Discover more about S&P Global’s offerings

While the extent and effectiveness of the global response to climate change remain uncertain, one thing is very clear: Companies and investors must prepare for a range of possible outcomes with diverging transition and physical risks. We look into these risks in our latest research, which debuted at the World Economic Forum in Davos, Switzerland.

Editor’s note: This research is based on a presentation delivered at the 2020 World Economic Forum meeting in Davos, Switzerland by Richard Mattison, CEO of Trucost, part of S&P Global.

Published: January 6, 2020

Companies in the S&P 500 Index own physical assets across 68 countries globally—and 60% of these entities (with a market capitalisation of $18 trillion) hold assets that are at high risk of at least one type of climate-change physical risk. 134 mining properties owned by companies in the benchmark index are exposed to increasing risk of heatwaves under a moderate climate-change scenario by 2050, and utilities companies with a market capitalisation of $515 billion own at least one asset at high risk of wildfire.

Heatwaves, wildfires, water stress, and hurricanes linked to increasing average global temperatures represent the biggest physical risks for these companies, with the location of assets the key factor in determining the extent of these risks—more than the industry or sector in which a company operates.

S&P Global Platts estimates energy-combustion CO2 emissions could skyrocket to approximately 50 gigatonnes by 2050, from 35 gigatonnes today, if current trends prevail. Even Platts’s most likely scenario—taking into account expected policy action and technological innovation—envisions emissions stabilizing after peaking around 2025. This is still far above needed targets; to keep global warming to 2 degrees Celsius, emissions would need to fall to about 15 gigatonnes by 2050.

Register for our upcoming webinar >

While the extent and effectiveness of the global response to climate change remain uncertain, one thing is very clear: Companies and investors must prepare for a range of possible outcomes with diverging transition and physical risks.

This need for determined action to reduce emissions and limit the effects of climate change poses important transition risks for companies and investors through regulation, changing market dynamics, and technology, among other factors.

As it stands, companies in the benchmark S&P 500 Index own physical assets across 68 countries globally—and 60% of these entities (with a market capitalization of $18 trillion) hold assets that are at high risk of at least one type of climate-change physical risk. And while corporate-level resilience to both transition and physical risk varies greatly within and across sectors, S&P Global data show that heatwaves, wildfires, water stress, and hurricanes linked to increasing average global temperatures represent the biggest physical risks for companies in the S&P 500.

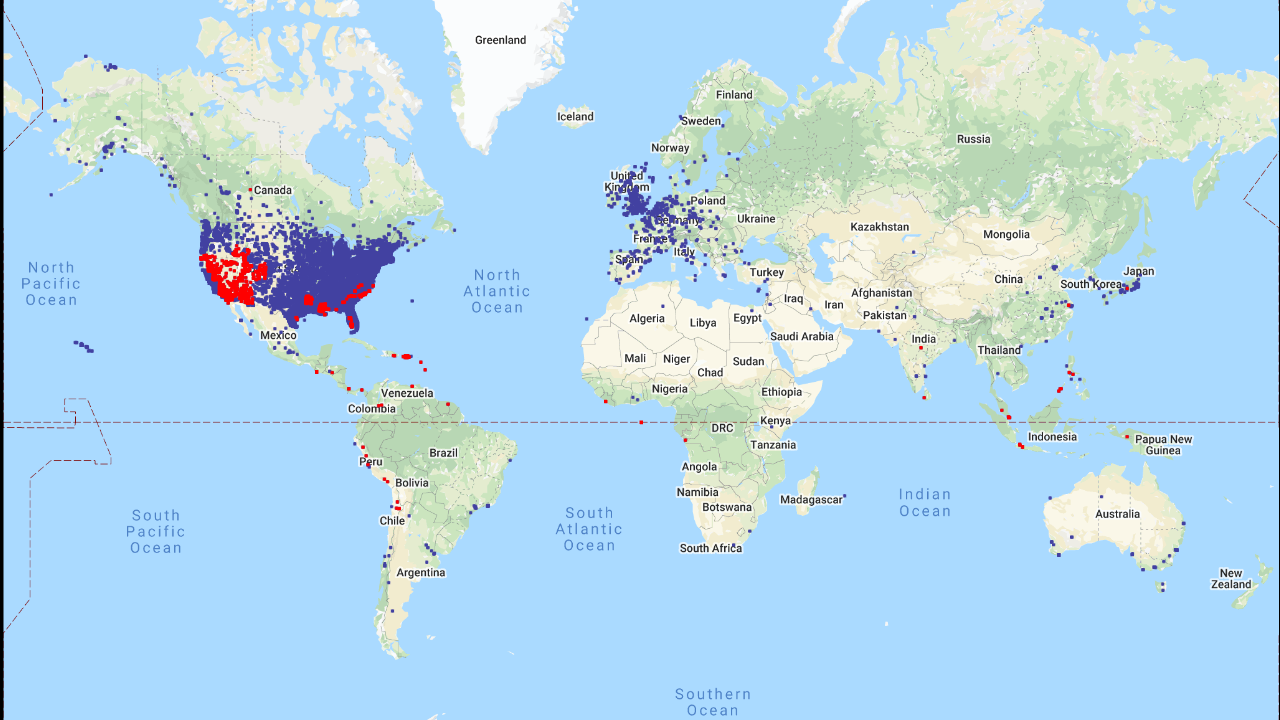

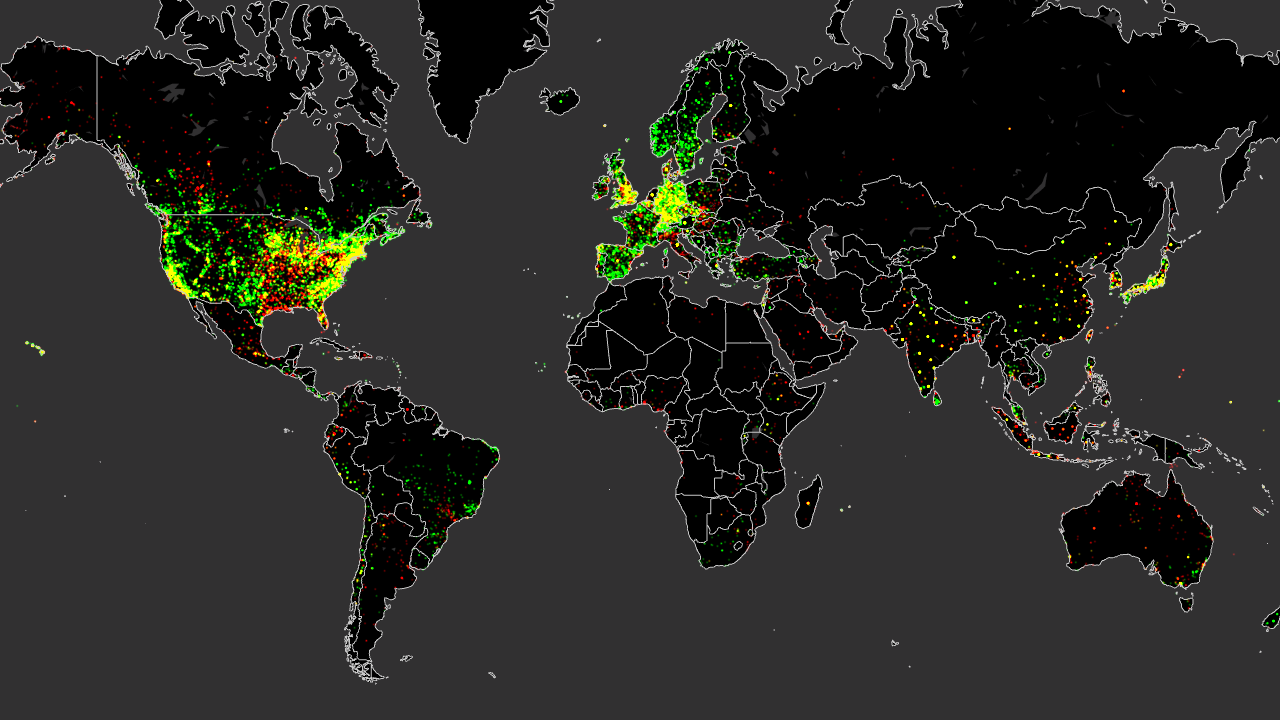

ALL S&P 500 ASSETS AT RISK

It’s important to note that the location of these assets is the key factor in determining the extent of these risks—more than the industry or sector in which a company operates.

Still, some sectors face heightened risks. For example, real estate investment trusts (REITs) included in the S&P 500 own properties across the globe with significant concentrations in the U.S., U.K., and Canada. Some of these properties are exposed to risk of inundation due to sea level rise, highlighting the need for effective planning and flood-mitigation measures to preserve asset values.

NEW YORK-AREA REAL ESTATE ASSETS OVERLAID WITH SEA-LEVEL RISE (MULTI-CENTURY)

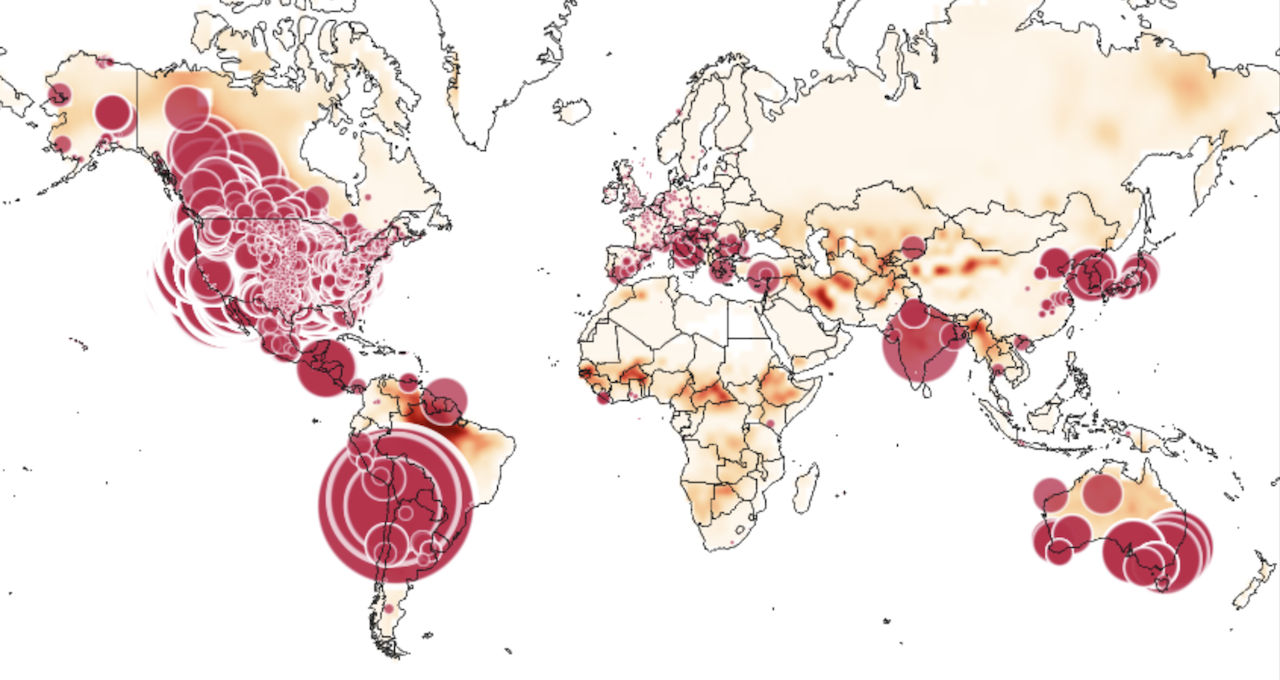

Similarly, S&P 500 materials sector companies operate mines and processing plants across 15 countries with more than 46% of all sector assets outside the U.S. Altogether, 134 materials sector properties owned by S&P 500 companies are exposed to increasing risk of heatwaves under a moderate climate-change scenario by 2050, with significant potential effects on operational efficiency and operating costs.

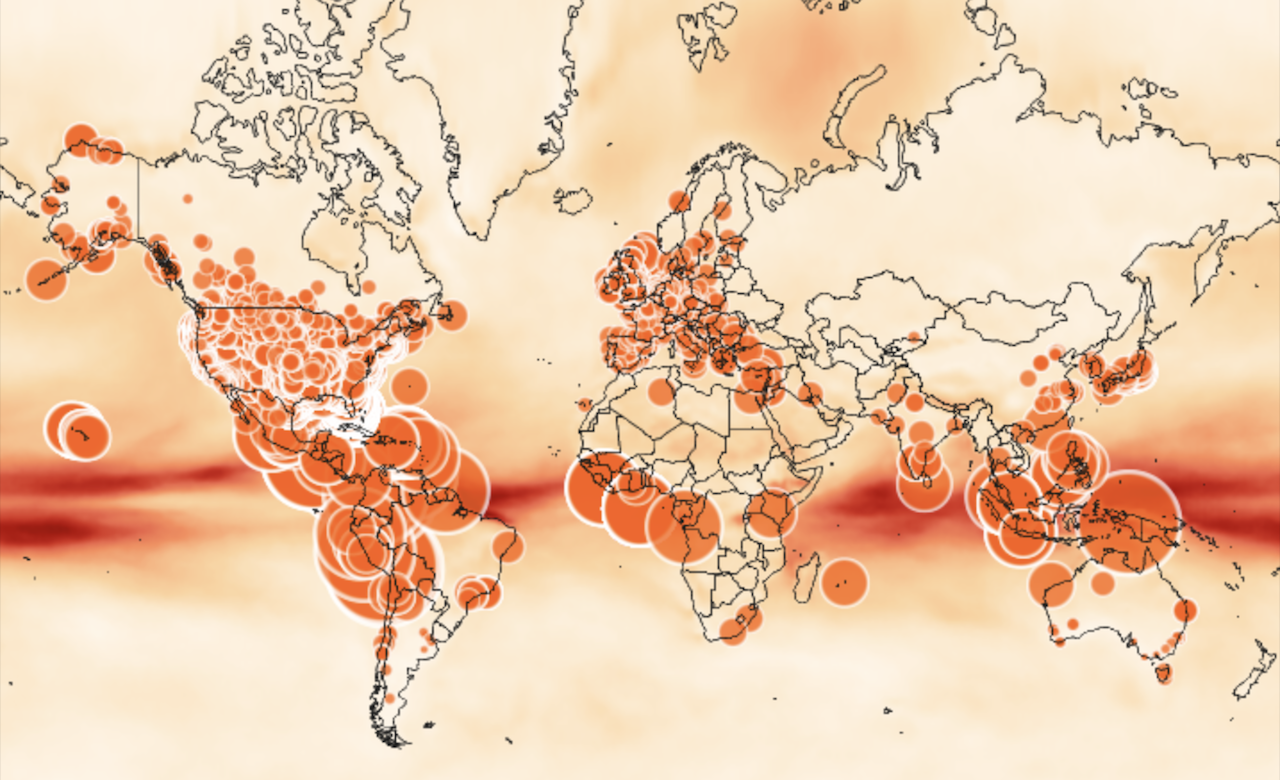

Finally, S&P 500 utilities companies with revenues of $184 billion and market cap of $515 billion own at least one asset at high risk of wildfire, exposing those companies to physical damage to assets, and legal liabilities where electricity-transmission infrastructure is implicated in wildfire outbreaks.

S&P 500 UTILITIES SECTOR ASSETS OVERLAID WITH WILDFIRE RISK (2030-2050)

Granted, it’s not possible to definitively say that climate change has “caused” a particular event, but the scientific community has a higher level of confidence about the effects in certain areas, such as extreme temperatures and precipitation rates, given that there’s more data to analyze. Because tropical cyclones, for example, derive energy from warm waters, the broad consensus is that rising sea temperatures will cause hurricanes and typhoons to become more frequent, and likely stronger. Either way, it’s clear that weak action to reduce emissions will accelerate climate change and associated events.

Humans are unquestionably producing increasingly large quantities of the greenhouse gases—through industry, transportation, agriculture, and other activities—that contribute to climate change. Even a stabilization of our carbon dioxide (CO2) output would fuel further climate change, because we currently pump CO2 into the atmosphere at a faster pace than natural processes such as photosynthesis and oceanic absorption can filter it out.

Absent a significant turnaround in this trend, climate change is almost certain to cause continued substantial losses to infrastructure and property, and, worse, increased illness and death. According to estimates from the World Health Organization (WHO), anthropogenic climate change was already leading to at least 5 million cases of disease and more than 150,000 deaths annually as long ago as 2000—that’s 20 years ago. Considering that the WHO now projects annual deaths will reach 250,000 in the period 2030-2050, it’s clear that anything less than decisive, widespread action is an imminent danger, not just to future generations, but to the almost 8 billion people alive today.

The 5th Assessment Report of the Intergovernmental Panel on Climate Change estimates that the average global surface temperature has increased 0.85 degree Celsius (1.5 degrees Fahrenheit) since the first industrial revolution, around the turn of the 19th Century—and that warming by the end of this century could range from 0.9-5.4 degrees C (1.6-9.7 F). Meanwhile, a 2018 report from the Intergovernmental Panel on Climate Change suggested the world had only 11 years left to prevent irreversible damage from climate change—and while the mission of September’s U.N. Climate Action Summit was aimed at keeping the world’s temperature increase below 2 degrees C, many scientific leaders doubt this can be accomplished. In fact, The United Nations Environment Programme (UNEP) projects that even if countries meet the commitments of the Paris Agreement, it’s likely that warming will rise to 3.2 degrees C by the end of the century.

S&P 500 MATERIALS SECTOR ASSETS OVERLAID WITH HEATWAVE RISK (2030-2050)

Trucost, part of S&P Global, recently launched its Climate Change Physical Risk Analytics, helping companies and investors understand their exposure to a range of physical risks at the asset level, including floods, droughts, wildfires, heatwaves and extreme weather events. Trucost predicted in March that 2019 would be the year that companies transform the way they manage climate-related issues; that environmental, social, and governance (ESG) concerns are critically important to capturing mainstream investor attention; and that ESG issues are reshaping business models across a broad swath of Corporate America. Given all of the focus on ESG in financial markets—with lenders and investors, among others, all seeking greater clarity around the prospects for sustainable finance—this is ringing true.

While nearly all countries have committed to curbing global warming by substantially reducing greenhouse gas emissions, very few have met this promise. In fact, the Climate Action Tracker (CAT), an independent scientific analysis produced by the research organizations Climate Analytics and the New Climate Institute, lists all developed economies as insufficient. In the CAT—which looks at the comprehensive climate pledges and policies of 32 countries, covering around 80% of global emissions, to assess efforts to limit the global average temperature increase as per the Paris Agreement and additional policies and actions taken to curb output—the U.S. notably ranks in the “critically insufficient” category, along with Russia, Saudi Arabia, Turkey, Vietnam, and Ukraine. While all other countries scored by the CAT range between “highly sufficient” and simply “insufficient,” just five sovereigns—Ethiopia, Kenya, India, Bhutan, and the Philippines—are 2 degree C compatible and only Morocco is in the green as compatible with the Paris Agreement’s 1.5 degree C warming target, perhaps due to these countries’ relative lack of dependence on carbon-intensive industries rather than their climate-mitigation efforts.

S&P Global Platts analysts estimate that an adherence to historic trends would send energy-combustion CO2 emissions skyrocketing to approximately 50 gigatonnes by 2050, from 35 gigatonnes today. (For context, one gigatonne is roughly equivalent to just one year of transport emissions—including aviation—in the E.U.)

Platts’s most likely scenario—taking into account expected policy action and technological innovation—envisions emissions stabilizing after peaking around 2025. This is, as we said, still far above needed targets; in our 2 degree scenario, global emissions would need to fall to about 15 gigatonnes by 2050. At the same time, oil demand would peak closer to 2040 in our most likely scenario (and not at all under business as usual). Undertaking a more intense climate change goal of limiting global warming to 2 degrees would require oil demand to peak within the next decade.

For countries and companies, understanding future climate risk depends on transparency around the geographic exposures of assets and operations. But asset-level exposure to climate risk involves a complex interplay of transition and physical risks. Companies’ exposures and resilience don’t conform to clear patterns, highlighting the need for in-depth investor analysis to evaluate climate risk at the asset and company level.

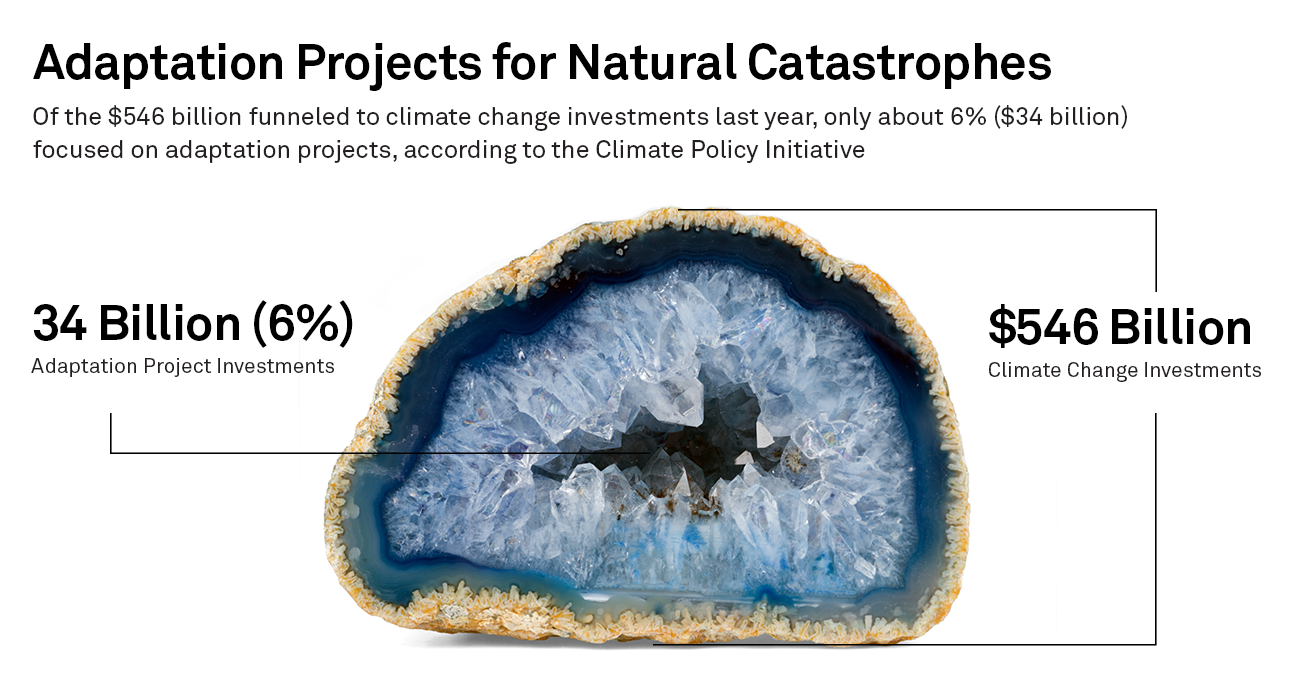

Recently, much of the effort to address the risks of climate change have come in the area of adaptation—that is, adjusting to the effects, rather than trying to prevent them (because, in many cases, they’re already happening). This adaptation can take the form of moderating or avoiding the expected harms or exploiting opportunities that come along. Either way, countries’ and companies’ financing needs in this regard are far higher than the capital available, with some estimates placing funding needs by 2030 at as much as nine times what is now being spent.

This takes on greater importance when we consider that, according to Swiss Re, insured losses from natural catastrophes, including climate-related events, reached $219 billion in 2017-2018—the highest 24-month figure on record. Total economic losses from natural catastrophes totaled $497 billion. MunichRe puts those figures slightly higher, at $222 billion and $505 billion, respectively. Meanwhile, of the $546 billion funneled to climate change investments last year, only about 6% ($34 billion) focused on adaptation projects, according to the Climate Policy Initiative. Overall, UNEP forecasts adaptation costs in developing countries alone at $140 billion-$300 billion by 2030, and $280 billion-$500 billion by 2050.

And the adaptation-funding gap isn’t just a problem for emerging economies. While developed countries are more resilient to extreme weather events, many need substantial investments to prepare for the effects of climate change. On the bright side, investment in adaptation offers a “resilience benefit”—that is, cost-effective protection against extreme weather damage—attractive risk-return prospects that may help attract private investors.

LOCATIONS OF S&P 500 RENEWABLE AND NON-RENEWABLE POWER SITES

On a granular level, stronger climate regulation and rising carbon prices present significant and increasing transition risks for S&P 500 utilities companies, particularly those with substantial fossil fuel-generation assets.

For example, one large power producer located in the eastern U.S. is exposed to high regulatory-transition risks with 52,000 megawatts of fossil fuel-generating capacity in the country, where carbon prices would need to rise significantly to limit climate change to 2 degrees C.

Similarly, an energy infrastructure company based on the U.S. West Coast is exposed to high regulatory-transition risk due to its holdings in jurisdictions facing high carbon-price risk, and is also exposed to high wildfire risk with assets in the fire-prone regions of California, Nevada, and Arizona.

On the other hand, another large American power producer, headquartered in the Southeast, would likely be more resilient to regulatory transition risk due to its focus on renewable power generation and holdings of a limited number of fossil-fuel plants in jurisdictions where carbon prices are expected to rise.

These cases highlight the diversity of transition and physical risk exposures within a single sector, linked to the geographic distribution of each company’s asset holdings.

Meanwhile, carbon-pricing regulation is developing globally as countries implement a patchwork of policies leading to stark differences in current carbon prices and future price trajectories between countries, and affecting multinational companies in complex ways.

AVERAGE CARBON PRICE RISK PREMIUM FOR COUNTRIES OVER TIME (2030-2050)

Exposure to transition risks linked to carbon pricing is greatest for the S&P 500 in the U.S. and Australia, because of the high degree of action needed to shift comparatively weak carbon-pricing policies to deliver on climate-change goals. Power-generation companies are typically exposed to high carbon-pricing risks, but physical risks vary significantly based on the geographic operations of each company. Conversely, S&P 500 financial firms with low emissions generally have lower carbon-pricing risk exposure, but in some cases own assets at high risk of physical climate change.

All told, physical and transition risks are rising and will impact companies differently based on the geographic distribution of their assets. As already stated, it’s the location of these assets, rather than the industry or sector in which a company operates, that is the main determinant of risk. Similarly, while emissions intensity is correlated with sector, the location of emissions is important in assessing the transition risk associated with rising climate regulation and carbon prices. High emitters in jurisdictions with weaker carbon-pricing policies are potentially at greater transition risk if and when climate policy tightens, compared to their peers in highly regulated jurisdictions that have already adapted to the higher cost of carbon.

Additional Contributors:

Steven Bullock — Global Head of Research at Trucost

Rick Lord — ESG Analytics Manager

Joe Maguire — Senior Writer