Discover more about S&P Global’s offerings

Maya Weber reports, with research by Kent Berthoud, Andrew Cooper, Ashleigh Cotting and Simon Heald

Growth in women’s representation in energy leadership positions has increased in the past 10 years, but there’s still a long way to go.

Read more related content on #ChangePays in Energy.

Women now occupy less than one-fifth of senior leadership spots at energy companies around the world, but trends this decade show growth for women on boards of directors, in career paths leading to the executive suite, and at the C-suite level.

That’s according to an analysis of companies around the world that are constituents of the S&P Global BMI Energy (Sector) Index and S&P Global BMI Utilities (Sector) Index. The analysis, by S&P Global Platts Analytics and S&P Global Market Intelligence, was based upon a dataset of personnel compiled by S&P Global Market Intelligence.

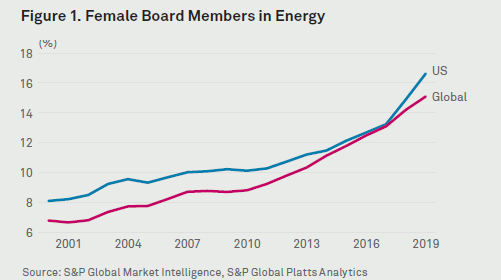

Gains were most visible on boards, where efforts to diversify are more established, with an added push from investors and, in some places, regulation (see figure 1).

The share of female board members in the S&P Global indices nearly doubled since 2000 to reach 15% for the energy sector on average. Growth in this decade was more than twice that of the last decade.

While it is unlikely that growth in women’s representation on boards would continue at the current rate, this would see energy boards attain 50-50 gender parity by 2058. Based on the same assumption, US boards would reach parity sooner, by 2044.

“As much as anything, it’s about getting in at the grassroots in the schools, in opening people’s minds up to the sorts of jobs they can do”

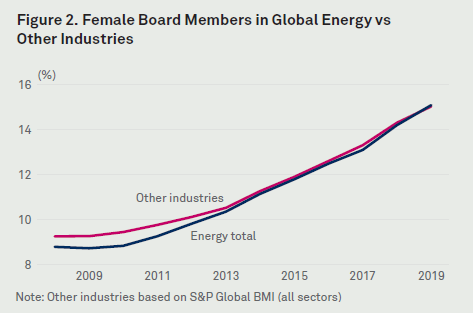

Comparing the energy and utilities indices with the S&P Global Broad Market Index as a whole, the energy sector since 2013 has closely tracked the broader swath of industries when it comes to female board representation (see figure 2).

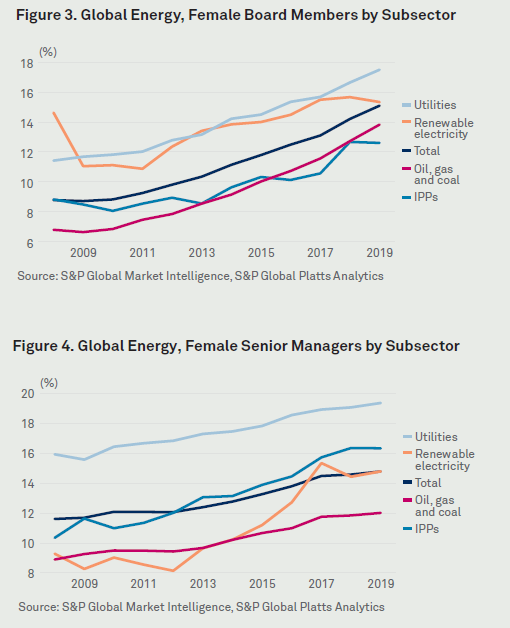

However, there were differences within the global energy sector – with subsectors such as utilities; renewable electricity; oil, gas and coal; and independent power producers seeing significant variations (see figure 3).

Reaching further down, the analysis considered a category that included senior managers and executives in an effort to get a look at the pipeline feeding into the highest levels. One of the common explanations for why there aren’t more women in the C-suite is that there aren’t enough women a step below to promote.

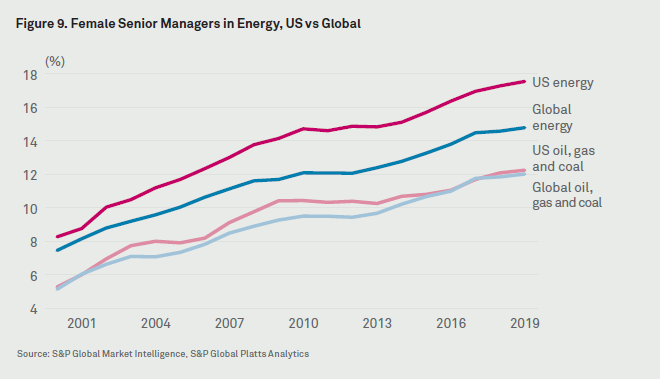

Women filled 15% of those senior manager pipeline spots in 2019 on average for the energy sector, up from less than one in 10 in the early 2000s (see figure 4).

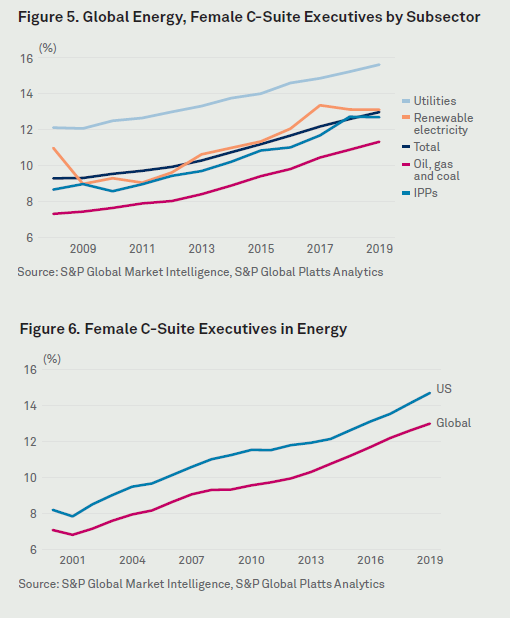

Representation in the powerful C-suites, encompassing top leaders such as the CEO, chief operating officer and chief financial officer, has been at slightly lower levels. If the current rate of growth does not increase, it could take until the 2090s for energy C-suites to reach gender parity.

Women now occupy 13% of C-level executive slots in the global energy industry, still less than one in eight, the data showed, but that’s almost doubled since 2000 (see figures 5 and 6).

Fiona Boal, head of commodities and real assets at S&P Dow Jones Indices, drew attention to the growing share of women in the senior manager ranks, but said it was still to be determined whether those women would take the final step into the C-suite.

“The fact they’re there has to be encouraging,” she said, however, “you can have a lot of women in senior management roles, but they ... often wrongly are perceived not to be in the path that takes you into the senior levels of running a company.” That could include fewer women in operational, mainline or revenuegenerating parts of the business that often feed into the C-suite.

Caren Byrd, managing director for investment banking at Morgan Stanley, said, “I’m happy to see [the numbers] going in this direction.” The gains in the board numbers are important for diversity because, “it starts at the board … it’s the board that picks the C-suite,” she noted. Boards also plan for succession of CEOs.

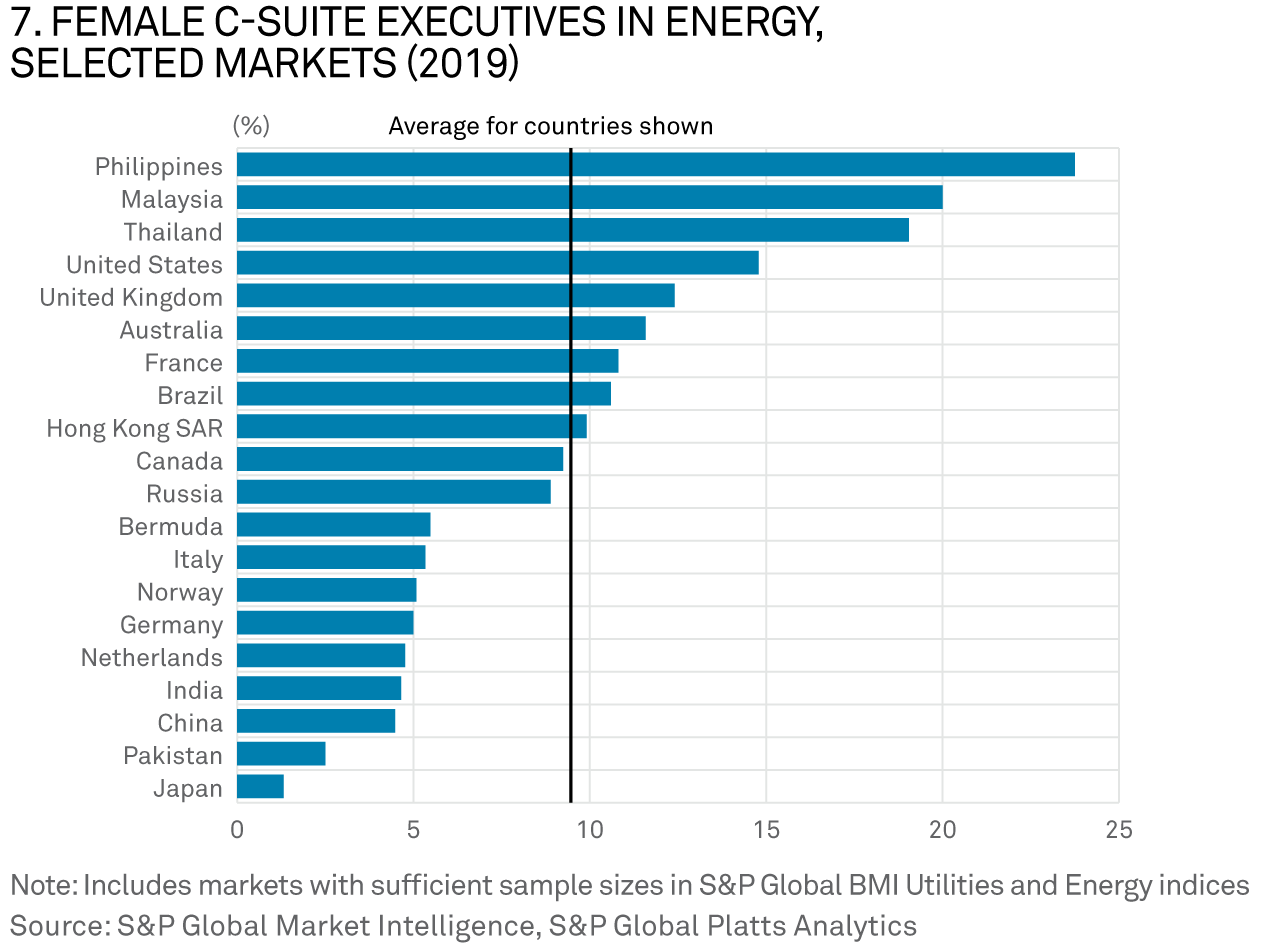

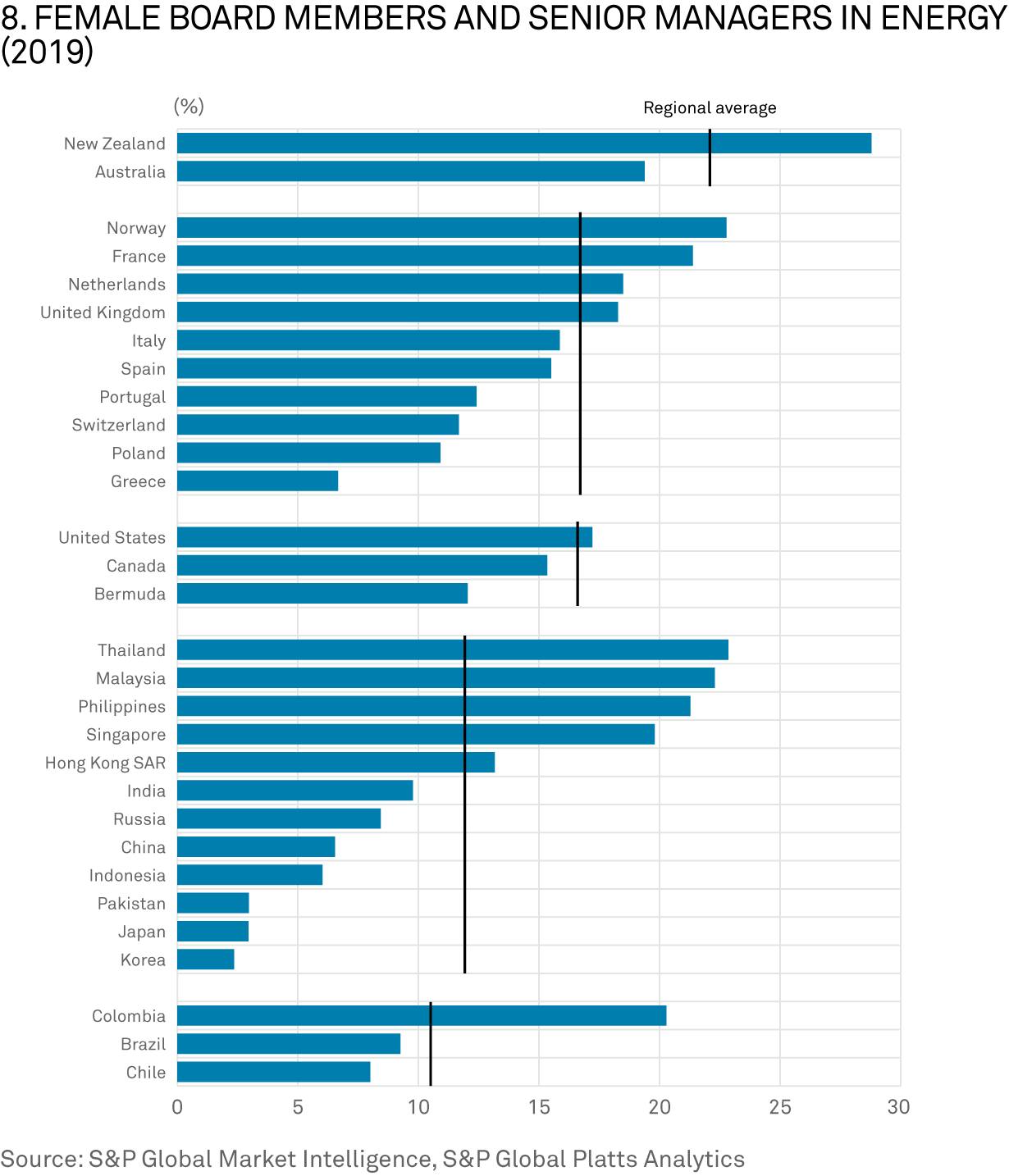

There were variations by region. The US maintained a small lead over the global average in energy sector C-suite representation at about 2% higher since 2000; it also currently exceeds the global average for boards. Southeast Asian countries like Thailand, the Philippines and Malaysia were among the highest performers in the indices, while elsewhere in Asia, Japan, South Korea and Pakistan trailed (see figure 7).

Utilities consistently beat the energy sector average, as well as oil, gas and coal companies in the share of women in all three categories: board, C-suite and senior manager levels.

The oil and gas sector, though, has been making similar gains to utilities, just starting from a lower level.

The share of women on utility boards globally rose to 17% in 2019, from 12% in 2009.

In power and utilities, expectations have changed about the pool of candidates to be considered for boards.

“At this point it’s a given, it’s understood, that the slate [for boards] has to really be well-represented … for gender and ethnic diversity,” said Jennifer Rockwood, who leads the power and utilities practice at recruitment firm Russell Reynolds.

Complementing the data analysis, S&P Global Platts interviewed more than a dozen female leaders about their perceptions of gains, hurdles and efforts underway related to gender parity.

A frequent refrain was that their companies or organizations had embraced research findings that teams with diverse representation have better performance outcomes, make better decisions, or see more innovation. Several cited the importance not only of gender, but also other underrepresented groups when seeking to increase diversity, noting numbers are substantially lower for women of color.

With the share of women on boards still below one in five, some suggested energy companies should look beyond the traditional roles feeding the director positions.

“If they broadened the searches a little bit, they’d probably just naturally get more diversity,” said outgoing FERC commissioner Cheryl LaFleur, who was due to leave the agency at the end of August. “I think most boards are woke enough to want it, but it’s been in tension with the narrow pools that are sometimes considered for some of those jobs.”

In the oil and gas sector, the share of women on boards reached 14% in 2019, double the level in 2009.

While that is still below one in five, some multinational oil majors blew past those averages. The board of BP is 36% female, though its executive team is still just 15% female, according to data provided by the company. Shell has approached parity, with women making up 45% of the board at the end of 2018, up from 8% in 2011, the company said. That may reflect a trend by those large companies, particularly in Europe, to advance diversity and offer generous maternity leave and flexible work schedules, the lack of which can still (%) Average for countries shown frustrate women in smaller companies.

Compared with smaller peers, Maria Victoria Zingoni, Repsol’s executive managing director of commercial businesses and chemicals, believes large, multinational companies such as hers are well-positioned to deal with issues such as diversity and inclusion, and have a responsibility to drive them forward. She said large companies in particular “understood that this is important because you don’t want to lose 50% of the talent.”

Zingoni also said gender diversity can put energy companies in a better position to tackle the challenges they are facing. “If you understand better your customers, you understand better your suppliers, you have a different understanding of what the energy transition means and how to approach that, you have different standpoints in your decision making and that helps you make better decisions,” she said.

Despite embracing the goal of increasing diversity in senior leadership ranks, female leaders frequently cited a struggle to attract and build a pipeline of talent, from the entry level on, particularly in the energy sector where there is a high demand for people in technical positions and engineers.

“You have to have a diverse pipeline throughout your organization so that when you are making selections you do have gender in the pool,” said Patti Poppe, CEO of US utility company CMS Energy. “You have to work really hard to get the limited pool of diverse candidates in the engineering positions [and] they’re highly sought after.”

Several also described a need to encourage women to enter mainline or operational parts of the business, or profit-and-loss centers, if they are to advance to higher levels.

“In the push to bring women forward, we pulled them into coordinating roles, and in pulling them into coordinating roles, we pulled them away from operational roles,” said Christina Verchere, CEO of OMV Petrom. “They would get to a certain level and couldn’t progress further up because they had a gap in their experience.”

As with boards, utilities also showed higher numbers at the C-suite level than the energy sector average, though women were still below one in five. In 2019, women made up about 16% of utility C-suite spots, up from 12% in 2009, the analysis found.

Rockwood sees an upward trend of women in leadership in power and utility companies as companies are starting to see the fruits of investments in grooming the next generation of talent.

There are still challenges, but there is an “absolute concentrated focus” on cultivating the next generation, she said.

As a sign of progress in the utility space, Anne Pramaggiore, senior executive vice president and CEO of Exelon Utilities, pointed to research from the Edison Electric Institute. It found that 20.9% of CEOs of US regulated investor-owned utilities were female at the holding company level.

“Some of it is a function of the skill sets that are now viewed as necessary to run their utilities. With change in the business model and technological change, people are coming to run utilities with different skill sets such as finance, or the regulatory and legal side of the business,” she said.

Those are areas where women probably have been present at higher levels for longer periods than in engineering and STEM, she said.

Sue Kelly, president and CEO of the American Public Power Association, said that as utilities move away from their traditional business model – of having poles, wires and generation or “keeping the lights on and the beer cold” – customers expect more, and want to exercise options using technology, she noted. That allows different disciplines to have a say, she said.

“Consumers are going to be the new asset class,” offered Lisa Frantzis, senior managing director at Advanced Energy Economy and managing director at Navigant Consulting. “Everything is moving more toward a much more interactive customer, [and] the customers are not just men.” Globally, she said the value in the power sector is shifting to distribution and behind the meter, with the annual global investment by 2030 estimated at $1.3 trillion, she said.

As public-facing, regulated entities, utilities also face greater expectations to mirror the communities they serve.

Companies interviewed described efforts to bolster diverse representation at multiple levels in the employment track. Those included creating networking groups, having senior managers mentor or sponsor budding leaders, and attempting to diversify the pool of applicants considered during the hiring process. With the urgent need for employees in technical areas, these also included outreach to schools and sponsorship of educational programs.

“As much as anything, it’s about getting in at the grassroots in the schools, in opening people’s minds up to the sorts of jobs they can do,” said Hilary Mercer, VP of Shell’s Pennsylvania Chemicals. She described challenges getting over “the paradigm” that there are jobs women can and can’t do.

For the oil and gas sector, drawing in diverse young recruits may be more difficult, given public perceptions of the fossil fuel industry, as well as preconceptions about the fieldwork, the need to move to remote locations, and a relatively low number of role models for women or minorities in the sector. The challenge is heightened by expected retirements and stiff competition for young talent from the high-tech sector.

Amanda Eversole, COO at the American Petroleum Institute, said there is room to help the industry clearly communicate the breadth of opportunity in the field. Jobs ranging from data scientist to supply chain specialist pay well and offer long careers, she said.

Amid challenges around public perception that could impact the ability to draw women and men, Crystal Heter, segment president, natural gas transportation, for Tallgrass Energy, said, “the industry needs to do a better job of advocating for the measures it has taken, and the progress it has made, to be socially responsible.”

Katie Mehnert, founder of Pink Petro, a social media organization for women professionals in the energy sector, and Experience Energy, a jobs platform, sees a need for oil and gas companies to embrace a “cultural shift,” in which diversity and inclusion become core values, rather than a “priority” that can be set aside.

She sees a need to reach “way down” into elementary school, to talk about where energy comes from, and better tell the industry’s story about its impact on humanity.

“The industry is not sought after by women and young people and minorities. Let’s face it,” said Mehnert.

S&P Global Platts Analytics and S&P Global Market Intelligence conducted this analysis based on S&P Global Market Intelligence people data for the constituents of the S&P Global BMI Energy (Sector) Index and S&P Global BMI Utilities (Sector) Index.

The two indices include a total of 799 companies: 461 companies in the oil, gas and coal industry; 241 companies classified as utilities; 50 companies classified as independent power producers; and 47 companies classified as renewable electricity. The higher number of oil, gas and coal companies reflects the total number of publicly traded companies in existence in each category. There are more than 2,000 publicly traded oil, gas and coal companies across the globe. In contrast, there are almost 600 publicly traded utilities, roughly 180 publicly traded IPPs and about 230 publicly traded renewable electricity companies. The analysis classified companies by their primary industry, according to the Global Industry Classification Standard used by S&P Global Market Intelligence.

The renewables category includes companies engaged in generation and distribution, rather than those that manufacture capital equipment or provide technology, components and services.

For the selected companies, the analysis identified board members, senior managers and other key executives. The latter two categories included more than five dozen roles tracked in the S&P Global Market Intelligence database. Researchers identified the gender of the individuals covered in the analysis based on several factors. Honorifics in the database helped identify the gender of 85% of the individuals included in the analysis. Pronouns used in biographical data fields enabled identification of another 13.5%, and the remaining 1.5% were classified by matching first names to external sources, such as the US Census Bureau. This classification method was 95% accurate when backtested against the known dataset.

Growth rates based on current trends used a simple linear regression, calibrated using the previous decade of data.