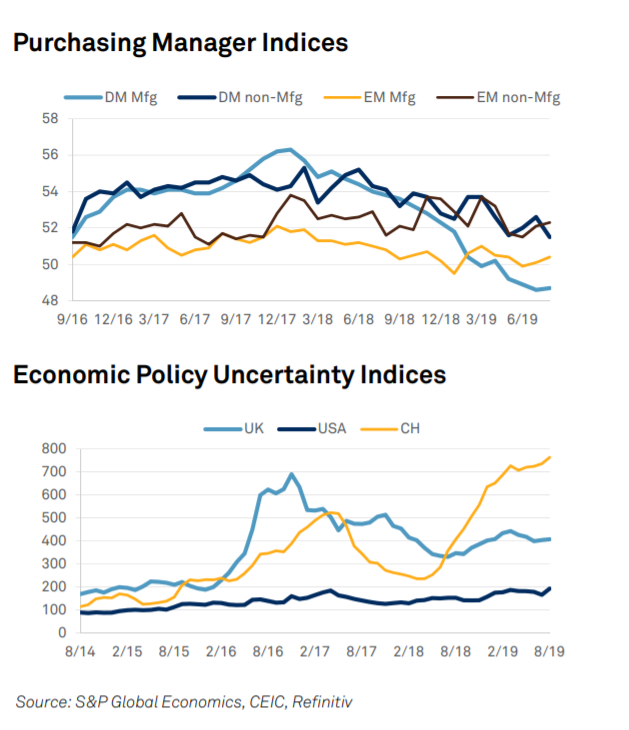

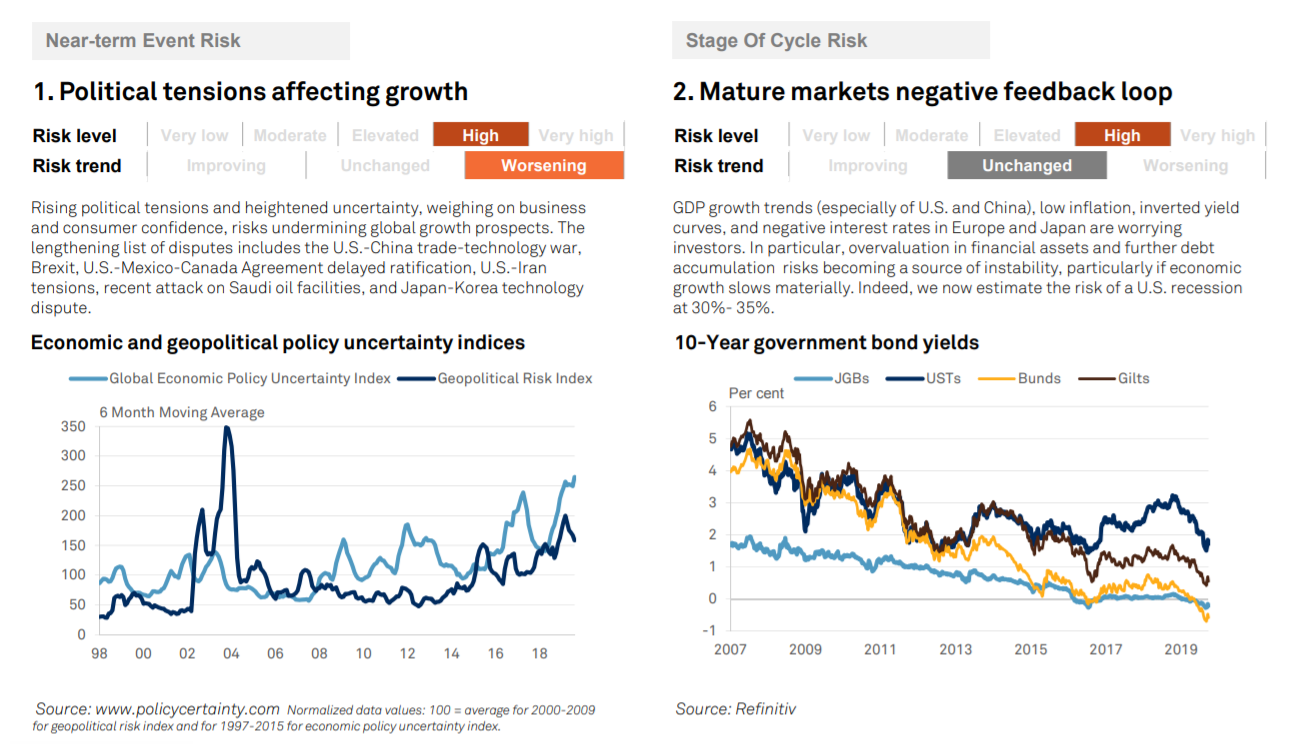

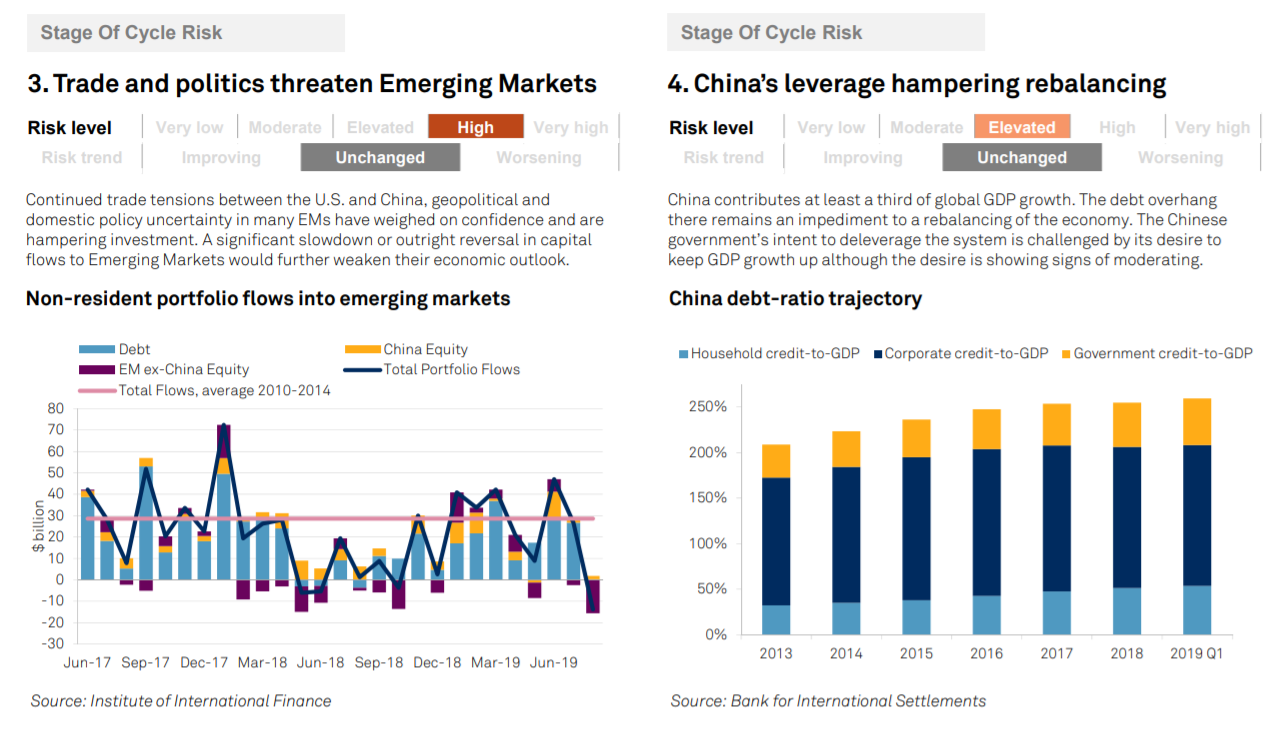

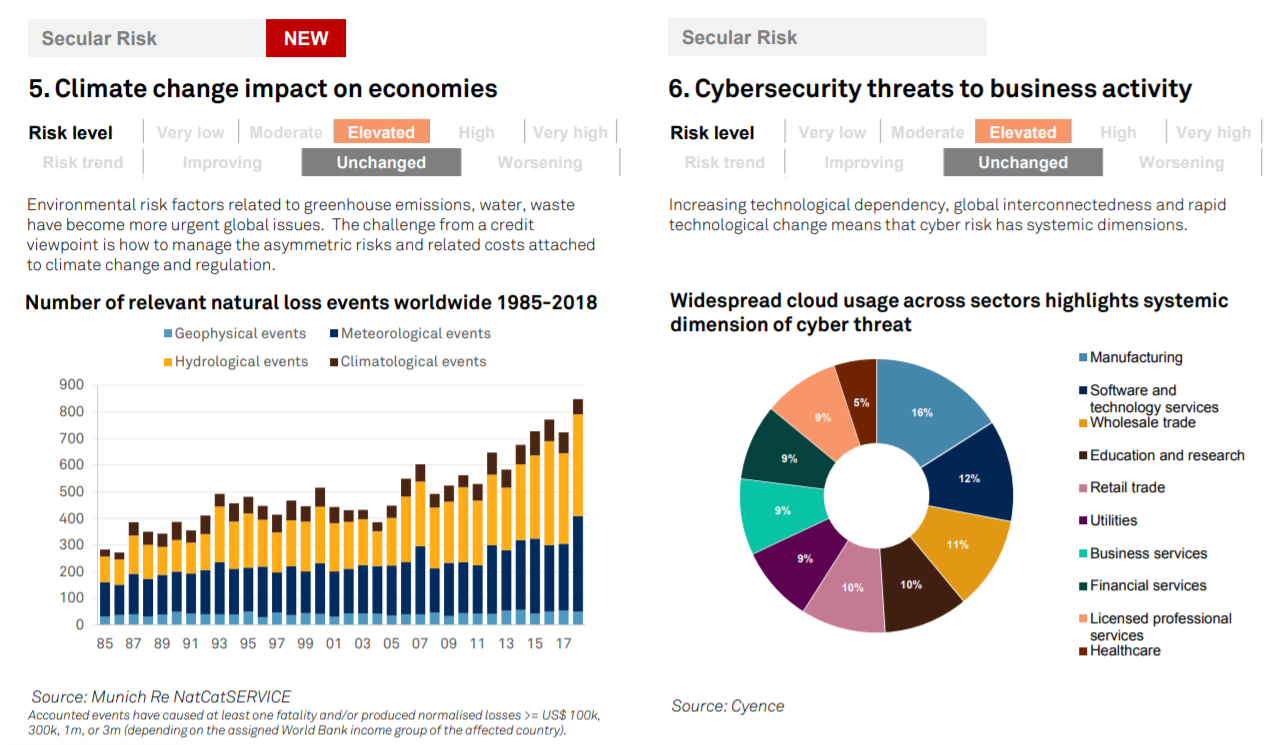

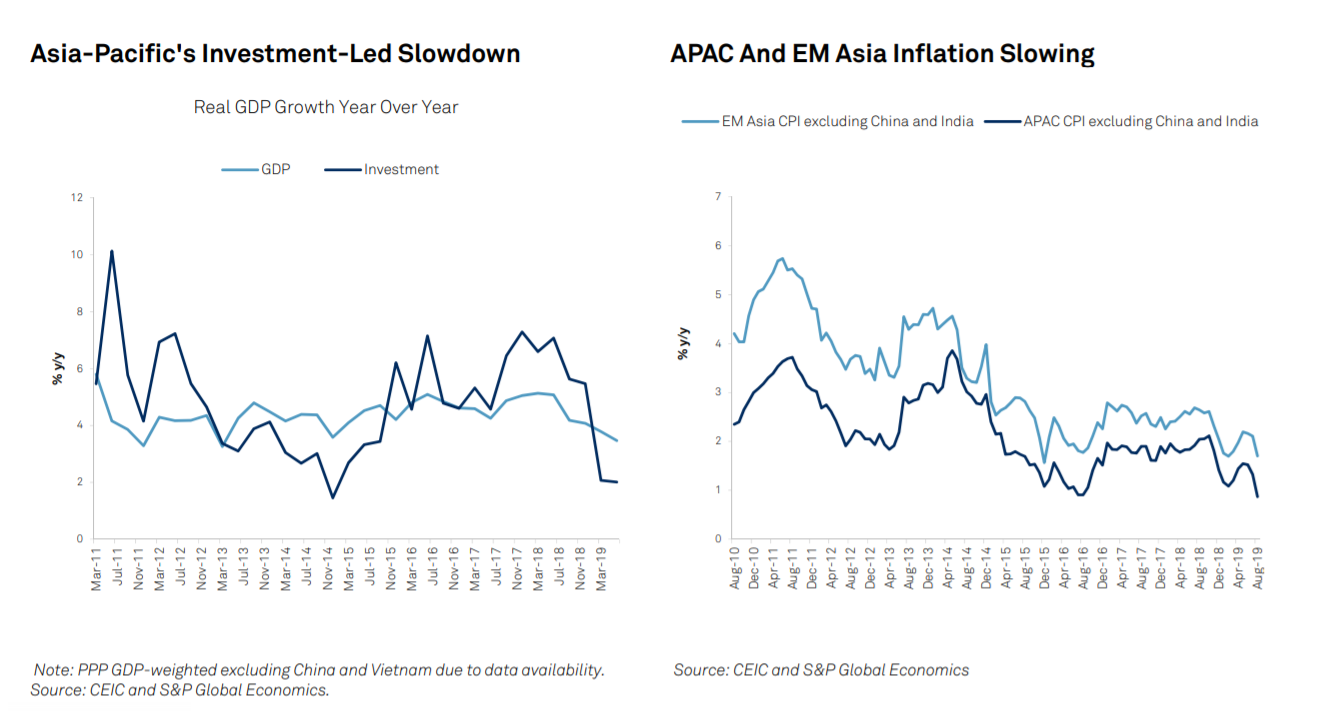

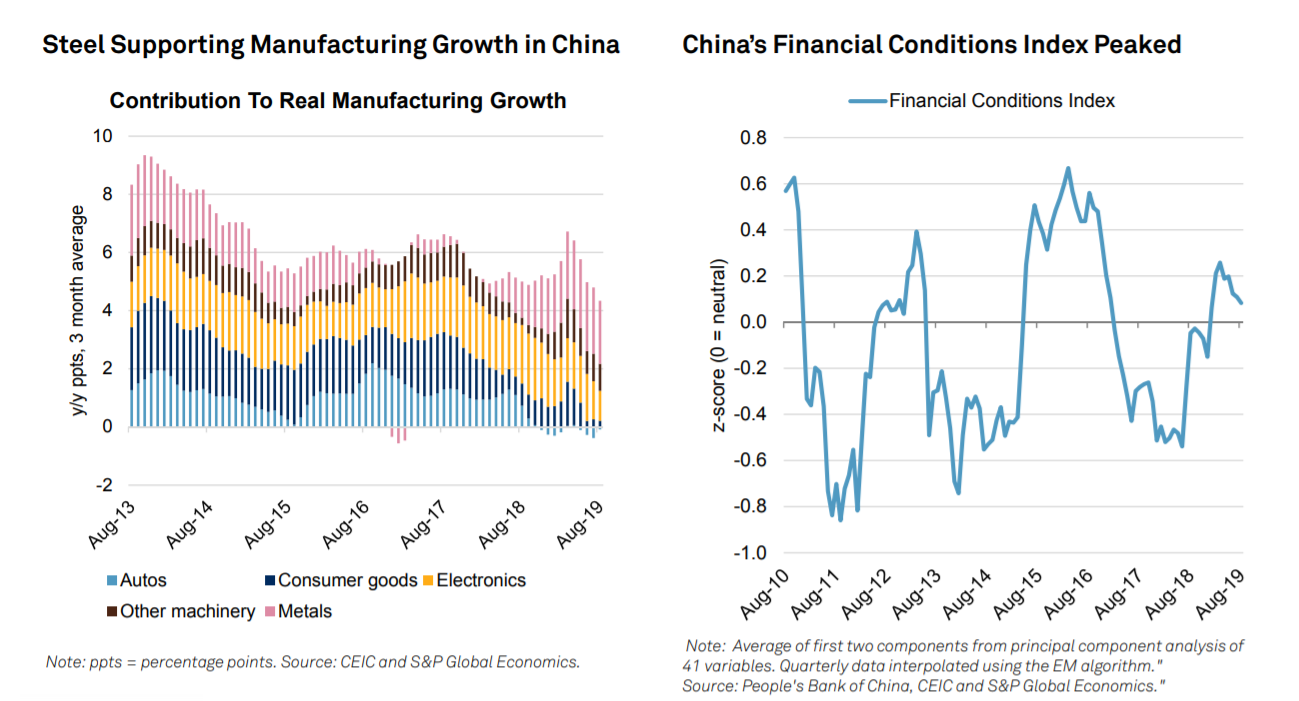

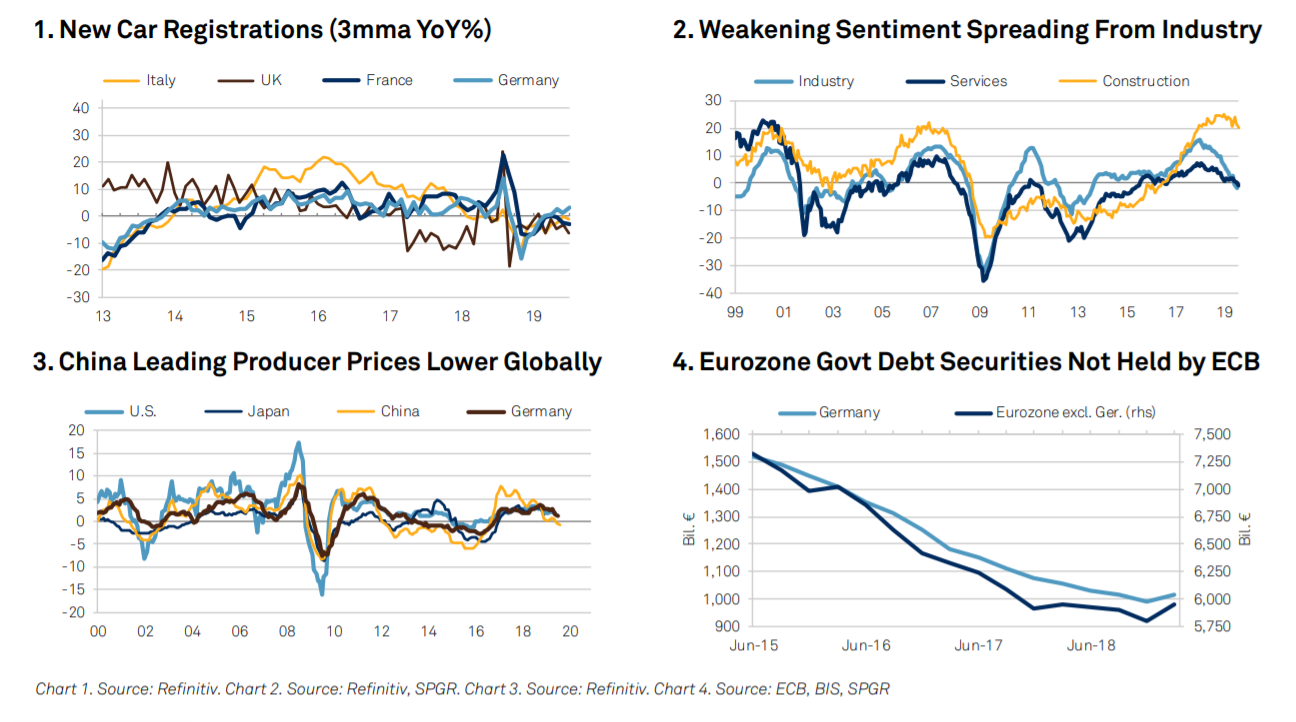

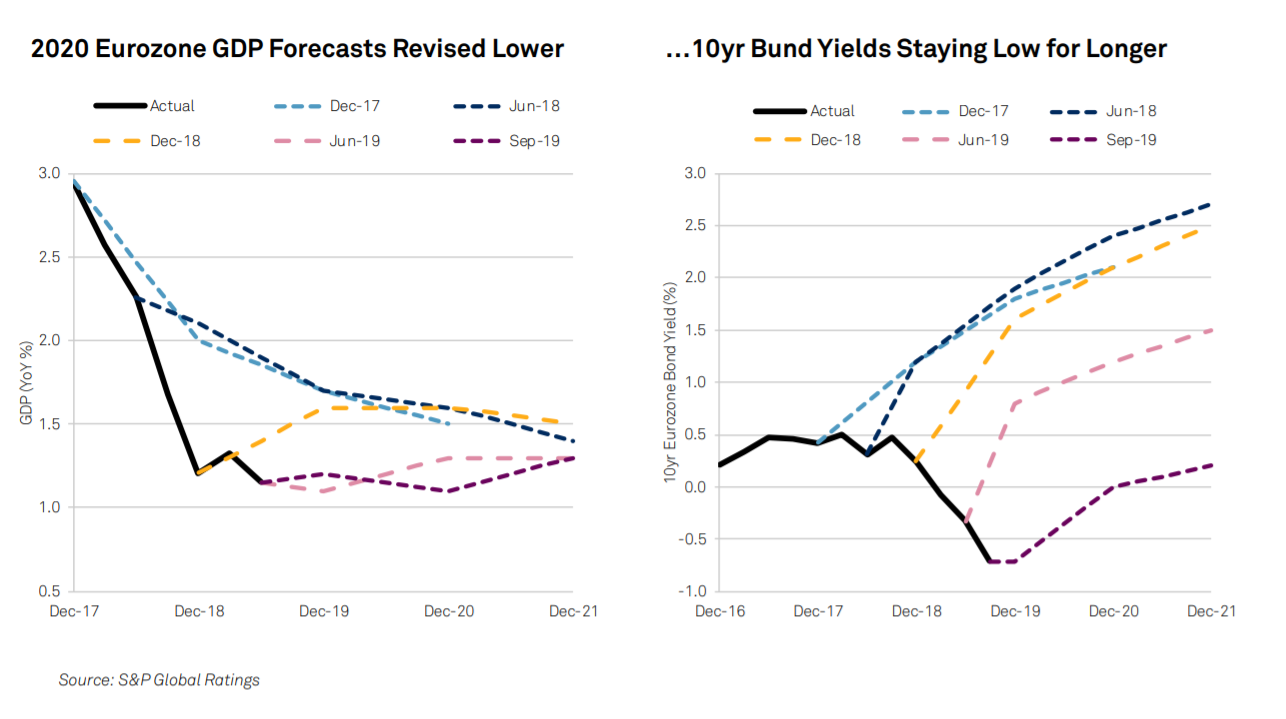

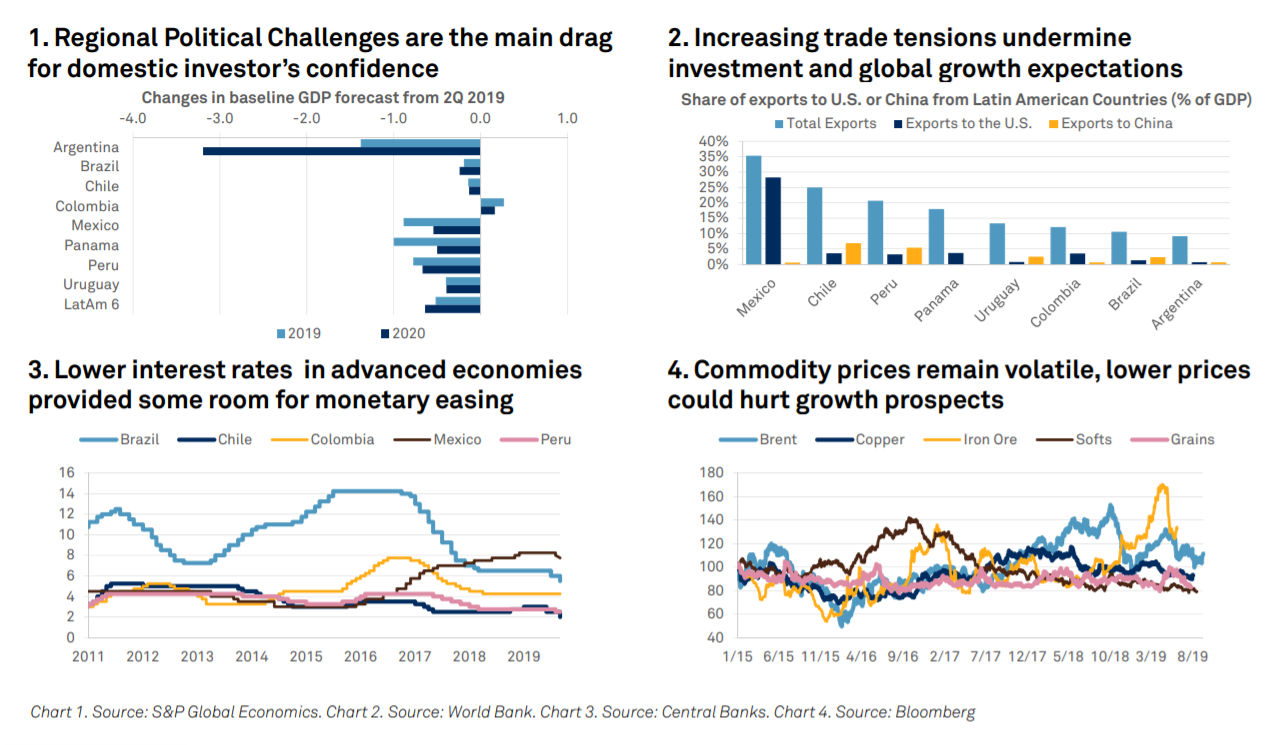

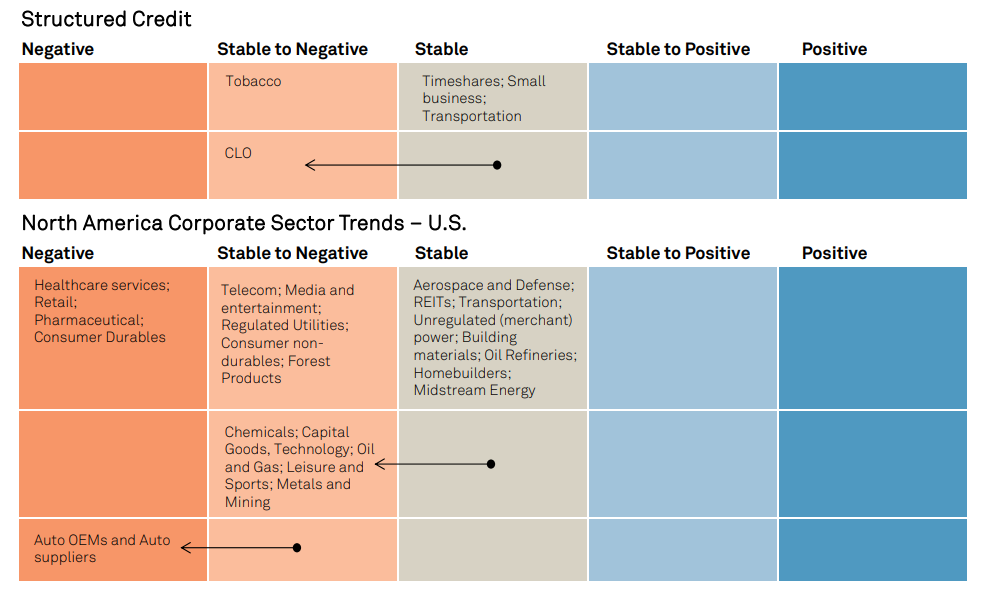

HighlightsFaltering growth: Economic growth expectations are faltering as political and trade tensions stymie investment plans and erode confidence. Global recession remains unlikely given renewed monetary stimulus, but lower-for-longer rates are heightening financial-sector risks. Credit quality is deteriorating in cyclically-sensitive sectors.

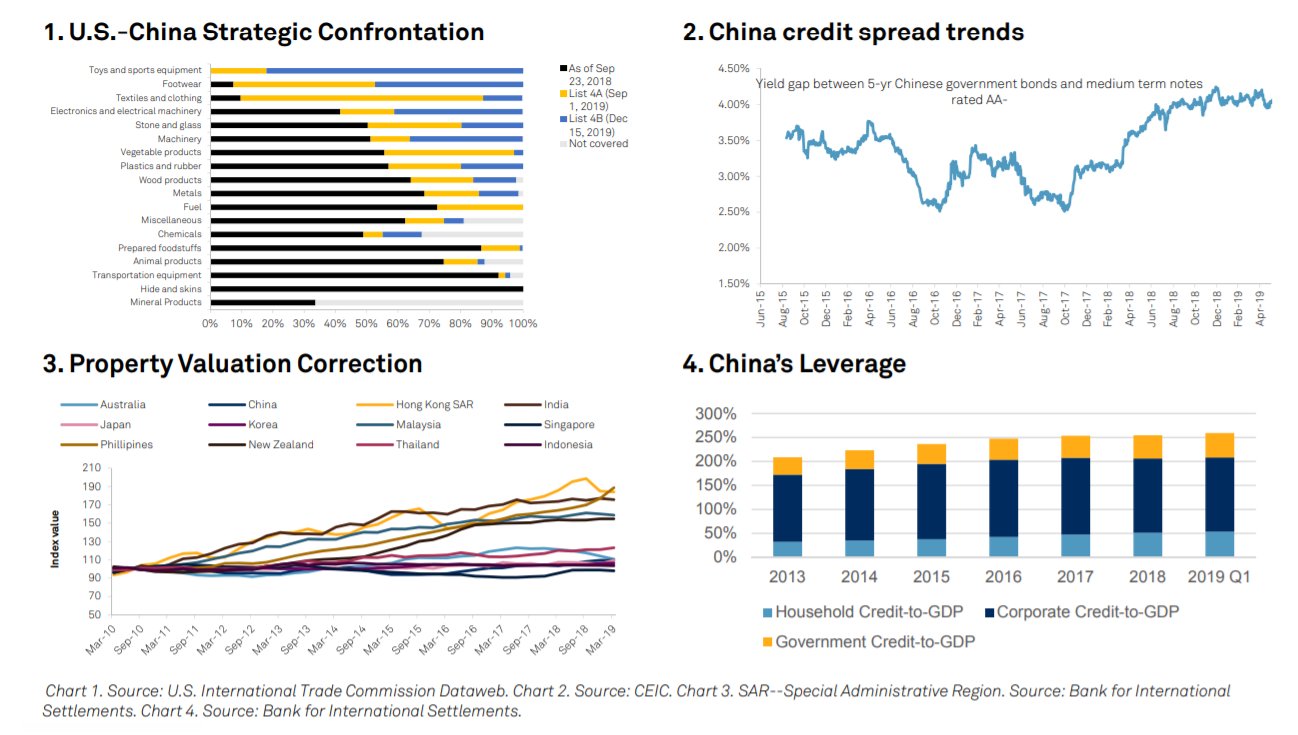

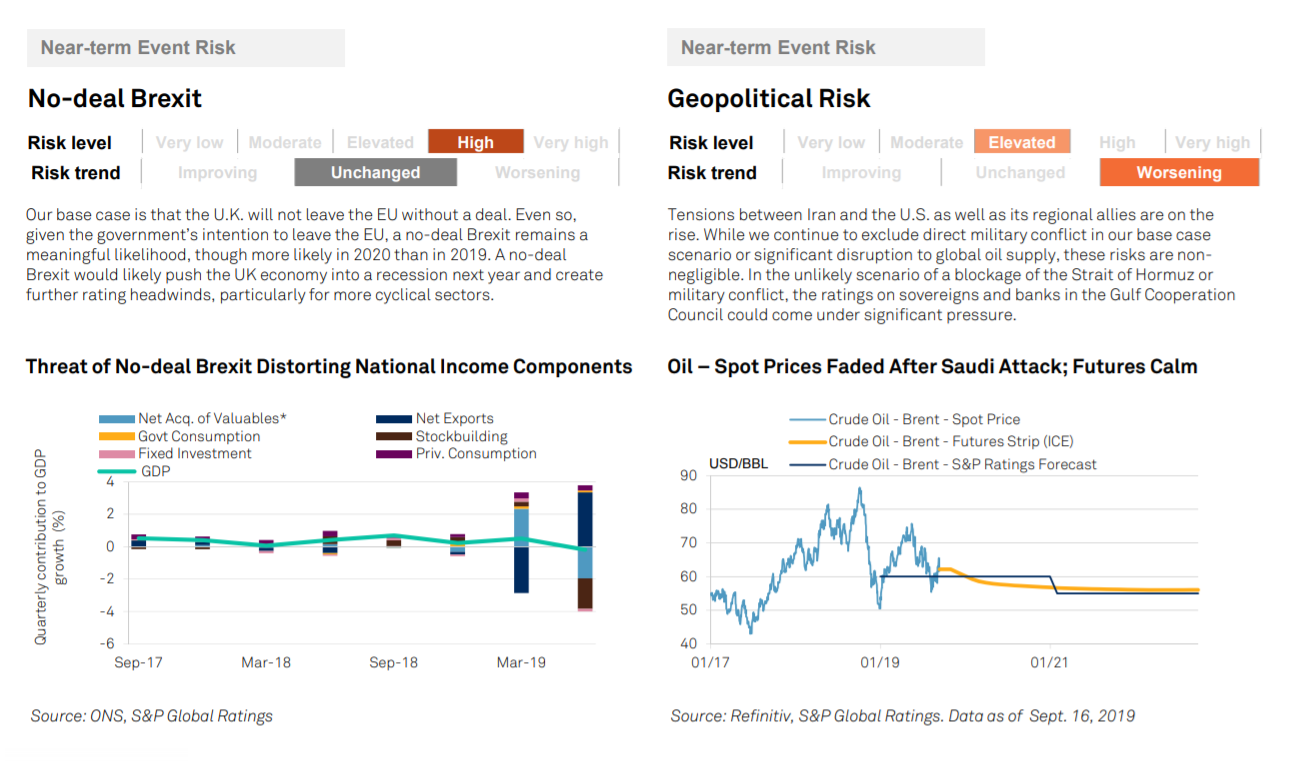

Tensions: Domestic political tensions – possible impeachment hearings in the U.S.; the Brexit imbroglio; elections and policy uncertainty in Latin America – are eliding with persistent global risks – U.S. and China trade and tech disputes; proxy conflict in the Middle East – to create a confidence-sapping climate of uncertainty. There is little prospect of immediate resolutions.

Policy response: Central banks have once again reached for the monetary policy playbook with widespread reductions in interest rates and renewed unconventional stimulus. This has helped underpin financing conditions and is likely to mean low interest rates and flatter yield curves persist into 2020-21. Absent further shocks, this is likely to prevent a global recession.

Risks for the long term: Nevertheless, this renewed stimulus poses longer term risks as it further encourages financial risk-taking through a hunt for yield, undermines financial sector profitability and exacerbates pension liability pressure. There is little sign that the stimulus has boosted investment intensions or confidence.