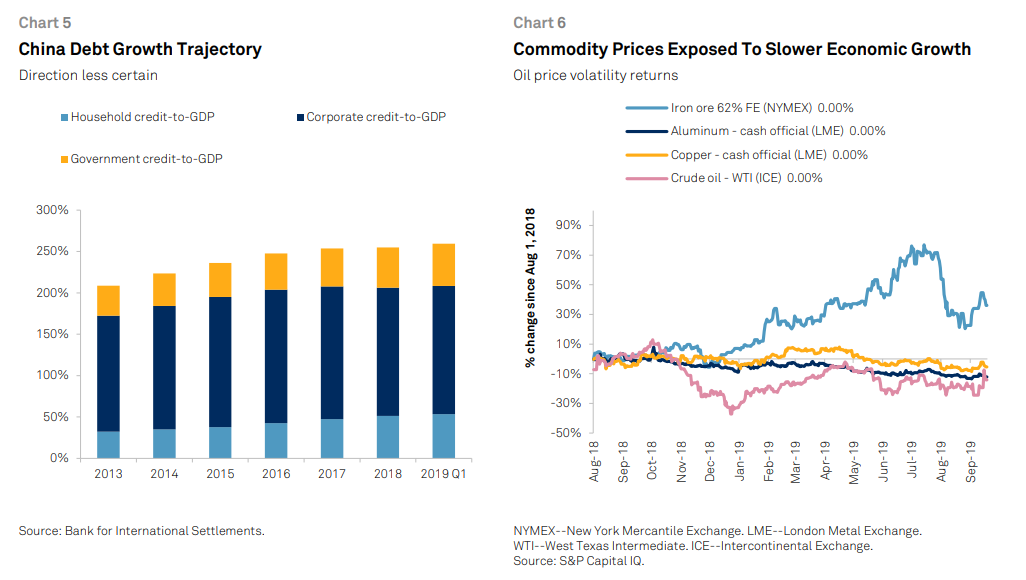

China contributes at least a third of global GDP growth. The debt overhang (see chart 5) there remains an impediment to a rebalancing of the economy. The Chinese government’s intent to deleverage the system is challenged by its desire to keep GDP growth up although the desire is showing signs of moderating.

5. Commodity volatility affecting sales and input costs (elevated, unchanged)

The recent spike and retreat in oil prices after the September 2019 drone attack on Saudi highlights the potential volatility of commodities prices. Some prices remain high (see chart 6). Concerns about economic growth and trade flows could place pressure.

Other risks.

- Japan-Korea trade dispute. Japan has introduced export licenses for some material exports to Korea critical for technology supply chains. Should relations deteriorate further, technology supply chains could be affected given both countries' role as upstream suppliers.

- Hong Kong political risk. While street protests in Hong Kong have affected the air transport, retail and hospitality sectors and dented confidence, the impact on property and other sectors has been limited. This risk is more Hong Kong-specific with limited spillover to other economies.

- China economic risk. There is a risk that a weak transmission of China's policy decisions may translate to softer growth numbers. However, this is not a top risk.

- Technology risk. We removed 'technology disruption and cybersecurity' risk as it is shown in our global top risks. In Asia, financial technology has had a massive impact in China.

Financing Conditions

Lower rates favor issuance

What's changed?

Lower policy rates favor issuance. Central bank actions have supported debt issuance through lower debt-servicing costs. However, this is juxtaposed against the economic slowdown that prompted the stimulus in the first place.

Key assumptions

Financial markets are more risk-aware. With lower debt servicing costs, which has boosted Asia-Pacific issuance in 2019, and a deteriorating economic backdrop (which could dent capital demand, thus lowering issuance expectations), investors are becoming more selective. This may restrict the access of lower quality borrowers to markets. There is a risk of net capital outflow from Asia Pacific.

Key risks

Lending conditions. Over the past few months, global lending conditions have broadly improved. Most borrowing costs are still falling or are gyrating at lower levels than at the start of the year. Emerging-market financing conditions remain supportive.

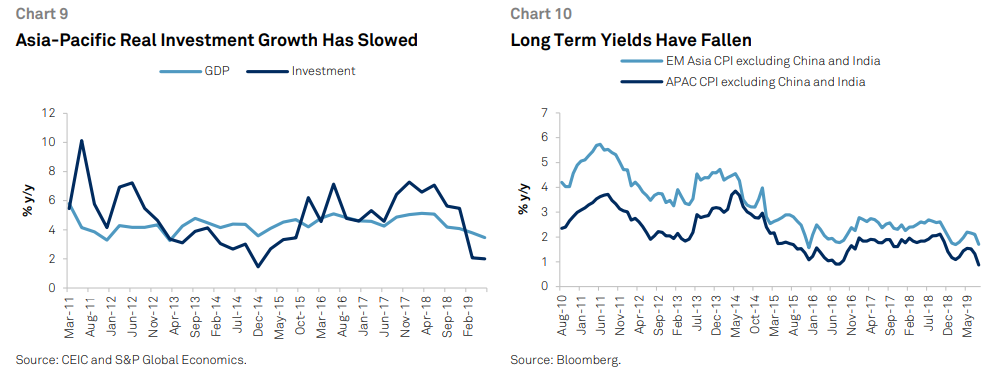

Economic slowdown. Some risk aversion persists with spreads (Chart 7) widening disprortionately for lower quality borrowers amid slowing growth. Favorable lending conditions continue to support issuance, especially for high-quality borrowers that are more resistant to volatile financial markets.

What to look for

Increase in issuance growth. Asia-Pacific has seen about US$1.16 trillion in new corporate bond issuance this year (as of September 17), surpassing the record US$1.08 trillion issued in 2016 through September (Chart 8). This is on track for strong issuance growth in the region through the remainder of this year, despite the global and regional risks.

We expect global bond issuance to finish 2019 roughly 4% higher than the 2018 total. Our base-case assumptions for 2019 have changed somewhat, given the Federal Reserve's and the European Central Bank's recent shifts toward easing. These more accommodative stances by the central banks have helped lower borrowing costs for lenders after a particularly challenging end to 2018.

Macroeconomic Outlook

Collateral damage to confidence

(Editor's Note: The views expressed in this section are those of S&P Global Ratings' economics team. While these views can help to inform the rating process, sovereign and other ratings are based on the decisions of ratings committees, exercising their analytical judgment in accordance with publicly available ratings criteria.)

What's changed?

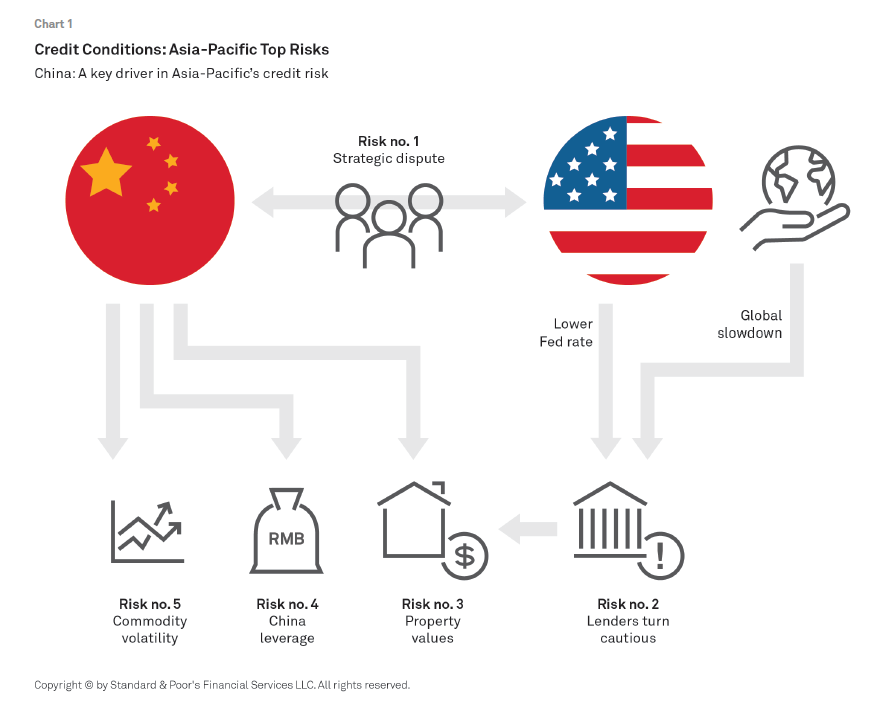

Eroding confidence in the outlook is intensifying the investment-led slowdown across Asia-Pacific. Trade and technology tension is high and rising (now including the Japan-Korea dispute). Higher oil prices drag on growth. China’s stabilization has proven short-lived.

Key assumptions

Stalemate in the U.S.-China relationship. We think a comprehensive deal remains far off. We expect bilateral tariffs to be held at current levels for some time, and for there to be a restrictive environment for investment and technology relationships.

Global financial conditions to remain supportive. Major central banks have begun easing and we expect policy rates to remain lower for longer. Should this maintain support for investor risk appetite, it will provide room for lower policy rates across Asia Pacific.

China's limited policy support points to a slowdown. Conditions are tightening moderately as policymakers show restraint. Recent policy signals suggest a lower growth target for 2020.

Key risks

Escalating protectionism. Further U.S.-China tariff hikes or non-tariff barriers, including export controls, would undermine confidence and investment. The Japan-Korea dispute could affect the broader region given both countries’ key roles in technology supply chains.

Geopolitical tension and higher oil prices. Asia-Pacific is a net oil importer and a sustained surge in oil prices could depreciate currencies and raise costs for business and households.

Sudden tightening. This could result from less accommodative monetary policies by major central banks than is priced in by markets or higher investor risk aversion should recession fears increase.

What to look for

The policy stance in China. If policymakers continue to show restraint, with one eye on controlling financial risks, growth over the next 12-18 months could slow appreciably.

Sector Trends

Slowdown gradually flowing through

The overall net rating outlook bias is largely flat at positive 1.5% at August 2019 from +1.4% in May 2019. There is a slight improvement in Australian banks' credit profiles and favorable momentum in some government credit profiles that helped raise the bias ratio for financial services and governments to +12% from +8%. However, nonfinancial corporate sectors are being challenged by slowing economic prospects, uncertainty over business conditions, tight sales margins, and, for some, tariffs. This is especially so for autos, capital goods, consumer products, technology, and telecoms. The corporate net ratings outlook bias has declined to negative 7% from -4% since May 2019.

What's changed?

Corporates slightly worse. The sectors with the most negative rating bias are autos, capital goods, consumer products, technology, and telecoms. This is due to a mix of soft sales, competition, higher input costs and, for technology, higher tariffs on Chinese exports to the U.S.

Australian banks better. Following the Australian Prudential Regulation Authority's announcement that it will implement its plan to strengthen Australian banks' loss absorbing capacity, we revised to stable from negative our rating outlooks on the four major Australian banks.

Key assumptions

GDP growth. Regional GDP growth is expected to continue slowing in line with China's.

Financing. Financing conditions are likely to be choppy because of lender nervousness despite the Fed possibly cutting rates again.

Key risks

Trade, liquidity, credit cycle. The clear-and-present risk is an escalation of the U.S.-China strategic conflict. Other risks include currency, interest and liquidity risks, and a potential turn in the global credit cycle.

What to look for

Confidence, refinancing risk. Softening business and consumer confidence could affect demand, and tightening lending conditions may undermine issuers' ability to manage refinancing risks.

(We calculate the net rating bias by deducting the percentage of negative outlooks and CreditWatch listings against the percentage of positive outlooks and CreditWatch listings. A minus figure indicates that the former exceeds the latter; and a positive figure, vice versa.)

Nonfinancial Corporates

Demand drops, growth slows

|

What's changed?

Slowing demand. The sectors with the most negative rating outlook bias are autos, capital goods, consumer products, telecoms, and technology. Weak sales are cutting automakers' earnings. China's economic slowdown and subdued global capex needs in the auto, electronics, and construction sectors are hitting profitability and cash flow of capital goods companies. Intense competition, product development, and higher input costs are squeezing consumer product margins. Tariffs on Chinese exports of major IT products to the U.S. will further dampen technology demand.

Key assumptions

Moderate sales. Possibly lower growth in auto, capital goods, food staples, real estate development, retail, and technology. Some growth is likely in cosmetics, sportswear, and healthcare, and telecommunications, and prices may be more stable for metals and mining.

Mixed capex. For auto, new technology costs may be needed. Capex would be lower for capital goods, stable-to-mixed for metals and utilities, and higher for chemicals and transportation infrastructure.

Key risks

Fragile consumer sentiment. Further slowdown in demand (for example, if China's GDP growth is below expectations) would compound the challenge facing corporates in Asia Pacific.

Trade tariffs. Potential imposition of trade tariffs could affect trade flows and the import and export activities of regional businesses, e.g. automakers.

Liquidity. Should financing conditions tighten again, this could trigger a lender pullback for more leveraged issuers. Currency volatility remains a risk factor.

If the credit cycle turns. An abrupt credit cycle downturn would constrain issuers' ability to refinance.

What to look for

Business confidence. China continues to be the growth engine for Asia-Pacific economies and commodities. Any economic shock emanating from China or other major economies would dampen business and consumer confidence.

Financial conditions. Some industries will need to fund their capex (e.g. the telecommunications sector's 5G rollout) and some corporate mergers and acquisitions (M&A). A market shutdown in Asia Pacific, as occurred for U.S. speculative grade debt in the fourth quarter of 2018, would have a ripple effect.

Financial Institutions

Stable profiles, some threats

|

What's changed?

GDP slowing. GDP growth forecasts for end-year 2019 are now lower due mainly to increasing trade uncertainties which is causing numerous central banks to embrace more dovish interest rate policies.

Banking industry risk trends in Japan weaker. Persistent low-profitability in the ultra-competitive Japanese banking sector is contributing to weaker standalone bank credit quality in Japan.

Australian major bank outlooks stable. Negative outlooks on the Australian banks were recently revised to stable, following the regulator’s announcement concerning loss-absorbing capital.

Key assumptions

Slower macroeconomic outlook. The cyclical downturn in Asia-Pacific trade continues to be manageable, at current rating levels, for most regional financial institutions, but is contributing to downward rating pressures.

Governments remain supportive. A point of contrast with Western Europe and the U.S. is that systemically important banks in most Asia-Pacific jurisdictions will likely benefit from extraordinary government support, in the unlikely event it was required.

Key risks

High debt, elevated asset prices. High private sector indebtedness and high asset prices amid a protracted low interest rate environment across much of the region. These factors set the stage for a potential deterioration in credit quality.

Property sector risks. A meld of property risks across much of Asia-Pacific banking--including banks’ high exposure to property, high property prices, and corporate-sector property risks--are a risk for future bank asset quality.

What to look for

Asset quality, capital, and earnings stable. Aside from India, nonperforming loans should remain relatively low in most jurisdictions in 2019. The regional slowdown may mean banks are challenged to repeat similar good asset quality, by global standards, in 2020. Earnings and capital should generally remain supportive of ratings at current levels.

Insurance

Market volatility threatens profits

|

What's changed?

Market volatility. Recent hikes in equity market volatility on rising trade tensions will dent some insurers' profits. Forex volatility may affect insurers (Taiwan, Japan, and Korea) with sizable overseas investment exposure. Furthermore, lower for longer interest rate trends may hike loss reserves provisioning, impacting earnings.

U.S.-China trade tensions. While the fundamental demand for insurance remains strong given still-low penetration within the region, slower economic activity may reduce demand for marine cargo and trade credit insurance.

Key assumptions

Capital buffers. Built up retained earnings and moderate liability guarantees had shored up capital buffers to absorb recent market volatility. Underwriting capacity and no major catastrophes are keeping premium rates low for P&C insurers and reinsurers. Higher acquisition and compliance costs may dent profits.

Asset growth. Chase for yield, amid volatile investment markets, may prompt insurers to undertake more credit risks. In China, insurers' greater involvement in supporting equity markets and investment toward banks' perpetual bonds present downside risks. The higher correlation between insurers and banks increases sensitivity to economic risks with mounting concentration risk concerns.

Key risks

Offshore expansion. A more aggressive strategy for overseas investment exposes insurers' to greater balance-sheet volatility. Insurers with unhedged offshore investments will see potential forex fluctuations. Amid low interest rates, we expect hedging costs to rise.

Nonmodeled risks. Ongoing urbanization and changing weather patterns will require insurers to revisit their catastrophe (natural and man-made) pricing assumptions. This could impact reinsurance arrangements. Recent typhoons affecting Japan and coastal cities in China will mean insurers need to revisit their geographic exposures and this may result in higher reinsurance costs.

Regulatory changes. Evolving regulatory developments may lead to changing business and investment strategies. Changing regulations will mean increasing compliance costs and human resources.

What to look for

Typhoons. As we step into the fourth quarter of the year, insurers remain exposed to the residual effects of the typhoon season.

Public Finance

Fiscal expansion heightens risks

|

What's changed?

High positive bias declining. Positive rating outlooks on sovereign ratings of New Zealand and Japan drive a current positive bias, but rising leverage risks--especially for local and regional governments (LRGs) in China--are cutting into that positivity.

China's investment yet to revive. China remains highly dependent on investment-driven growth, but China's new investment growth has remained subdued despite the government's loosening monetary policies and accelerating fiscal expansion.

Key assumptions

Chinese LRGs' modest investment growth. LRGs' new bond issuance will continue to rise for refinancing and new investment, while the authorities will control LRGs' overall debt burden by restricting LRGs from further extending off-budget borrowings. Public investment growth, after considering on-budget and off-budget borrowings, will therefore stay modest.

Most Australian states to increase borrowing. Record infrastructure spending plans will raise borrowing needs, especially as tax revenue slows. Weaker domestic conditions are reducing the growth in goods and services taxes, while falling property prices are leading to conveyance duty write-downs. New accounting standards are resulting in operating leases being recognized as debt.

Key risks

Revenue pressure. China's authorities have initiated a series of tax cuts to promote economic growth. Some LRGs may find their revenue basis and budgetary balances coming under greater stress.

Off-budget borrowing to support growth. If China's economic growth decelerates rapidly, LRGs' off-balance sheet debt may spike again, resulting in weaker transparency and another hike in LRGs' debt burden. If the credit cycle turns. Tighter credit conditions could weigh on economic growth, LRGs' budgetary balance, and liquidity buffers.

What to look for

Policy shifts if growth weakens. The response of local governments should economic performance weaken more than we expected will be to push for more aggressive fiscal expansion, affecting longer term credit trends in the LRG sector.

Sovereign

Trade still at the forefront

|

What's changed?

Trade risks remain a concern with new tariffs announced. The threat of U.S. tariffs covering almost all Chinese imports has risen as trade talks between the world's two biggest economies show little progress. U.S. sanctions on China's largest mobile phone manufacturer complicates bilateral relations, with potential disruptions for global growth and trade flows.

Lower expected interest rates in developed markets, moderating pressures on emerging markets. The swift change in developed-market interest-rate trends has seen investors searching for yields in emerging markets again. Concerns about capital outflows from emerging markets have eased somewhat as a result.

Key assumptions

Trade actions to not derail growth in major economies. Despite intensifying trade tensions, the economic slowdown in key economies in Asia Pacific will be moderate. Stimulus measures undertaken by governments to offset the associated pressures will not materially weaken credit metrics in most cases.

The continuing evolution of US-China relations will not cause sustained and serious market disruptions. New measures coming out of the two countries will not elevate uncertainties that could create risk aversion toward emerging economies that will offset the cushion to credit quality due to the easier global monetary environment.

Key risks

Sudden capital swings possible. A sharp deterioration in international and domestic politics could still trigger investor risk aversion. Abrupt reversals in capital flows remain a risk.

Reversal of China's deleveraging. If trade talks fail and economic pressures mount, China's deleveraging policy could reverse. Sovereign credit support is likely to weaken due to growing risks of financial instability, with negative implications for other sovereigns in the region.

What to look for

Geopolitical and economic risks. Higher tensions in the Middle East could sour investor sentiment and threaten energy prices. This standoff may also affect North Korea's attitude on further negotiations.

Structured Finance

Slower growth, subdued consumers

|

What's changed?

Interest rate cuts and housing market sentiment in Australia. Interest rate cuts and signs of stabilization in house prices have seen some improvement in sentiment for housing markets. However, this is in the face of softening economic conditions in Australia and continued slow wage growth.

Easing credit availability. Recent developments in Australia's regulatory framework including borrower debt serviceability measures point to some easing in credit availability for households.

Rising uncertainty in economic growth and trade tension in China. China recorded the lowest GDP growth for years in the second quarter, which was no surprise to the market considering the many macro and industrial challenges since 2018.The renewed trade tensions now pose a threat to the real economy rather than just cast doubt on market stability.

Key assumptions

Stable employment. Ratings performance should remain largely stable, given relatively steady employment and economic growth, albeit at lower levels than we expect.

Key risks

Household Indebtedness. While recent interest rate cuts in Australia may ease debt serviceability strains for some households, Australian households continue to have high levels of indebtedness that may see resilience tested in the event of a severe shock to the economy. China is facing a slightly different household debt issue--despite the increasing income, debt is shooting up quickly in mortgages and consumption. China's ability to maintain stable employment and continued income growth amid the many challenges will decide the impact on debt serviceability.

Japan's consumption tax increase. The tax increase in October 2019 could affect the economy. If the credit cycle turns. If economic conditions worsen, unemployment and mortgage defaults could rise.

What to look for

China's slowdown, trade conflict. China's slowdown may worsen employment, potentially worsening loan performance. At this moment the highly diversified obligors' profile and quick accumulation of credit enhancement levels with fast loan paydown will underpin stable performance across transactions. The divergence among issuers in residential mortgage-backed securitization, and auto finance companies' continued penetration into lower-tier cities, however, deserve close attention for the impact on loan quality in the next 12 months.