Regional Credit Conditions

What's Changed?

Latin American countries' GDP growth has weakened, posing difficulties for issuers in the region. Policy uncertainty remains the biggest drag on economic prospects as investors remain hesitant about new administrations' ability to address financial and economic headwinds. Global economic unease also adds to regional investors' fears, given that global growth prospects for 2020 continue deteriorating in light of increasing trade tensions and geopolitical risks.

Political risks have gradually materialized in the region, undermining economic growth prospects as investor confidence erodes.

The AMLO administration's plans, such as a new business plan for PEMEX and the budget for 2020, have failed to boost investor confidence. In general, the government's aggressive assumptions have fueled skepticism in the domestic investors community. Furthermore, mixed signals from the executive and a lack of policy direction make investors uncomfortable. Lower interest rates and higher oil prices resulting from external conditions, could bring some relief to Mexican government's tight budget.

While pension reform has been progressing in Brazil, investors now believe that this particular reform won't fix all of the country's fiscal and economic problems. This, along with President Bolsonaro's difficulties in dealing with a very fragmented Congress has undermined investors' confidence and the country's growth prospects. The president's political capital is eroding, and the country still needs to pass substantial reforms to improve its fiscal position over the short term. Brazil's economy could improve if the government manages to pass the pension reform and advance other changes to reduce pressure on the fiscal side.

Argentina faces very complex economic and financial market dynamics, exacerbated by the timing of the electoral calendar. In our view, the increased vulnerabilities of Argentina's credit profile stem from the depreciating exchange rate, a likely acceleration in inflation, and a deepening recession. These factors will increasingly inhibit the ability of both the current and incoming administrations to contain market volatility and restore financial and economic stability.

We don't expect Argentina's troubles to spread across the region, given that the country has been experiencing economic and financial turmoil over the past few years.

Financing Conditions

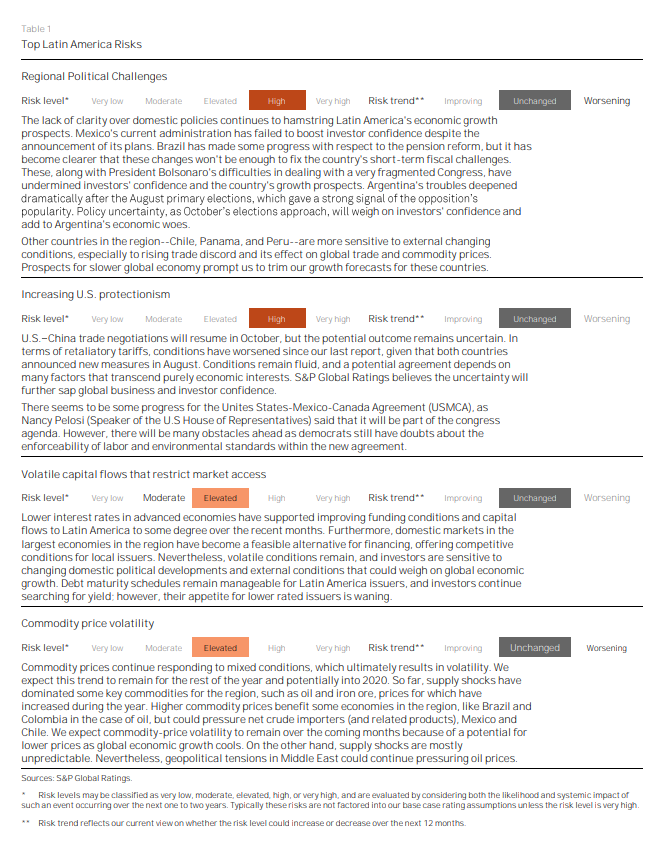

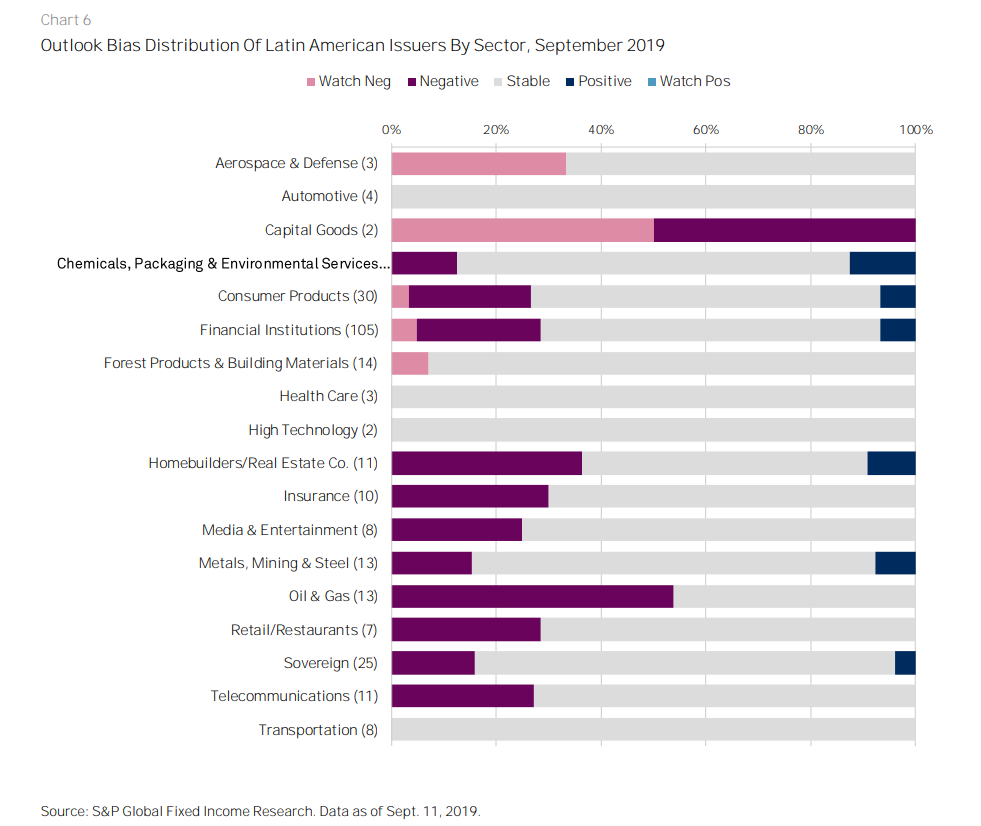

Favorable financing conditions, driven by central bank actions including the Federal Reserve, the European Central Bank (ECB), and others will likely lower the cost of financing through 2019. However, the souring economic prospects prompted lowering, instead of raising, interest rates reduced financing costs (as opposed to a reduction in risk premia). As a result, we're observing greater risk aversion at the bottom end of the credit spectrum, where issuers could face higher financing costs or worse, the lack of risk appetite altogether. Investors are more selective and looking for Latin American issuers with more solid fundamentals amid slumping regional economies and rising geopolitical risks. We expect banks to be more conservative in their loan originations, which will probably curb bank credit flows. Consequently, issuers could look for opportunities to refinance their debt in the market. We continue to see low appetite among corporations for increasing their leverage and invest. The majority of issuances so far in 2019 for Latin America was for refinancing purposes instead of corporate expansion or M&A.

While both financing conditions and the pace of bond issuances in Latin America have improved since the beginning of the year, $50.6 billion in bonds issued in the region as of Sept. 11, 2019, remains the lowest in five years. This trails year-to-date $47.1 billion in bond issuance in 2016 at the height of the Lava Jato scandal in Brazil. While refinancing appears manageable over the next few years, additional strains on borrowers with weaker credit fundamentals will inevitably appear, stemming from higher debt costs and refinancing needs, and potentially flagging economies once the currently benign conditions wane. (Recent actions by the Federal Reserve and ECB may allow benign conditions to linger longer.)

Neutral conditions. Generally, financing conditions remain balanced, though risk aversion is beginning to rear its head. More creditworthy borrowers with healthier balance sheets will continue to see lower funding costs in the short term and marginally improved demand for loans is likely to continue. However, nonperforming loans (NPLs) will likely rise and credit spreads will widen at the lowest end of the credit spectrum amid investor selectivity and subpar prospects for economic growth.

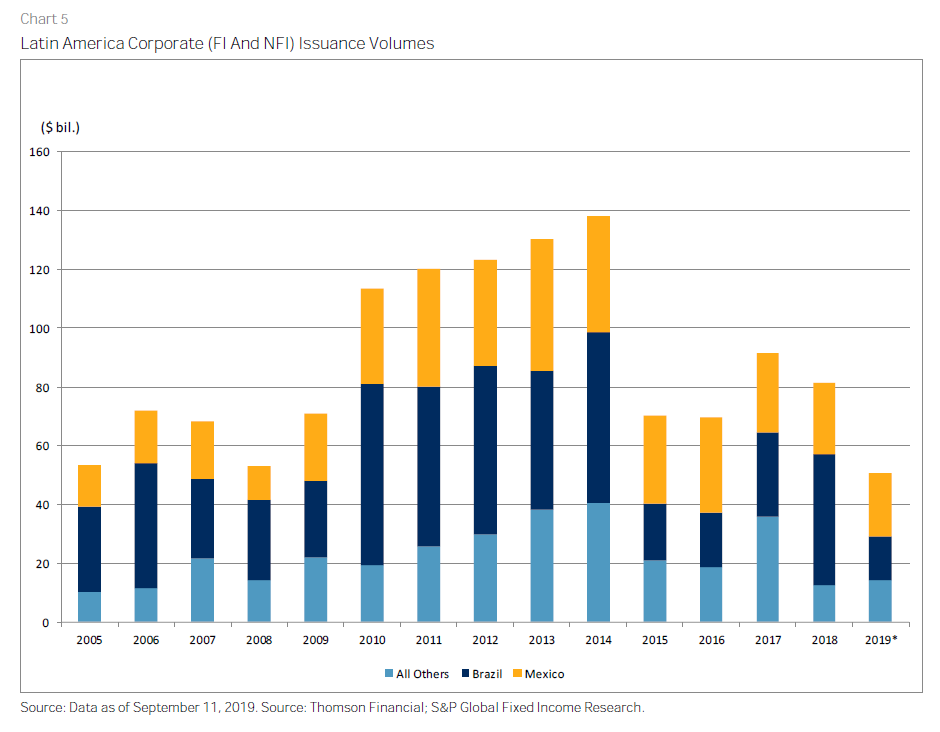

Maturing debt. S&P Global Fixed Income Research expects $226 billion of rated financial and nonfinancial corporate debt from Latin America (including the Caribbean) to mature through 2024-- a small fraction of the $12 trillion in corporate debt set to mature globally in the same period. Of the total corporate debt maturing in Latin America through 2023, $18.4 billion is due 2019, and scheduled maturities rise to a peak of $47.5 billion in 2021. The majority (74%) of the debt due 2019 is investment grade (rated 'BBB-' or higher), which should help mitigate refinancing risk, given that investor demand for investment-grade debt remains high. We expect the region's corporate refinancing demands to remain largely manageable, especially because corporate issuers have a multiyear window in which to refinance before the largest sums come due in 2021 and 2022, though this schedule is contingent on favorable lending conditions, which are likely to remain so for the remainder of this year but likely to wane further out in the horizon.

New issuances. The $50.6 billion in new bond issuances as of Sept. 11, 2019, is dominated by Mexican issuers ($21.4 billion), followed by those in Brazil ($15.1 billion) and the remaining $14.2 billion issued elsewhere in Latin America. Nearly 80% of issuances is domestic or privately placed (Euro/144A), with Minera y Metalurgica del Boleo, NAFINSA, and America Movil S.A.B. de C.V. (all of which are Mexican entities) issuing the largest deals so far this year.

Macroeconomic Developments And Assumptions

The Region's Growth Will Remain Disappointing Next Year

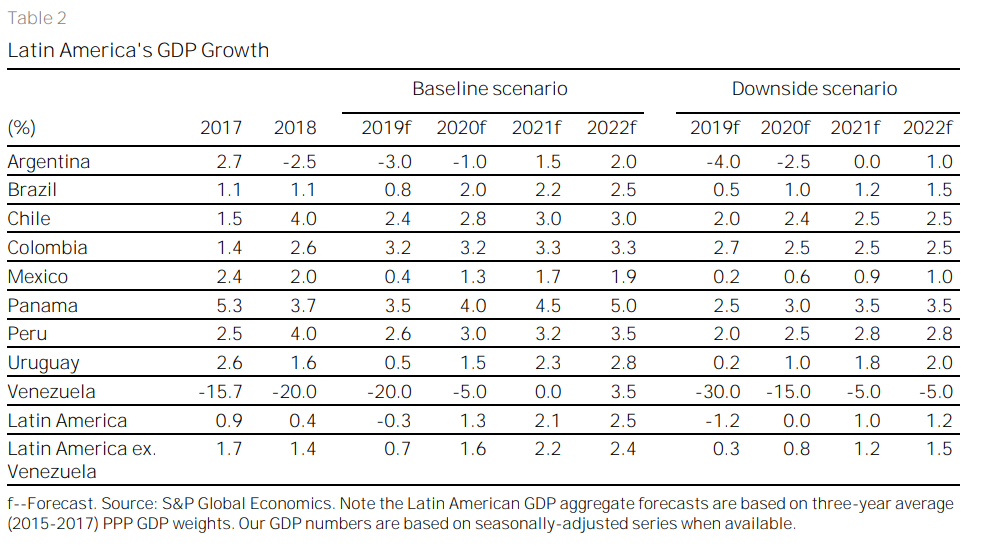

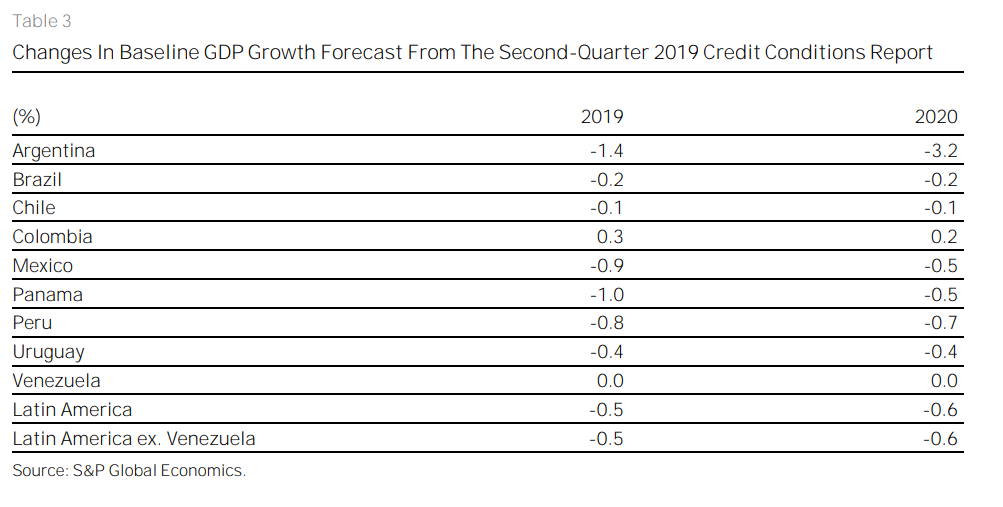

We have lowered our growth outlook for most of the major economies in Latin America for the remainder of 2019 and for 2020. This is due to ongoing weakness in domestic demand, unfavorable domestic political dynamics, and volatile external conditions. Aggregate GDP growth in the six largest economies in the region (LatAm 6) was shy of 0.5% year over year (y/y) in the first half of 2019, compared with 1.4% in 2018, mostly due to an about 1% y/y contraction in investment in the first half of 2019. We project growth of 0.7% in 2019 and 1.6% in 2020 for LatAm 6, which is still very low by historical standards (the 10-year average is about 2%) and compared with other emerging markets that are averaging 4%.

From a country-specific level, our downward revisions to growth stand out for Argentina and Mexico. In Argentina, the rising likelihood of an opposition winning the October presidential election and a recent change in policy direction will hamper domestic demand, as financial conditions tighten. We now see the Argentine economy contracting 3% in 2019 and 1% in 2020. In Mexico, fixed investment has fallen more than we expected, partly due to delays in public investment, but also due to lack of private investment amid the lack of policy direction under the current administration. We now see GDP growth of 0.4% in 2019 and 1.3% in 2020.

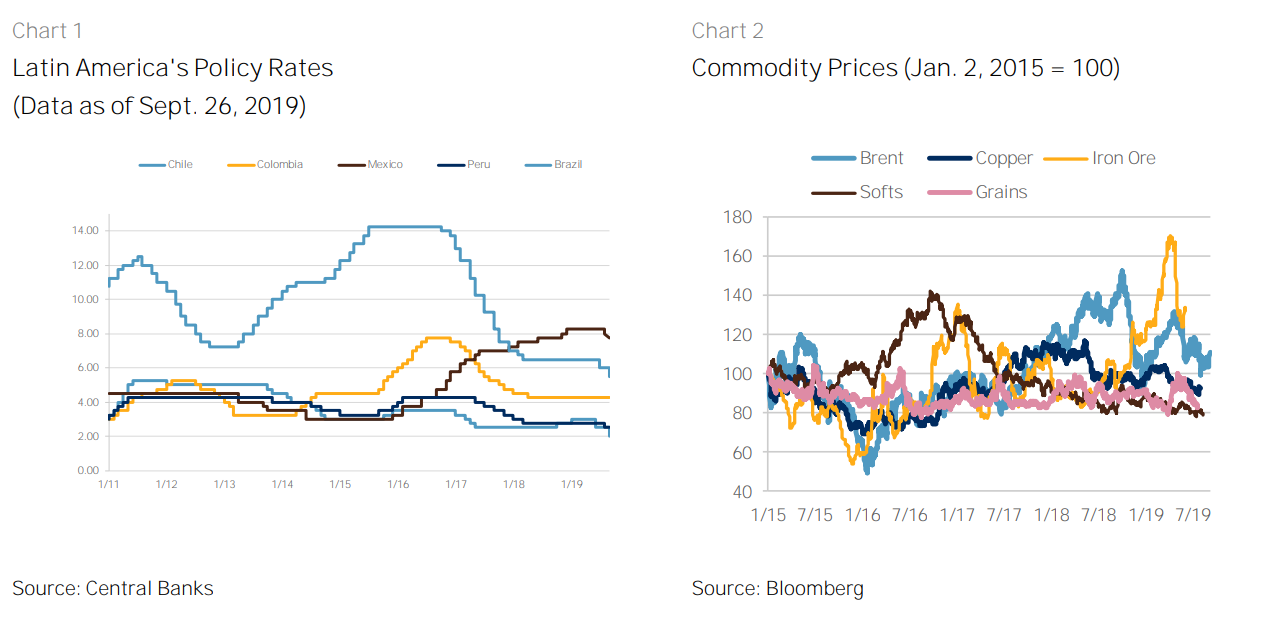

GDP growth in LatAm 6 has remained below 2% since 2014 due to weak investment, which in most cases has been a result of uncertainty over domestic policy direction, magnified by unfavorable external dynamics, and more recently the U.S. China trade tensions. As we look into 2020, it is hard to argue in favor of a meaningful improvement in domestic political dynamics or for a smooth and long-term resolution to the U.S. China trade conflict, especially as the U.S. 2020 presidential campaign heats up. This is why our expectations for 2020 reflect another year of sluggish GDP growth for the region (below 2% for LatAm 6), albeit higher than in 2019. The reason we expect stronger growth in 2020 than in 2019 has to do mostly with greater levels of monetary stimulus both across major advanced economies as well as in regional economies. The ECB has renewed a QE program, we now expect more easing by the Fed than previously, the People's Bank of China continues to introduce stimulus measures, and nearly every major central bank in Latin America is in the process of lowering interest rates. While high domestic political uncertainty means that the meaningful resurgence in investment the region needs to sustain higher GDP growth is unlikely, we believe the sheer size of monetary stimulus will help stabilize investment dynamics in several economies in the region. We have seen signs of this happening in the second-quarter GDP and in early third-quarter data in some countries.

Forecast Changes

- Argentina: The economic difficulties will persist regardless of the outcome of the October presidential election. We expect Argentina's economy to contract 3% this year and 1% next year, which will imply three consecutive years of GDP contraction.

- Brazil: The data continues to point to a sluggish recovery, with GDP growth of 0.7% y/y in the first half of 2019; however, signs of a recovery appeared in the second quarter, particularly in investment. We expect growth of 0.8% in 2019 and 2.0% in 2020 (compared with 1% and 2.2% from our previous report). The social security reform approval continues to progress and the central bank is loosening monetary policy, which underpin our expectations for a pickup in growth next year.

- Mexico: Data has been significantly weaker than we expected, with GDP expanding just 0.2% y/y in the first half of 2019, due to a 4% decline in investment, which has been partly due to the delays in public-sector investment that are typical during a transition in government, but also due to a decline private-sector investment. On the supply side, an ongoing contraction in oil production, which fell about 10% y/y in the first half of the year, has kept a lid on GDP growth. We project the latter at 0.4% this year and 1.3% in 2020.

- Chile, Colombia, and Peru: We also lowered our growth outlooks for Chile and Peru, in part due to weakness in copper production this year. For Chile, we forecast 2.4% in 2019 and 2.8% in 2020, and for Peru 2.6% and 3%, respectively. Conversely, better-than-expected data in the second quarter and upward revisions to historical GDP data prompted us to increase our growth projections for Colombia. We now forecast 3.2% growth for both 2019 and 2020, an improvement from the 2.6% expansion in 2018.

Key assumptions

- We now expect the effective Fed funds rate to end 2019 at 1.625%, one more 25-bps interest rate cut than what we projected in the previous quarter.

- We expect an orderly deceleration in GDP growth in most advanced economies through the rest of 2019 and into 2020. We see a 30% - 35% probability of recession in the U.S. in the next 12 months, and growth remaining close to potential in 2020.

- We assume recent policy easing in China will stabilize the economy.

- Regardless of who wins Argentina's presidential election, we assume that policy direction will pivot, in line with recent steps to stabilize the currency, such as capital controls. This means domestic financial conditions will be tighter than we previously assumed.

- Our macroeconomic projections for Brazil assume some version of the pension reform will be approved this year.

- Our baseline GDP forecast for Mexico assumes continued uncertainty over policies under President Andres Manuel López Obrador that reduces private-sector investment participation in key sectors, such as energy.

Risks to our macroeconomic outlook

- A more pronounced deceleration in real GDP growth in the major advanced economies than what we currently assume could impede the mild economic recovery we forecast for most Latin American economies in 2020.

- The ongoing trade dispute between the U.S. and China, if it continues to escalate, could renew risk aversion and lower appetite for emerging markets assets, resulting in periods of capital outflows from Latin America.

- The ratification of the USMCA is still at risk, especially given political polarization and the 2020 presidential election in the U.S. A significant delay in ratifying the treaty that would replace NAFTA could generate another round of uncertainty over trade and investment relations between the U.S. and Mexico. The ratification of the USMCA has been further complicated by the recent threat by the U.S. to impose tariffs on Mexican goods.

- The political situation in Argentina is fluctuating, and pressure on the currency and on the government's debt profile could trigger more drastic policy measures that result in a more protracted downturn in domestic demand than we currently project.

- Failure to approve a modest to ambitious pension reform in Brazil would reverse the recent increase in business optimism and discourage investment, which would prompt us to revisit our macroeconomic assumptions for the country.

- A more significant change in policy direction by President Andres López Obrador that either restricts or discourages fixed investment further, would lead us to revisit our assumptions for Mexico again.

Sector Themes

Sovereigns

|

What's changed?

The most prominent development was default in Argentina. The Macri administration decided to unilaterally extend maturities of short-term foreign and domestic currency debt after investor confidence plummeted following primary elections in August. The strong showing of opposition candidate Alberto Fernandez provoked capital outflows, weakened the currency, and effectively derailed the government's difficult economic adjustment program negotiated with the IMF. The government announced plans to restructure its long-term debt as well. The process could be difficult because the national elections are next month.

Mexico's president Lopez Obrador retains high popularity, except with most investors. A slowdown in private investment has trimmed economic growth in Mexico. The government has largely adhered to its budgetary targets by cutting spending to compensate for lower oil and non-oil revenues (compared with the budget forecasts). However, this may not be sustainable for long. The upcoming 2020 budget is likely to show moderate deficits, but GDP growth may continue to remain weak, and potentially jeopardize the government's fiscal plans.

A segment of the FARC guerrillas in Colombia abandoned the 2016 peace agreement and resumed armed opposition. While this is not a serious security setback, it adds to political tensions. President Duque's low popularity limits his ability to advance legislation in Congress. The political and humanitarian crisis in Venezuela shows no sign of resolution.

Key assumptions

- Commercial disputes between the U.S. and China don't damage global supply chains and overall investor confidence substantially.

- Broad continuity in fiscal, exchange rate, and monetary policy in Mexico despite anemic GDP growth.

- The spillover from Argentina's default is minimal for other sovereigns in the region.

Key risks

- Heightened risk aversion sparks substantial capital outflows from the region, undercutting stability and growth.

- Poor economic performance leads to unexpected policy changes in Mexico, sparking capital outflows and weakening the currency.

- Combination of delays in pension reform, tepid GDP growth, and potential scandals weakens the Bolsonaro administration in Brazil, raising the risk of weak leadership and prolonged low GDP growth.

What to look for over the next quarter

- Will Argentina have an 'orderly' sovereign default of its long-term debt or will there be a financial crisis affecting the banking sector?

- Will negotiations result in a political change, or a new government, in Venezuela?

- Will Brazil's Congress approve pension reform and will the government have enough political capital afterwards to advance with other fiscal reforms?

Local And Regional Governments (LRGs)

|

What's changed?

Argentina's political and economic malaise worsened over the last few months, leading to downgrades at sovereign and provincial levels. After the August 11th primary elections, governors started to plan for a potential change in national government because President Macri lost support in most of the provinces, with the exception of the city of Buenos Aires. Although the majority of governors were reelected in recent elections, we consider that political and economic decisions at the national level could add to the troubles for most provinces toward the end of 2019 and in 2020.

Although Brazil's pension reform at the national level could be overall positive, we don't expect it to bring meaningful fiscal flexibility for states and municipalities in the short to medium term.

With prospects for sluggish economic growth in Mexico, reductions in federal transfers to states and municipalities, and fiscal constraints, LRGs will struggle to repay or refinance debt, unless they levy local taxes more efficiently.

Key assumptions

- Argentina will remain in recession for the rest of 2019, higher-than-expected inflation will squeeze provincial budgets, and debt issuances will remain subdued. Debt burden, by itself, is not a credit constraint, but servicing foreign debt will be a risk in the next few months.

- Brazil's central government is likely to keep the commitment to guarantee states' debts, and we believe this has brought transparency and ongoing monitoring of LRGs' finances. We also consider that access to external financing will remain restricted for the rest of the year. If passed, pension reform in Brazil wouldn't benefit states and municipalities in the shorter term, but probably over the longer term. Earmarked operating expenditures continue to constrain budgets.

- Fiscal pitfalls among Mexico's LRGs would likely deepen if they don't address mainly operating expenditures toward the end of 2019 and into 2020. The relatively weak institutional framework, under which LRGs have been operating over the past years, continues to limit creditworthiness because rule of law is vulnerable to political decisions.

Key risks

- Argentina defaulting in the next few months and the increasing financial needs among provinces refinancing their foreign debt over the next few months.

- In Brazil, the rising budgetary pressures, which continue to weaken liquidity, could push more local governments to delay debt repayments. This would prompt us to revise our assessment of the institutional framework to a weaker category, which could hit LRGs' creditworthiness.

- Some of the issues that could undermine our base-case scenario for Mexico's LRGs: consistent decrease of federal transfers up to a point where states start reporting operating deficits, higher reliance on short-term debt to finance operating expenditures, a diminishing fiscal transparency, and political discretion to manage federal funds.

What to look for over the next quarter

- Monitor political developments in Argentina, because a change in government and public policies could generate more uncertainties over debt repayment and refinancing towards the end of 2019 and in 2020. Provinces with foreign currency debt face higher risk, given the very limited access to external financing.

- Concerns over the most financially stressed states in Brazil, given the absence of plans to foster fiscal sustainability in the longer term. We'll continue monitoring for any changes in the institutional framework--predictability, revenue and expenditure balance, and transparency and accountability.

- Assess budgetary performance for the remainder of 2019, given that states were unable to compensate for lower federal transfers, and the proposed budget for 2020 contains lower amounts set for LRGs. The lackluster economic growth for 2019 and 2020 will strain public finances.

Nonfinancial Corporations

|

What's changed?

Market access generally improved in June and August with more than eight issuances per month, compared with less than half of that in the previous months (with the exception of April). The market remains fairly open except for Argentine issuers whose ratings have been trimmed lately on the back of the slippage of the sovereign's credit quality (see the Sovereigns section).

Because of Argentina's sudden weakening after the primary elections, we downgraded many domestic issuers (please read "11 Argentine Corporate And Infrastructure Entities Downgraded, Three Placed On Watch Negative On Sovereign's Downgrade," Aug. 20, 2019). Entities with currency mismatch and/or short-term debt concentration face heightened refinancing risks. Business conditions are likely to worsen as well due to volatile macro and political uncertainties.

In contrast, conditions in Brazil improved slightly in the second quarter for many sectors, including protein producers, consumers, airlines, homebuilders, metals and miners, and transportation in general. A combination of external factors such as the African Swine Fever (ASF), the collapse of Avianca Brasil, and the overall favorable fundamentals for iron ore and steel prices prompted stronger performances in those sectors.

Mexican corporations remain under scrutiny, given that the largest government-owned corporations don't seem to have a clear and compelling business strategy, or at least investors doubt on the value of recent decisions (see "PEMEX's New Business Plan: Making A U-Turn Is A Risky Move," July 22, 2019). Still, our corporate ratings in Mexico remained largely unaffected, and we expect conditions to remain supportive.

Key assumptions

We expect Argentine entities' access to international debt markets to remain volatile in general, and we don't see chances of improvement at least for the next six months--until the first round of the presidential elections takes place (October 27th) and the new administration reveals plans and policies.

Domestic consumption in Brazil and Chile should remain fairly stable, while Mexico could face economic headwinds and conditions in Argentina will remain weak for some time.

Key risks

Argentine issuers with currency mismatch and short term debt concentration face heightened refinancing risks. Also, some sectors may face above-average downside risks if conditions continue weakening, such as utilities; engineering & construction and real estate (for more details please read "Key Corporate Risks To Monitor As Argentina Heads For Presidential Primaries," Aug. 7, 2019).

Country risks in Mexico, Brazil, and Argentina could limit the domestic companies' market access and curb performance.

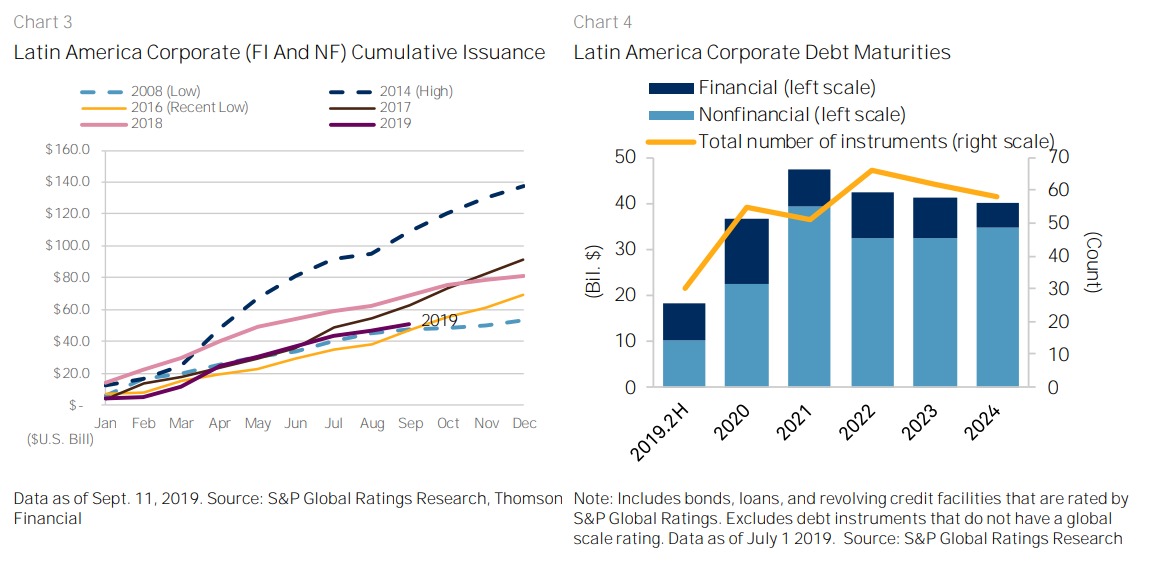

In general, we view on commodity prices as remaining supportive, but recent weakening of copper and pulp prices may pressure the sector players' leverages. We will continue monitoring the companies' counteractive measures.

The strike on Aramco's Abqaiq oil-processing facility and the Khurais oilfield in Saudi Arabia on September 14th has not only triggered higher oil prices, but will also heighten geopolitical tensions in Middle East. The attack will have significant ramifications for oil markets. Given that one combined strike can knock out not just 5% of global supply, but more than double the amount of global spare-production capacity, highlights oil market vulnerabilities. Oil price increases jumped by double digits, although it's too early to tell what the credit impact will be for industry players, and the magnitude of the impact will largely depend on how long and how much oil production is off the market.

What to look for over the next quarter

Mexico's government continues to put together a plan to provide financial support to PEMEX and bring more certainty to the company's bondholders. In the meantime, prospect for slower GDP growth are generally holding back investment decisions, and corporations are keeping capital expenditures (capex) allocations at maintenance levels. Mexico's consumer confidence index reached a record high in February, although the recent slowdown in retail and auto sales could signal that consumption is cooling. The health of export manufacturing remains closely linked to a still growing U.S. economy, although the risk of slower global growth and the unresolved new free trade agreement among Mexico, Canada, and the U.S. could undermine trade between Mexico and North America.

The Bolsonaro administration continues to push reforms. In particular, the proposed pension reform would save up to R$1 trillion in the next 10 years. Its approval would dissipate investors' fears about the proposal's execution and perhaps pave the way for additional reforms.

Argentina's decision to 're-profile' its debt needs, to be formally discussed in Congress, is likely difficult to execute due to the current administration's political weakening after the larger-thanexpected loss at the primary elections. Moreover, Argentina's political scenario is changing rapidly and will have a major influence on the credit quality of domestic corporations, because many issuers need to refinance debt maturities and are exposed to currency risks.

Infrastructure

|

What's changed?

The volatility in Argentina exacerbated after the primary elections. We believe the risk of the sovereign interfering with the ability of domestic companies to access, convert, and transfer money abroad is increasing. We also expect a further depreciation of the domestic currency and inflation to rise higher than we previously projected, between 45% and 55% for 2019 and 2020. We lowered the ratings on several Argentine infrastructure entities due to the likely lower cash flows, because we now consider future rate adjustments won't cover 100% of inflation cost pass-through, and due to debt because most of their financial obligations are in dollars. We will continue monitoring potential modifications of the regulatory framework that could impair the companies' repayment capacity.

The agreements between CFE and pipeline operators establish a new rate structure that doesn't include step-ups over time and incorporate a 10-year extension of the contracts. We updated our base-case scenario for all companies involved in the dispute and concluded that the agreements won't affect materially our expectations for financial performance. Consequently, the measures were credit neutral.

The Chilean discos' demand for electricity plunged in the past months, in some cases at about 30%. This was due to Chile's slowing GDP growth and the ongoing migration of energy users from the regulated spectrum to the unregulated segment. Therefore, we revised downward our demand haircut assumption that affected some projects that are mostly contracted with discos with takeand-pay contracts. So far, no rating changes occurred due to this trend, but we will continue monitoring it and its impact on the rated issuers' credit metrics.

Key assumptions

GDP growth and inflation. We correlate GDP performance to electricity demand and traffic levels at the transportation assets. On the other hand, inflation affects availability projects and regulated assets, such as transmission lines, pipelines, etc.

Key risks

- Slower GDP growth.

- Volatility spot prices in the electricity markets, and shorter-tenor power purchase agreements amid more volatile conditions.

- Incremental risk of re-contracting coal-fired power plants, particularly in Chile, which is planning for a greener energy matrix by 2025.

What to look for over the next quarter

The release of CFE's business plan that has been postponed since mid-year.

Potential modifications of Argentina's electricity regulatory framework, including rate adjustments. We expect capex to fall in the near future, at least until clarity of the economic and political landscapes increases.

Colombia will finally have the renewable energy auction on Oct. 22, 2019.

The terms of the sale of Sempra Energy's South American businesses, including Luz del Sur S.A.A. in Peru and Chilquinta Energía S.A. in Chile.

A new energy auction in Brazil (LEN A-6 with delivery by January 2025) is likely to occur on October 17. For this auction, 1,829 projects are registered to bid totaling 100 gigawatt (GW) in capacity, including 42 GW of gas thermal plants, 30 GW of solar and 25 GW of wind.

Financial Services

|

What's changed?

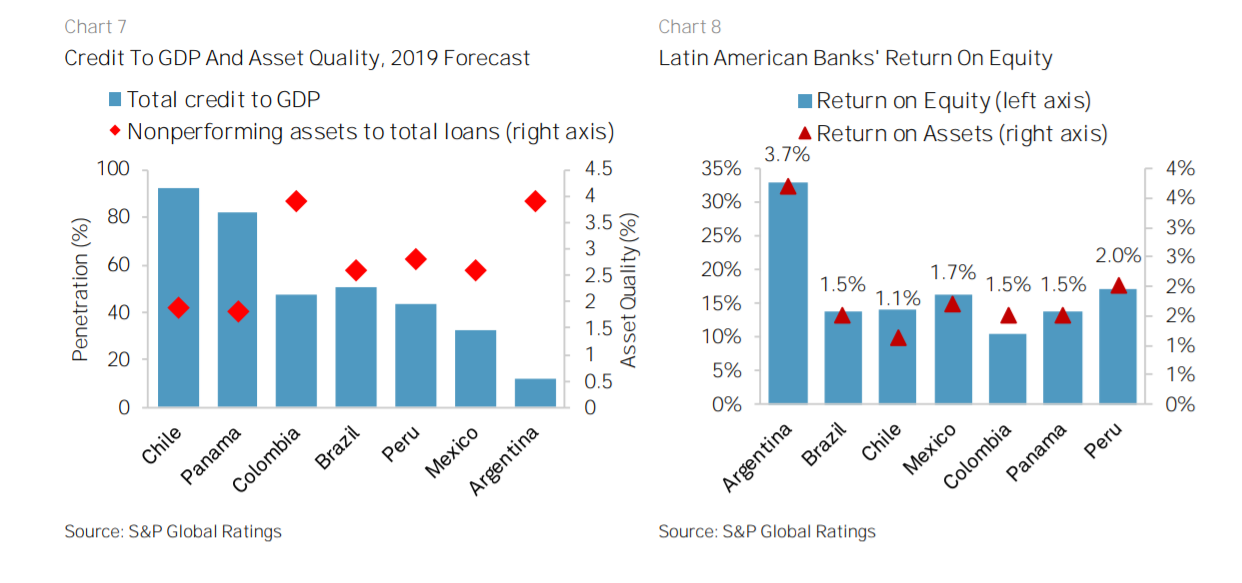

Argentine financial institutions are operating under very difficult conditions stemming from economic woes. Banks have been able to cope with the withdrawals since the primary elections thanks to the high levels of liquidity and the short-term nature of the dollar loans. Asset quality has weakened as lending continues shrinking in real terms as a result of the weak economy, and high inflation and interest rates. Non-performing loans to total loans reached 4.7% as of July 2019, still a manageable level thanks to the low banking penetration and banks' focus on the higher-income clients. On Aug. 20, 2019, we downgraded three Argentine banks to 'B-' from 'B', and revised the outlook to negative on all rated banks in the country, reflecting the sovereign rating action.

The Brazilian government is moving forward with its privatization agenda and reducing its participation in the banking system. Lending from private banks is growing at double-low digits, but lending among public has posted flat growth and BNDES is reducing its lending and divesting its equity exposures. We expect loan growth of 5%-8% this year, as corporations' demand for credit remains subdued. Asset quality metrics continue improving despite the still soft operating environment, and we expect this trend to continue.

Lending growth in Mexico is moderating because of the stagnating economy. In particular, growth of corporate and commercial loans--which make up about 65% of total loans--and the engine of credit growth--are slowing due to the lack of credit demand in light of low investment and weakening consumption. Nevertheless, banks' asset quality metrics remain resilient.

After the Concesión Ruta del Sol 2's contracts were declared invalid--due to the corruption probe of Brazil-based Odebrecht group--we expect nonperforming assets in Colombia's banking system to represent around 4% of total loans by the end of 2019, which are fully covered by reserves. We expect this metric to fall to about 3.75% and 3.5% in 2020 and 2021, respectively, based on improving economic prospects and increasing credit demand.

Low interest rates in Chile and Peru are prompting corporations to increasingly seek financing in domestic and international debt markets, resulting in low bank lending growth. Moreover, the softer economic growth and low investment confidence in both countries are reducing the corporate demand for credit.

Key assumptions

The adverse political dynamics, weakening domestic demand, and volatile external conditions will keep curb economic growth pace in the region. Therefore, we expect modest credit expansion and pressure on asset quality.

As a result of the Federal Reserve's current monetary policy, we expect the potential easing cycle in interest rates--in most countries--to pressure banks' profitability with a lag of 12-18 months.

Key risks

- A prolonged period of poor economic growth in the region--if political uncertainties prevail discouraging business and consumer confidence--could mute credit demand and cause nonperforming assets to rise.

- Volatile deposits in Argentina could continue pressuring banks' funding profiles.

- Venezuelan immigration to Colombia could pressure employment and wages, potentially affecting asset quality.

- Even though banking losses related to cyber security gaps are currently manageable, risks keep rising.

What to look for over the next quarter

- Mexican banks' asset quality and profitability amid ailing economy.

- Argentine banks' deposits and asset quality performance.

- Credit demand in Colombia amid stable economic prospects and the next steps for the implementation of Basel III capitalization rules.

Structured Finance

|

What's changed?

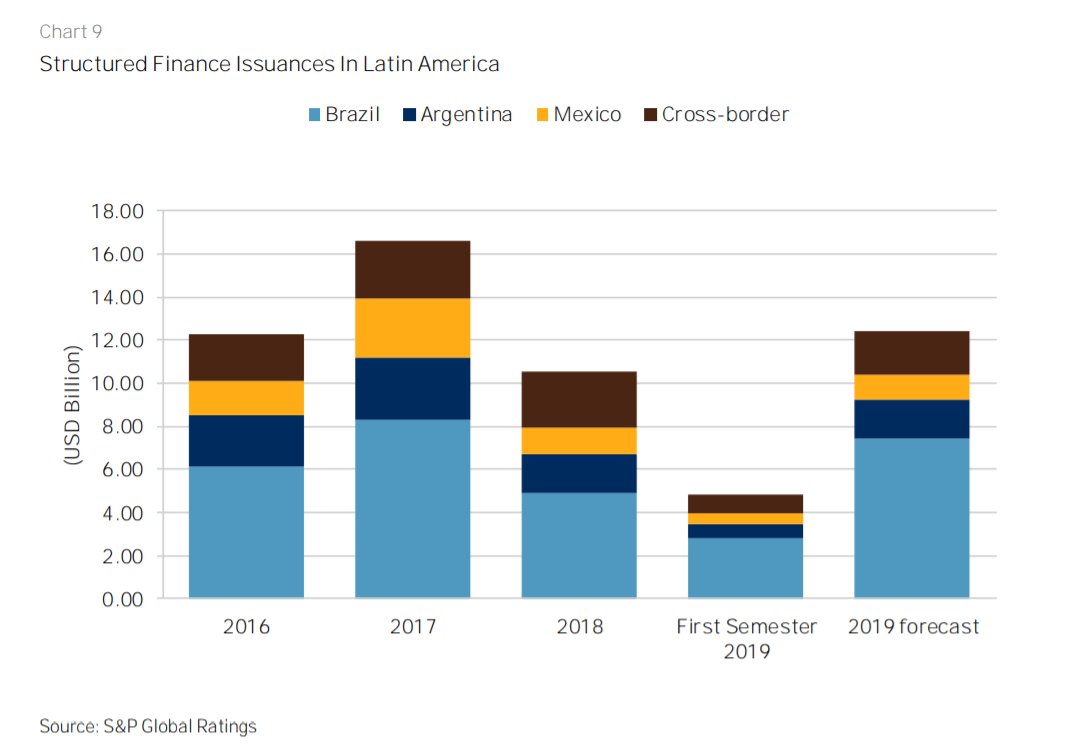

Structured finance issuances in Latin America during the first half of 2019 totaled about $4.7 billion, down about 20% in the same period of 2018. The drop mainly resulted from lower issuance volume in the cross-border market. Brazil accounted for the bulk of structured finance issuances in the region and should continue to drive the market.

As a result of the rating actions on Argentina, we placed 36 structured finance issue ratings on CreditWatch negative. The weakening of the sovereign will likely take a toll on the credit quality of the assets that back up the structured finance issues we rate. In addition, the Argentine ratings distribution will likely change, given the weaker macroeconomic conditions. About 80% of issuances that we rate in Argentina are backed by consumer credit as an underlying asset. Lowand medium-income individuals represent the bulk of borrowers from financial trusts, given that they have limited access to bank credit due to tight origination policies.

As we had expected, issuances in Brazil this year have increased significantly from 2018, albeit at a slower pace than we expected. Certificates of agribusiness receivables remain the most active class in the market, and this should persist for the remainder of the year. Nevertheless, we continue to observe interest in Fundos de Investimentos em Direitos Creditórios and new originators (particularly in covered bonds and fintech). On Aug. 19, 2019, the National Monetary Council, one of Brazil's financial regulatory bodies, approved Resolution No. 4.739, which is intended to widen the pool of funds available to finance purchases of homes in the country. In practice, the new resolution will allow residential mortgages to be linked to Brazil's Consumer Price Index (IPCA), which will attract significantly more investors to Brazil's incipient residential mortgage-backed securities (RMBS) through Certificados de Recebíveis Imobiliários (CRIs) and covered bonds through Letras Imobiliárias Garantidas (LIGs). We believe that indexing mortgages to IPCA comes with risks that must be monitored. The high volatility of Brazil's economy increases the risk of a sudden rise in inflation, which could result in a higher debt burden to homeowners, a rise in delinquencies, and weaker credit quality of securitized mortgages.

Issuances in Mexico during the second quarter of 2019 were in line with our expectations. Activity has resumed in the market across several asset classes, mainly asset based security (ABS) equipment and RMBS. We continue to follow closely the performance of ABS consumer and equipment transactions. Despite the subpar second-quarter 2019 GDP growth in Mexico, we didn't observe further weakness in our rated portfolio relative to the first quarter of 2019.

Key assumptions

- New issuance in Latin America between $11 billion and $13 billion, driven primarily by a rebound in Brazilian securitization.

- Stable collateral performance. Nevertheless, the sudden weakening of Argentina's credit quality will likely lead to downgrades of rated players.

- There are infrastructure projects that could bring securitization opportunities in the region.

Key risks

- Argentina's depressed economy remains a key risk to our expectations of new issuances and collateral performance.

- Mexico's GDP growth could continue to weaken and unemployment could rise, which could weigh on ABS transactions backed by consumer credit and equipment leasing.

What to look for over the next quarter

- Collateral performance and new issuances in Argentina.

- Debut of new issuers in Brazil and market sentiment.

- Mexico's GDP growth prospects and collateral performance domestic ABS market.

- New issuances in the cross-border market.