Regional credit conditions

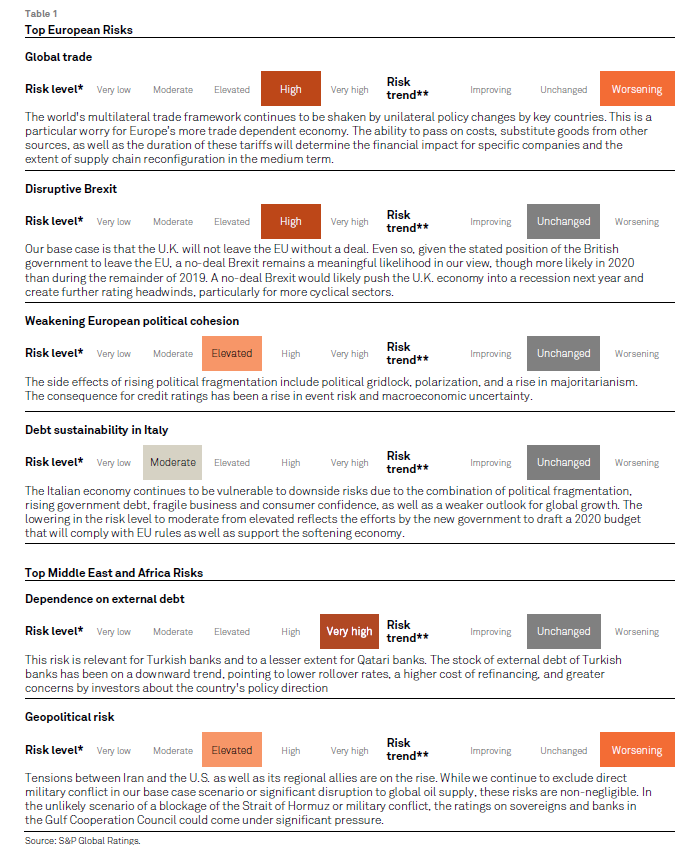

Assessment of key risks in Europe

Global trade – High, worsening

The world's multilateral trade framework continues to be shaken by unilateral policy changes by key countries. The strategic confrontation between U.S. and China remains intractable, while trade friction between North Korea and Japan has flared. Fractious trade relations weakens investment sentiment and long-term growth.

Europe is not immune. The U.S., after a recent World Trade Organization ruling, is in a position to impose punitive tariffs on EU products in compensation for illegal state subsidies to Airbus. The U.S. administration is still deliberating about whether to impose tariffs on U.S. auto imports from Europe on national security grounds, and there are disagreements about Europe's digital sales tax as well as sanctions on Huawei.

While the deteriorating trade environment may have only limited rating implications so far, the ability to pass on costs, substitute goods from other sources, as well as the duration of these tariffs will determine the financial impact for specific companies. In the medium to longer term, an unwinding in the global trading system would force many companies to reconfigure supply chains-- at some considerable cost and impacting margins--and would have greater ratings implications.

Disruptive Brexit – High, unchanged

Our base case is that the U.K. will not leave the EU without a deal. That remains the case now that the new U.K. government has lost its working majority. This has enabled opposition parties to pass legislation requiring the government to request another delay to leaving the EU until Jan. 31, 2020, unless an agreement is reached by Oct. 19, 2019, with the EU that is satisfactory to the U.K. parliament. Any extension of Article 50 requires the unanimous consent of the EU.

Even so, given the stated position of the government to leave the EU, a no-deal Brexit remains a meaningful likelihood in our view, though more likely next year than during the remainder of 2019. That could push the U.K. economy into a recession in 2020 with GDP falling by 2.8% in 2020 under our revised downside economic scenario. While some degree of short-term disruption would be unavoidable, an economic downturn would create credit pressures in more cyclical sectors, on individual rated U.K. companies, and other international companies with material business exposure to the U.K.

Weakening European political cohesion – Elevated, unchanged

The side effects of rising political fragmentation in formerly two-party systems include political gridlock, polarization, and a rise in majoritarianism. The consequence for credit ratings has been an increase in event risk, with more nationalist governments often proposing unilateral solutions to challenges that, in the developed world, appear increasingly universal. The fracturing of electorates seems to reflect a combination of developments:

- Population aging,

- Precarious employment and rising immigration,

- Competition from lower-wage economies and lower-cost technology, and

- Capital flight and tax evasion.

Populism often begins with a promise to prioritize other forms of public spending over debt servicing. The Greek government's decision to hold a referendum in 2015 lead to the electorate rejecting the terms of an emergency European loan. As a consequence, the economy contracted, and the banking system lost €45 billion (23% of GDP) in system deposits. The U.K.'s 2016 referendum on its EU membership appears, three years later, to have crowded out policy space to address the country's other pressing challenges, while rendering the economy vulnerable to recession. In Italy, a new pro-EU government is in place but faces the same economic and structural constraints as its antecedents, most of them arising from an aging electorate resistant to the need for labor and fiscal reforms within the confines of the Economic Monetary Union.

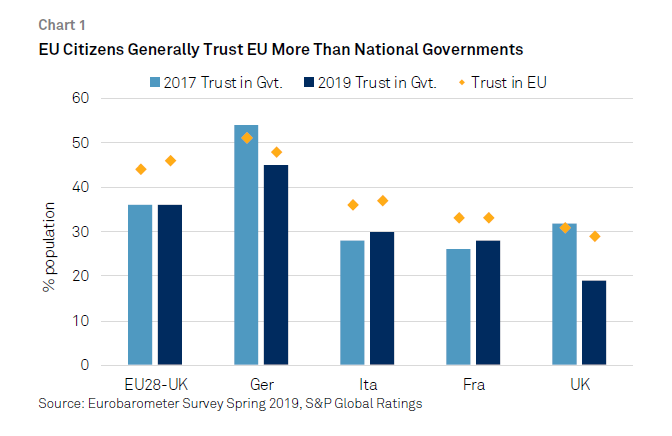

Not all European political systems are fragmenting. The Benelux countries are long accustomed to multiparty coalitions, federalism, and devolution of powers to the regions. Nor, at least in Europe, is nationalism overtly on the rise. Citizens' support for the EU--while below 50%--regularly exceeds citizens' approval of their national governments by an average of 10 percentage points (see chart 1 below) across nearly all the EU-28. If there is a trend toward rising distrust among EU member citizens, it is distrust of national governments--not the supranational EU.

Debt sustainability in Italy – Moderate, stable

The Italian economy, the third largest in the EU, is vulnerable to downside risks due to the combination of policy drift, rigid labor and product markets, poor inclusiveness of young people in the economy, weakening global demand for exports, and fragile business and consumer confidence. For 2019, we forecast annual GDP growth of just 0.1%, followed by a weak recovery in 2020 of 0.4%. Positively, a new, more centrist government is in place, and they have declared their commitment to drafting a 2020 budget that will comply with EU rules. Authorities' strategy to avoid a VAT hike next year depends upon their finding offsetting budgetary savings of about 1% of GDP and convincing the European Commission that planned tax cuts for lower wage workers will pay for themselves. The pressure on the new government to both deliver a European budget and shore up growth will be no less intense merely because growth is slowing down everywhere. Moreover, as the second-largest manufacturing economy in Europe, Italy won't be immune to weakening Chinese demand for capital goods and consumer durables.

Assessment of key risks in the Middle East and Africa

Dependence on external debt – Very high, unchanged

Turkish banks' external debt has continued to decline, pointing to a continued drop in rollover rates, higher costs, and greater concerns by investors about the country's policy direction. As of June 30, 2019, the total stock of external debt of private-sector Turkish banks stood at $145.7 billion ($64.8 billion of short-term debt and $80.9 billion of long-term debt, including $33.2 billion of private-sector banks' debt coming to maturity in the next 12 months). This stock was $5.6 billion lower than at year-end 2018. We expect the lack of investor confidence to continue restricting Turkish banks' capacity to access capital markets at manageable prices. The stock of foreign currency liquid assets increased slightly in the first six months of 2019, reaching $94.8 billion, compared with $92.7 billion at year-end 2018. These assets continue to provide some leeway for banks to withstand more stress. However, it is worth mentioning that around $62.7 billion represent banks' exposures to the central bank, meaning that a lower rollover rate will displace the problems to the balance sheet of that body. Arguably of even greater importance for banks and the broader economy is whether or not foreign exchange-rich households become comfortable enough with current exchange rate levels to start converting their savings back into Turkish lira.

Political paralysis and weak investor confidence have slowed Lebanon's customer deposit growth in recent years, leading to a contraction in May 2019 of close to 1%. We expect a small turnaround in nonresident deposits for the rest of 2019, mainly because of the central bank's financial engineering operation in July. Nevertheless, these inflows will be insufficient to meet the country's high external financing requirements. If the government fails to implement substantial reforms or if geopolitical tensions were to escalate, the decline in Lebanon's foreign exchange reserves could accelerate and the country's ability to repay its financial liabilities could deteriorate further.

Mounting geopolitical risk in the GCC--Elevated, worsening

Tensions between Iran and the U.S. as well as its regional allies continued to increase following the recent attack on Saudi Aramco facilities, reducing Saudi oil production by more than half1. The Saudi authorities plan to restore production capacity in the next few weeks and use existing reserves in the meantime.

While we continue to exclude direct military conflict in our base case scenario or significant disruption to global oil supply (through closure of the Strait of Hormuz, for example), the risks are on the rise. If that were to happen, oil prices would spike and, as long as export routes remain viable, GCC countries would benefit from higher fiscal revenues.

At the same time, we think that investors' appetite in the region would weaken and foreign funding could potentially start to flow out, with Qatar being the most vulnerable. The external debt of Qatari banks has continued to increase, reaching $136.5 billion at the end of June, compared with $121.2 billion at Dec. 31, 2018. In the unlikely scenario of significant escalation in tensions leading, for example, to a blockage of the strait or military conflict, the ratings on GCC sovereigns and banks could come under significant pressure.

Financing conditions

Eurozone

Following the announcement of the ECB's new expansionary package, we expect rates to remain low at least until 2023, maintaining favorable financing conditions despite some tightening in credit standards. With both low interest rates for bank loans and low bond yields, a limited appetite for borrowing is the main constraint on external financing.

The ECB's package includes lowering the deposit rate to -0.5%, from -0.4% previously. We therefore expect interest rates to remain low for both consumers and firms. Interest rates on new business loans currently stand at 1.6%. However, so far most banks have not imposed negative rates on customer deposits, and so, in this competitive lending environment, we expect a continued squeeze on lending margins.

Even so, banks in the eurozone have slightly tightened their credit standards for loans to firms in the second quarter of the year, mainly considering general economic risk and a weaker outlook for individual firms--and we believe this is likely to continue. Apart from two quarters at the end of 2016, banks have been easing credit standards for firms since 2014. At the same time, we expect companies to decelerate fixed investment amid the economic slowdown, mirrored by decreasing corporate loan demand from banks.

Concerning loans to households, credit standards tightened for consumption loans while they remained unchanged for loans for house purchases, reflecting resilience in the housing market.

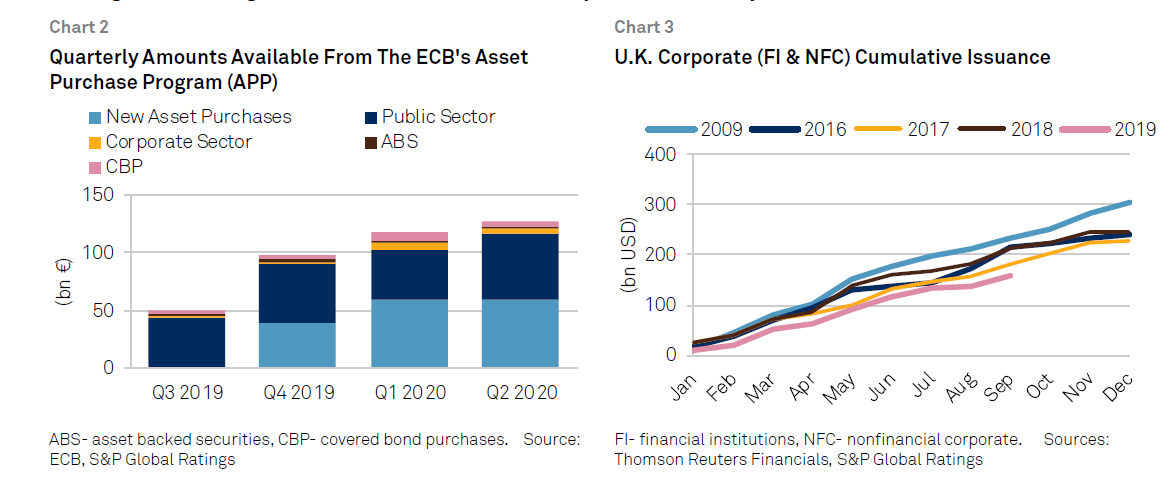

The resumption of ECB net asset purchases of €20 billion a month from November 2019, plus reinvestment of €183 billion of maturing debt over the next nine months (see chart 2), together with the third round of Targeted Longer-Term Refinancing Operations that has just commenced, will maintain ample liquidity in the eurozone.

U.K.

We don't expect the Bank of England to hike rates before the second quarter of next year. Consequently, interest rates for both corporates and the consumer should not rise in the short term, though they should do so earlier than in the eurozone.

Corporate bond issuance in the U.K. this year lags behind previous years, reflecting contained appetite for borrowing, despite low funding costs (see chart 3). In the context of uncertainties about the form Brexit will take, firms continue to hold back on investment decisions. Investment in the U.K. has decreased by 2.4% since the Brexit referendum. Households' demand for credit has also softened, with the mortgage growth rate turning negative in the first half of the year and consumer credit growth slowing to 4.0% over the 12 months to July, from 8.5% two years earlier.

Macroeconomic developments and assumptions

|

Eurozone

What's changed?

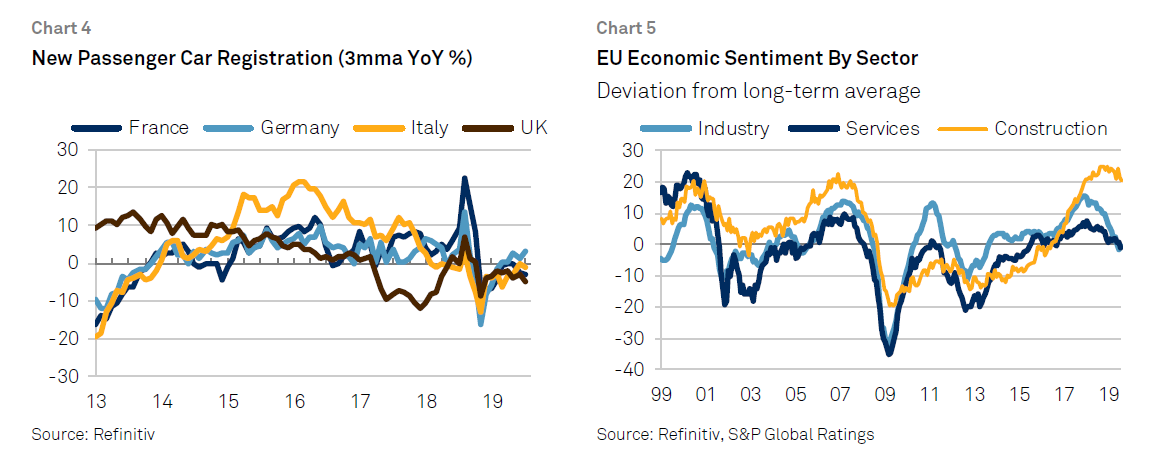

The eurozone economy expanded for the 25th consecutive quarter in second-quarter 2019 by 0.2%. Real wages increased by a strong quarterly 0.7%, but domestic demand failed to accelerate on flagging employment (up a quarterly 0.2%). The overall dynamic is also not totally convincing, in the sense that GDP growth has been stuck at a meager 1.2% a year since the end of 2018, sliding from a peak of 3% in 2017. One the one side, bank loans recovered over the second quarter and new car registrations picked up (see chart 4), erasing the one-off effects that pulled down GDP growth over the second half of 2018. On the other side, the region's manufacturing sector and especially in Germany haven't overcome their weaknesses. The transition and deleveraging of the Chinese economy as well as the political uncertainties surrounding global trade--which intensified over the summer--have brought German exports and business investment to a standstill. There is little doubt now that the German economy will experience a (light) technical recession during the third quarter of 2019. Even more worrying, the weakness in the European manufacturing sector is spreading to the service sectors, while the construction sector--which added one-fourth to 1.2% GDP growth last year--has peaked (see chart 5). As a result, we lowered our eurozone GDP growth forecast for 2020 to 1.1% from 1.3%.

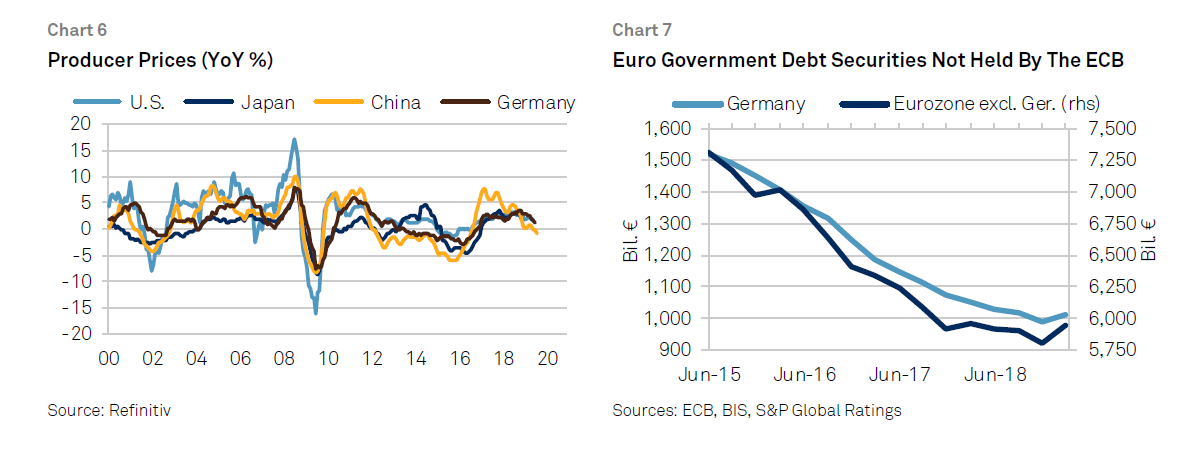

The easing in five-year credit default swaps on Italian government bonds following the formation of a new government suggests that homemade political uncertainties have receded somewhat. Inflation expectations have stabilized. However, with five-year, five-year inflation forward swaps trading at 1.3%, market-based expectations still undershoot the ECB target by far. Behind the lack of traction, from wages to core prices (see chart 6), a reason for subdued consumer price pressures lies in China, which is exporting deflation once again. Against the backdrop of flagging growth, low inflation, high external political uncertainty, and a likely German recession, the ECB had no other choice but to deliver an "all-in" monetary stimulus at the start of September. While being broadly in line with our expectations, the ECB exceeded markets' expectations, deciding to cut their deposit rate to -0.5%, introducing a two-tiered system for the remuneration of banks' excess reserves, easing the modalities for long-term refinancing operations, and resuming bond purchases at a pace of €20 billion a month from November for as long as necessary. "QE infinity," or quantitative easing without a stated end, will require the ECB to raise the self-imposed limit of 33% outstanding on public bonds purchases, as it already holds some 27% of eligible bonds (see chart 7). Since the ECB started QE, it has absorbed €1.8 trillion of eurozone government bonds from debt capital markets.

Key assumptions

- The eurozone economy will continue to expand more moderately over the next quarters. The resilient French and Spanish economies will somewhat counterbalance the German and the Italian economies, which continue to hover at, or close to, recession.

- Risks to growth remain tilted to the downside as political uncertainties--Brexit and the U.S.- China trade war in particular--act as impediments to investment despite exceptionally favorable financial conditions.

- Continuity in ECB monetary policy is of the essence, despite the change in governance, and we expect the central bank, with inflation undershooting, to deliver another rate cut as soon as December. The ECB is unlikely to react to a transient increase in oil prices triggered by geopolitical developments.

Key risks

- Because the German economy is overreliant on Chinese and car demand, weakening external demand remains the main downside risk to European growth. The risk of a further escalation in the trade war has not abated, as the U.S. administration should decide on any hike in tariffs on EU auto imports before year-end.

- A conflict in the Middle East that jeopardizes Saudi spare capacity would significantly damage an already faltering European economy.

- A positive risk to our scenario is nevertheless emerging, as some eurozone countries have decided to loosen fiscal policy next year in response to Mario Draghi's appeal to rebalance the European policy mix.

What to look for over the next quarter

- How resilient the European construction sector is as a driver of growth.

- Budget discussions in many European countries, especially in Germany to assess how strong the fiscal stimulus could effectively become, and in Italy to judge the stability of the new coalition.

U.K.

What's changed?

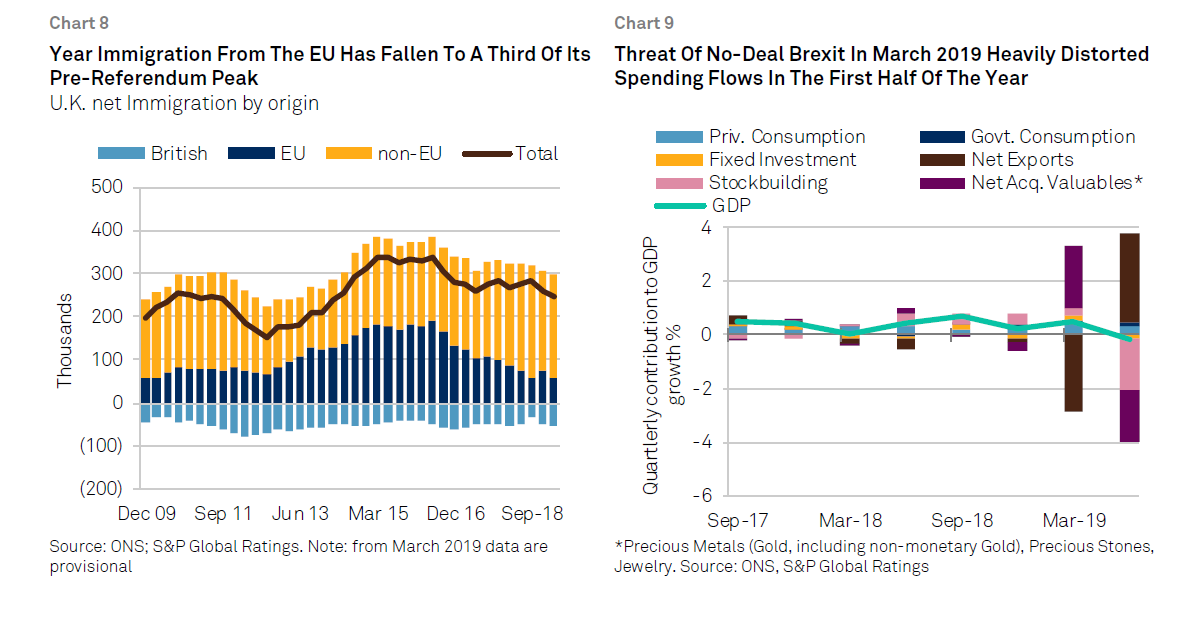

The new U.K. government's "do or die" approach to Brexit, namely to leave the EU by end of October with or without a deal, hit a wall when Parliament passed legislation requiring the government to request another extension to Article 50 until January 2020, unless a deal satisfactory to lawmakers is reached by Oct. 19, 2019. In view of the circumstances, we have left our risk assessment of a nodeal Brexit at high. A further extension to the Brexit deadline, but also a snap election after October and before the end of the year is now likely. This prolongs uncertainty about the ultimate shape and form Brexit will take, weighing in particular on investment. It could also keep some pressure on net immigration into the EU that in the year to end-June 2019 had dropped to less than one-third of its peak in the year to June 2016 (see chart 8).

The earlier threat of a no-deal exit at the end of March 2019 created major distortions in GDP components, which are now clearly visible in first-half data. Throughout most of 2018, as a precaution businesses had been stocking up on inventories, especially inputs for domestic and export production. Once the Article 50 period was extended, they started unwinding inventories (see chart 9). For example, the import of goods rose by 14.3% in the first quarter--roughly the same as over the previous four years taken together--and then fell by a similar rate in the second quarter. Notably playing a major part was the net acquisition of valuables--mostly gold, including nonmonetary gold. It is difficult to say, though, whether the reasons were a flight to safety, speculation, or other motives. However, these Brexit-driven swings dominated GDP numbers, raising growth in the first quarter and depressing it in the second quarter. Meanwhile, household consumption remained firm, pointing so far to relatively steady but slowing underlying growth.

Key assumptions

We spotted some soft data points indicating economic weakness in the second half of the year, including some reluctance of consumers to commit to big-ticket purchases, such as cars. Consumer spending growth could soften further at the turn of the year, as the impact of uncertainty finally kicks in. Despite this, household spending should continue to support the economy against the backdrop of a still very robust labor market and record pay growth.

It is also likely that we see further large swings in GDP spending components before and after the current Brexit date of Oct. 31, although they will likely be less pronounced this time round. This could mean a surprisingly strong third quarter and then a correspondingly weak fourth quarter.

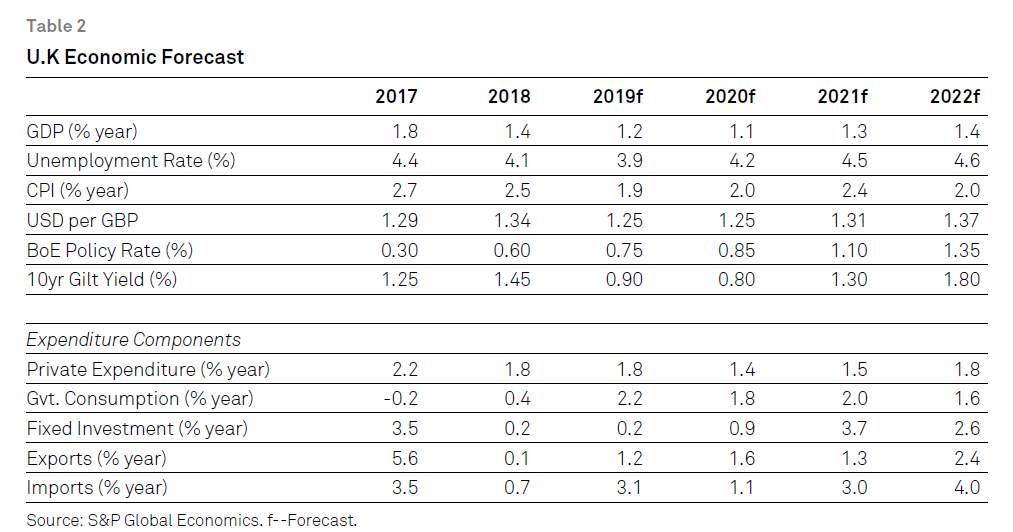

Looking further ahead, we note that we continue to base our forecast here on the assumption of the U.K. leaving the EU with a deal and a transition phase through 2020. As the transition phase shortens with every extension of the leaving date, time will be limited to sufficiently flesh out all the details of a potential deal, leaving some issues unresolved after the transition phase ends. In order to account for this, as well as the protracted uncertainty, we have revised down our forecasts for 2020-2022 (see table 2).

Key risks

Should the U.K. leave the EU without a deal at the end of October (or potentially at the end of January 2020), we would lower our forecast considerably.

EMEA Emerging Markets

What's changed?

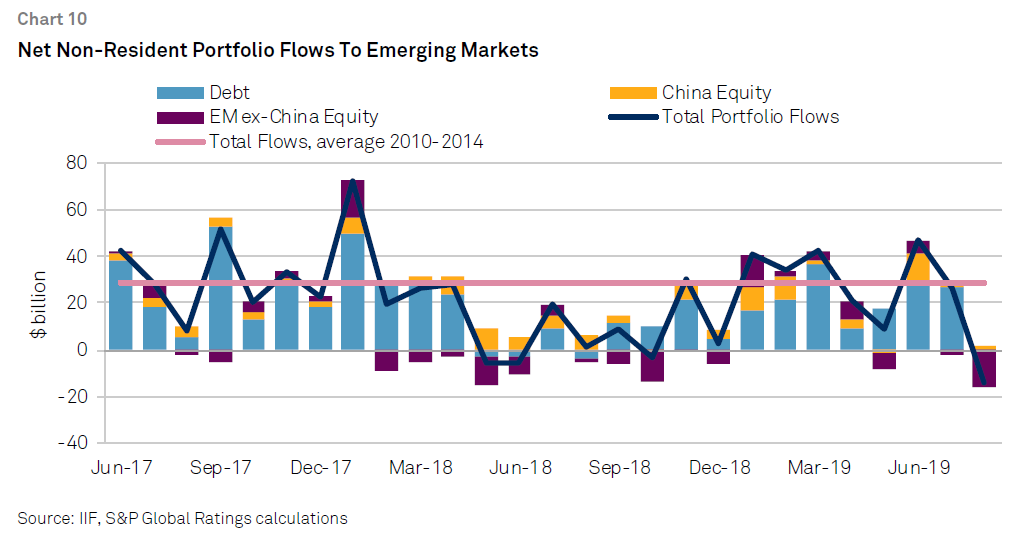

Investors' sentiment toward emerging market assets remains fragile, as illustrated by the volatility in capital flows over the third quarter. While the expectations of the U.S. Federal Reserve's shift toward a looser monetary policy boosted portfolio inflows into emerging markets in June and July, the escalation of trade tensions in August led to a reversal (see chart 10).

The disruption in Saudi Arabia's oil production in mid-September has triggered a temporary rise in oil prices. Although our baseline assumption is that oil prices remain within current trading ranges, the situation is uncertain.

Financial conditions have eased in Turkey and Russia, in line with global trends. The Turkish central bank slashed the policy rate by a cumulative 750 basis points (bps) over the course of two meetings, bringing the key rate to 16.5% in September. The Central Bank of Russia continued to ease policy, cutting the key rate by a cumulative 50 bps, to 7% in September. Long-terms yields have fallen in both economies. The South African Reserve Bank lowered the repurchase rate by 25 bps in July, but kept the key rate unchanged in September, at 6.5%. Nevertheless, long-term yields came under upside pressure in August, reflecting investors' concerns about the sustainability of the country's fiscal path. The rise in the risk premium has offset the positive impact of looser global financial conditions, with South African 10-year local government bond yields finishing the third quarter at a higher level than at the end of the second quarter.

We expect further monetary easing in all three economies over the next few months amid generally favorable inflation dynamics. This is conditioned on a stable external environment for foreign financial flows (which depend on investors' perceptions of external and country-specific risks) and, in case of Turkey and South Africa, on the oil market. A sustained increase in oil prices beyond the current trading range will raise inflationary pressures in these economies from higher energy prices and weaker currencies, and make it more difficult for their central banks to continue lowering rates.

Russia

The recent rise in oil prices will result in larger external and fiscal surpluses, but provide little boost to Russia's economic growth, since the fiscal framework in place requires the government to save most additional oil revenues. Economic growth picked up slightly in the second quarter, to 0.9% year on year from 0.5% in the first quarter. We continue to expect that growth will accelerate in the second half, thanks to monetary easing and the pickup in public spending.

The U.S. government imposed additional sanctions on Russia in August, prohibiting U.S. financial institutions from participating in the primary market for non-ruble-denominated Russian sovereign debt. Our baseline macroeconomic scenario already incorporated some possible restrictions on Russia's primary sovereign debt, and we maintain our forecast of 1.3% GDP growth in 2019 and 1.8% in 2020. Nevertheless, the outlook for sanctions is highly uncertain. For example, we still do not know whether new sanctions on primary debt issuance will lead U.S. investment banks to eliminate Russia from their bond indices--a step that would likely raise the cost of capital for Russia2.

Turkey

The second-quarter GDP release in Turkey surprised on the upside, with the economy expanding by a quarterly 1.3% (or -1.5% over the last year), but the recovery remains fragile. A temporary fiscal and credit stimulus lifted household spending in the first half of the year, but the decline in investment deepened. Tourism has performed strongly this year, and previous gains in price competitiveness will continue to support goods and services exports. However, with slower growth potentially ahead for some key trading partners, external demand is set to moderate. While looser credit conditions should support a recovery in capital spending, the rebound is likely to be modest, held back by low business confidence amid policy uncertainty and expectations of subdued domestic and foreign demand. We keep our forecast of a contraction in headline GDP at 0.5% this year, but revised our growth expectations for 2020 down to 2.9%, from 3.2% previously.

South Africa

The South African economy rebounded in the second quarter from the contraction in the first quarter, growing by an annualized 3.1%, but continues to face headwinds from low confidence levels among consumers and businesses, amid slow progress with structural reforms and uncertainties about the fiscal trajectory. Unemployment soared to 29% in the second quarter, with the number of unemployed at a historical high, as employment gains were only marginal, while labor supply rose strongly. The announcement of additional support to Eskom, South Africa's electricity utility, added to investors' concerns about the sustainability of the fiscal path of the economy. We have lowered our growth expectations to 0.6% this year, from 1% previously, and 1.6% in 2020, from 1.8%.

Key risks

Any protracted delays in restoring oil supplies in Saudi Arabia or a significant escalation in geopolitical tensions in the Middle East could lead to a spike in oil prices. This would hurt consumer demand in the oil-importing economies of Turkey and South Africa, at a time when external demand is slowing and investment is weak.

Weaker capital flows, or an outright reversal, remains the risk for emerging economies in EMEA. As trade conflicts remain unresolved, and concerns about global growth intensify, investors' appetite for emerging market assets seems to become more and more reliant on the expectations of additional monetary stimulus from advanced economies. Country-specific risks, such as the fiscal situation in South Africa, U.S. sanctions on Russia, and risks related to the banking sector in Turkey, also remain on investors' radar.

What to look for over the next quarter

- Russia: U.S. sanctions on Russia, including the impact of recent sanctions on primary debt issuance.

- South Africa: Fiscal developments, including government support to Eskom. The Medium Term Budget Policy Statement unveiled in October should have additional details about the country's fiscal trajectory.

- Turkey: Dollarization trends in the Turkish banking sector, rollover ratios of external debt, and bank's asset quality.

Sector Trends

|

Banks

|

What's changed?

The economic environment is becoming less supportive, and low-for-longer rates are becoming a reality. Besides announcing a comprehensive set of easing measures, the ECB made conditions for TLTRO III more attractive to banks. The introduction of a two-tier system for remunerating excess liquidity holdings should ease the impact of lower rates, especially for German, Dutch, and French banks. We now expect another cut in the deposit rate by December and deposit rates remaining negative until end-2023.

In this scenario, the likelihood of banks restoring profitability to modest levels looks remote, and therefore is an increasingly structural problem rather than a cyclical phenomenon. While banks will try to increase fees to help offset margin pressure, strategic measures (process re-engineering, digital investment, consolidation) are increasingly needed to improve efficiency.

Banks and banking systems that have a more limited ability to make structural changes will suffer more. That is why, for example, we have assigned negative outlooks to nine of the largest German banks and banking groups. The rationale for in-market consolidation remains stronger than ever, but we have seen little willingness to pursue it.

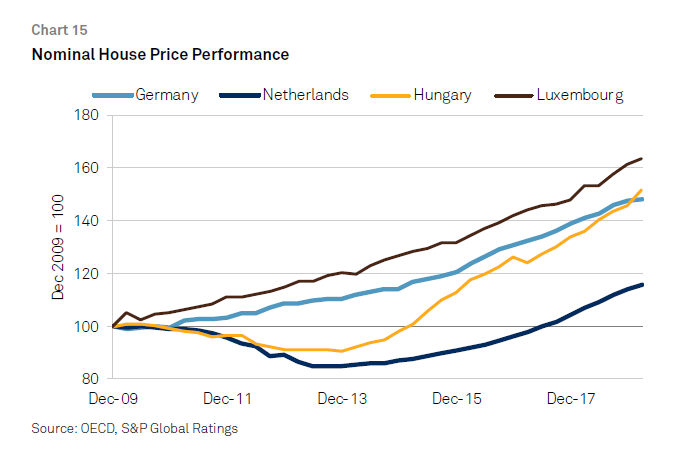

Furthermore, the extremely accommodative monetary policies leave the door open for imbalances to surface. In Germany, Luxembourg, and Hungary, for example, real estate asset prices continue to grow briskly (see chart 15). Prolonged growth in private-sector credit, outpacing that of GDP, would also be something to watch. Continued price distortions in the market across sovereign, corporate, or bank debt could lead to higher risk taking as investors search for yield and will continue contributing to increasing disintermediation. The competitive environment for banks will generally remain tough, aggravated by the emergence of fintechs.

The U.K. market has not escaped margin pressure, but a no-deal Brexit remains the key risk--albeit at present it's unlikely we would downgrade the country's banks as a result. Conversely, political developments in Italy, in particular the formation of a new, more pro-EU coalition government, have somewhat eased short-term concerns. The negotiation of next year's budget in a month's time will provide more color.

We've seen several recent episodes of increased consumer activism against banks, which suggests that litigation risks could be on the rise. In the U.K., for example, which has long been at the forefront, banks reported more claims than expected related to the mis-selling of payment protection insurance ahead of the Aug. 29, 2019, deadline. That said, after eight years, more than £50 billion in payouts, and a heavy reputational cost, the cessation of claims is a critical step for the industry. In Spain last week all eyes were on the European Court of Justice, which issued a statement about mortgages linked to Spain's IRPH price index. The advocate general's ruling suggests that banks will avert the worst-case scenario of IRPH clauses being considered null. Previously, Spanish banks reported sizable compensation payments from misconduct involving the sale of hybrid instruments, the use of floors in mortgages, and other practices. Similarly, Polish banks are awaiting a European Court ruling on foreign currency-denominated loans.

Key assumptions

- Sustained low policy rates will continue to undermine bank profitability as credit volumes will unlikely boost materially. Conversely, credit conditions will aid refinancing and asset quality.

Key risks

- A disruptive Brexit, resulting in severe macroeconomic weakness in the U.K. would lead to deteriorating asset quality, lower activity, weaker earnings, and, to a lower extent, weaker capitalization for banks. We see outlook revisions as more likely than downgrades for U.K. banks in the near term. Smaller lenders, more focused on U.K. retail banking or property-related lending, would be more vulnerable in this scenario. We expect banks in other European countries to be able to accommodate the effects of a no-deal Brexit. In particular, ratings on Irish banks have some cushion to absorb the impact.

- Economic growth challenges spreading to other eurozone countries, leading to renewed concerns over European banking systems that have not yet completed their turnaround from previous crises (Italy, for example).

- Lack of a decisive response from banks to their profitability challenges.

- A build-up of asset bubbles, higher risk taking, or irrational pricing.

What to look for over the next quarter

- Initiatives by domestic banking authorities toward preventing the buildup of imbalances.

- The reaction of the least profitable banks to low-for-longer interest rates, as well as the progress of banks in systems hard hit in the previous downturn to accelerate their recovery.

Nonfinancial Corporates

|

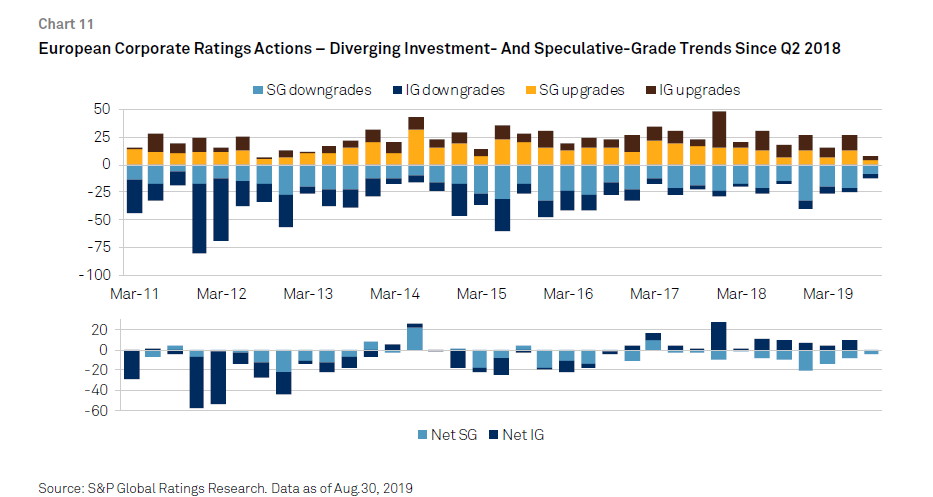

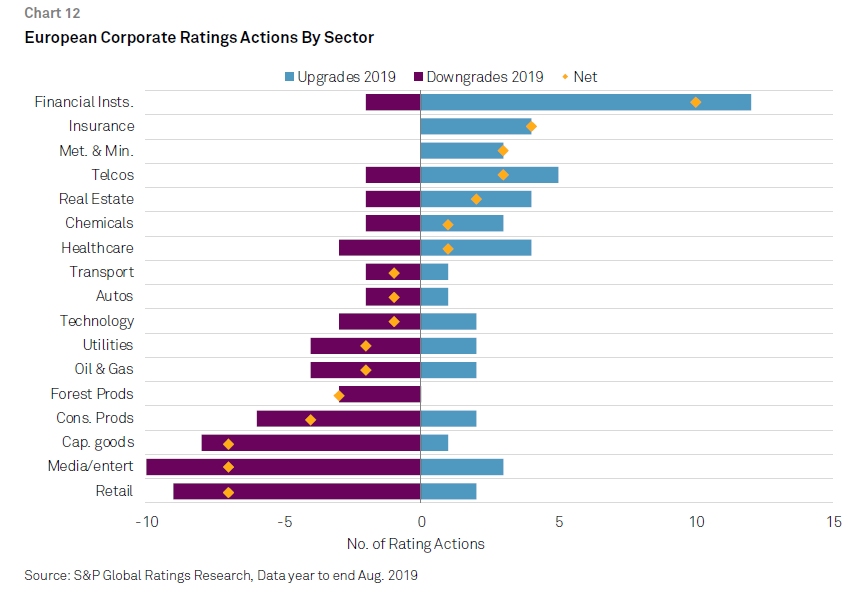

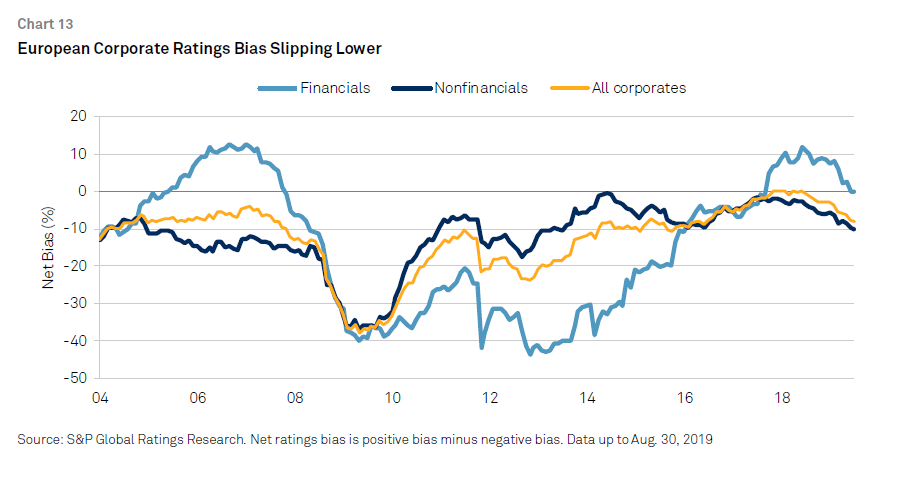

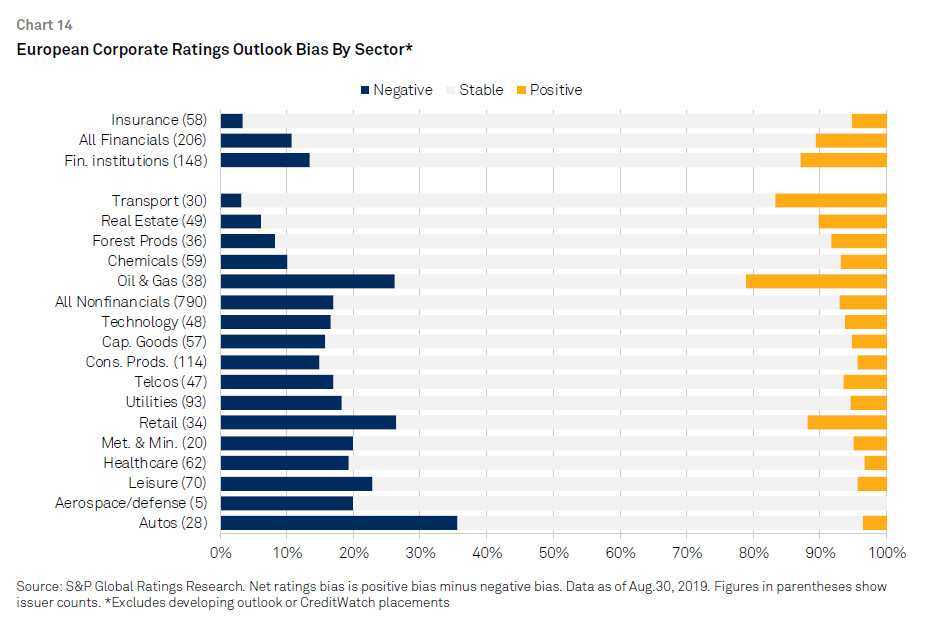

What's changed?

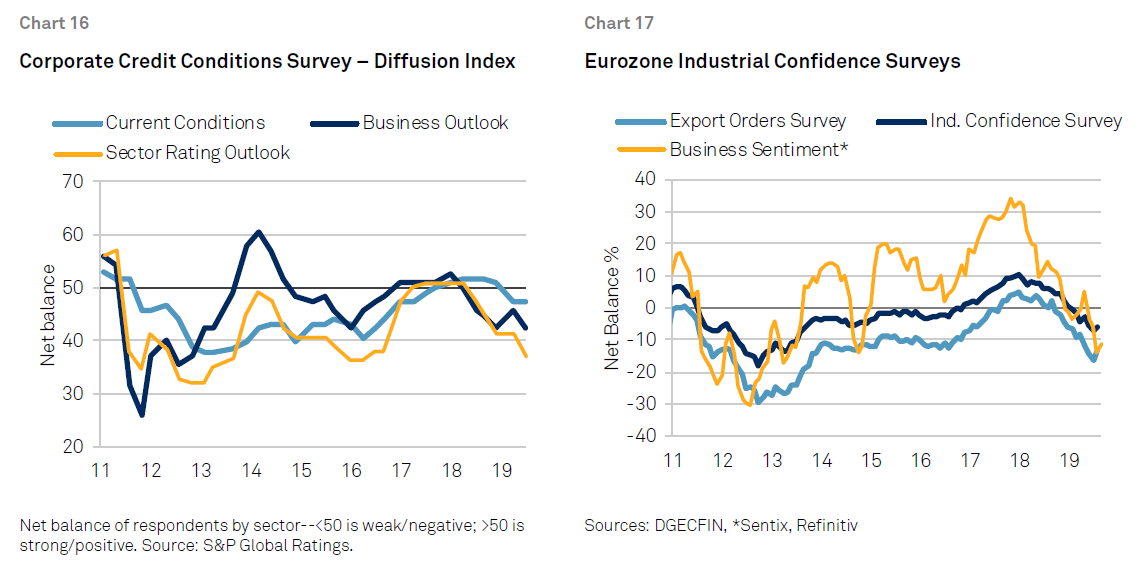

- Sector outlooks: Credit trends are weakening across a growing range of industry sectors, which are visible in our latest quarterly Credit Conditions survey (see Appendix table 3 and chart 16). Sectors already showing weaker trends, such as autos, retail, leisure, and capital goods, are joined by steel, technology, mining, real estate, and transport infrastructure (airports), since our last survey. This reflects weaker operating conditions due to the slowdown in global trade or those adapting to technological and environmental factors and weakening industrial sentiment in the eurozone (see chart 17). We count 13 out of 29 sectors with a negative or stable to negative outlook for the next 12 months, the highest since June 2016.

- Autos: We continue to see business conditions in the auto industry as weak. We recently updated our forecast for global light vehicle sales, which look set to fall by 2%-3% this year, and we foresee virtually no growth over 2020-2021. Worsening global economic conditions, the trade war between the U.S. and China, and the high cost of innovation for carmakers will continue to dampen sales. Potential tariffs on auto sales into the U.S. from the EU, and possible fines for noncompliance with EU carbon dioxide emissions regulation in 2020-2021 would pressure margins. Lower auto demand is also having a negative impact on other sectors, such as capital goods, chemicals, steel and technology.

- Steel: We see business conditions in the steel sector as currently weak, due to high iron ore raw material costs and softer demand, including from the auto sector, and slower economic growth, which is squeezing margins.

- Transport infrastructure (airports): We see a clear trend in European aviation of decelerating traffic growth, regulatory developments, and geopolitical events. Because of the weakening economic environment, we expect traffic to continue decelerating for the next year. We now forecast GDP volume multiples to fall to 1.0x-1.5x through 2020, down from 2x-3x in 2018. Airport charges remain topical, with some airports facing material tariff cuts from regulators.

Key assumptions

- We expect continuing credit headwinds in fourth-quarter 2019, with downgrades continuing to outpace upgrades. But, we don't see major changes in the overall outlook bias or sector outlooks. However, this will partly depend on how Brexit, global trade, and tensions in the Middle East evolve.

Key risks and what to look for in the next quarter

- No-deal Brexit: Brexit-related risks have continued to contribute to negative rating actions on EMEA-based corporate and infrastructure companies. In a no-deal scenario we envisage a small number of issuers could potentially face a negative rating action: a downgrade, outlook revision to negative, or a negative CreditWatch placement. The most exposed sectors continue to be automotive, leisure, retail, real estate, aerospace and defense, and transport infrastructure.

- Trade: Industries exposed to a likely extended period of U.S.-China tariffs--including autos, capital goods, chemicals, and technology industries--are facing the challenge of adapting supply chains. Large players have already started to supply the U.S. from other locations, but smaller companies have much less flexibility to reorganize and avoid the tariffs, which are impinging on operational performance.

- Oil & gas: Following the strike on the state oil producer Saudi Aramco's Abqaiq oil-processing facility and the Khurais oil field, which led to a short-term spike in oil prices, we don't expect much uplift to the credit quality of most global exploration and production (E&P) companies. Similarly, we don't envisage negative consequences for oil-consuming sectors such as chemicals and transportation. There would be bigger risks of course if prices had skyrocketed or if a conflict had broken out.

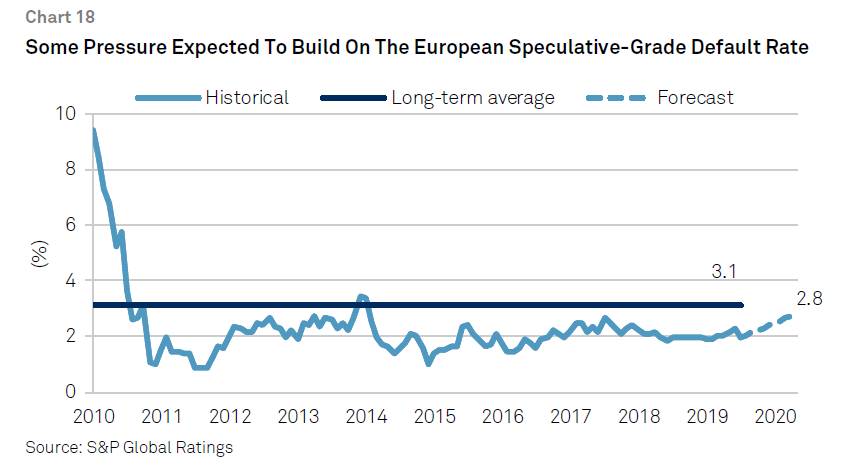

- Leveraged finance: The ECB's low-for-longer policy stance may encourage larger, more aggressively structured leveraged buyouts to capitalize on cheap and available financing. This would raise the risk of higher defaults and lower recoveries down the road when the cycle turns. However, for the next 12 months, we anticipate the European speculative-grade default rate to rise slowly from 1.96% (August 2019) toward 2.68% as credit deterioration persists (see chart 18) despite low debt service and extended debt maturities. Continued low interest rates also look likely to keep pension liabilities and deficits high, possibly having a negative impact on financial ratios, credit ratings, and the outlooks of certain companies.

- Financial policy: Decisions about financial policy remain a high risk in certain sectors, with continued M&A activity being carried out to strengthen competitive positioning, including in telecom, consumer products, and business services.

Sovereigns

|

What's changed?

- While the disruption to Saudi Arabia's oil production capacity at Abqaiq looks to be temporary, the vulnerability of most of the world's spare energy capacity to aerial attacks is a game changer that implies rising commodity price volatility at an inconvenient time for the global economy.

- The ECB's relaunch of QE and its commitment to a lower-for-longer monetary stance has pushed real interest rates to all-time lows across the eurozone, with positive implications for economic stability in Europe and capital flows into emerging markets.

Key assumptions

- Our baseline assumption remains that neither Iran nor the U.S. want to engage in direct military confrontation, and that oil prices remain within current trading ranges.

- We expect the Germany's Federal Constitutional Court to issue a ruling by end-2019 that will not prevent the ECB from carrying out its asset purchase program or increases in its issue holding limits.

- While support for fiscal stimulus among the strongest eurozone economies is on the rise, our baseline assumption is that delivery is slow and scale is modest.

Key risks

- Europe should manage to (just) avoid a technical recession, but its reliance on foreign demand makes it particularly vulnerable to external shocks in the form of trade wars or oil price shocks.

- A key risk toward the end of 2019 for eurozone sovereign debt markets continues to be the impending decision by the Germany's Federal Constitutional Court on the legality of the ECB's asset purchase program. A negative ruling would inflict potentially irreparable damage on the ECB's strategy to reinflate the European economy and raise the specter of convertibility risk in the market.

- The Dutch government has surprised many observers by committing to include tax cuts representing 0.4% of GDP and other stimulus measures in its 2020 budgetary proposal. The question is whether the much larger German economy adopts a similar countercyclical fiscal stance, which would lower the risk of recession in the rest of Europe.

- Italy has a new coalition government with positive implications for the direction of fiscal and structural policies. Nevertheless, in the absence of a stronger economic recovery next year, Italy-specific political risk remains material.

Structured Finance

|

What's changed?

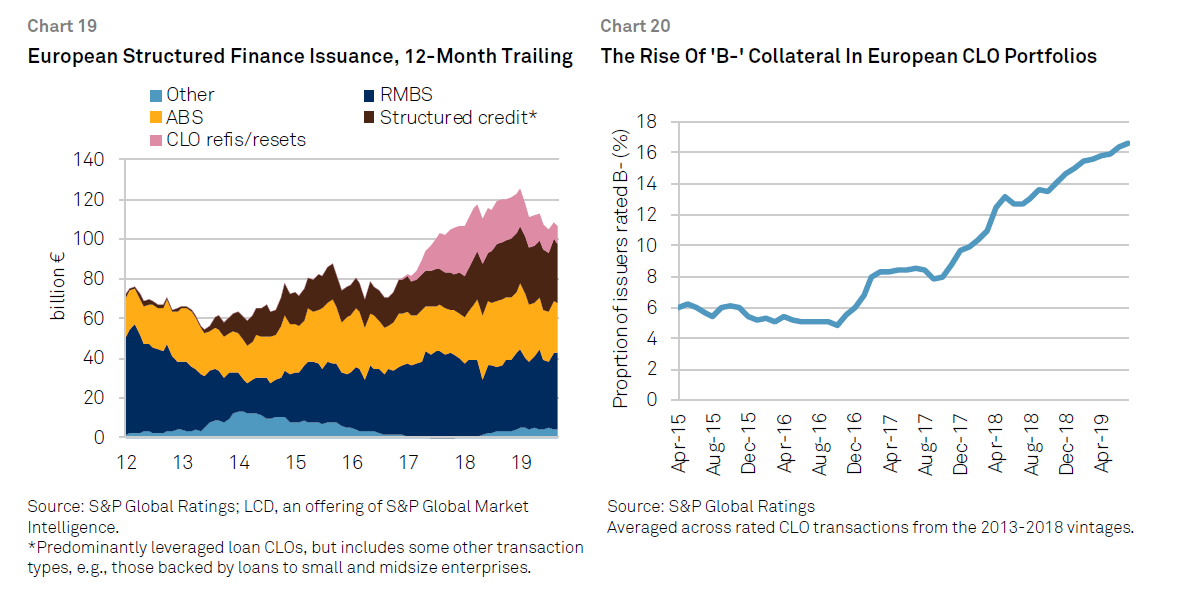

The third quarter of 2019 saw further settling of the European securitization market, after an issuance shutdown earlier in the year, prompted by teething problems with the EU's new Securitization Regulation (see chart 19). Issuance has normalized even though several technical standards for the new regulations have not yet been completely finalized, including those covering disclosure requirements. That said, the ECB's swing back toward monetary easing will likely be a net negative for structured finance issuance. The prospect of rate cuts and renewed asset purchases has already affected the relative attractiveness of structured finance for both issuers and investors. Many covered bonds now have a deeply negative yield, and new issuance in August included the lowest-yielding benchmark covered bond ever, at close to -0.6%. Meanwhile, a new round of TLTROs could directly substitute for some securitization and covered bond issuance.

Key assumptions

- Outstanding technical standards for the EU's Securitization Regulation could clear the final stages of the legislative process in the coming months, helping to reduce related uncertainty.

- A new round of TLTROs will likely dampen bank-originated securitization and covered bond volumes.

- The economic environment remains sufficiently benign that neutral to positive ratings migration should continue across our European structured finance ratings universe. In the 12 months to end-June 2019, our ratings on average moved higher by more than one-fifth of a notch.

Key risks

There are currently few signs of deterioration in aggregate credit performance for the collateral pools backing most types of European securitizations that we rate. However, one area of focus is the growing concentration of collateral rated 'B-' in asset pools backing European collateralized loan obligations (CLOs; see chart 20)—a trend that's been more pronounced in CLO portfolios than in the overall universe of European speculative-grade corporates that we rate. Some market participants have expressed concern that a greater concentration of 'B-' credits in the pool puts CLOs at greater risk of breaching certain triggers in the event of a corporate downturn, notably their 'CCC' concentration limits and subsequently junior overcollateralization tests. However, such a breach could actually be credit positive for senior noteholders, as CLO transactions are designed to pay down their liabilities and de-lever earlier in this scenario. The extent to which new CLO issues may generally be closing with lower quality collateral pools is taken into account in our ratings analysis, and these transactions will have more credit enhancement for a given tranche rating, all else being equal.

What to look for over the next quarter

- EU Securitization Regulation: Over the next quarter, we will track the likely timing of final ratification by the European Parliament for the remaining technical standards. It will also be interesting to see whether any pricing differential emerges between transactions with the "simple, transparent, and standardized" label and those without.

- ECB: We will monitor banks' uptake of the ECB's new round of TLTROs, assessing the likely impact on bank-originated securitization and covered bond issuance.

- Interest rate benchmark transition: We will follow the ongoing adoption of the sterling overnight index average (SONIA) rate as a new benchmark in pound sterling-denominated transactions, as well as developments in the project to reform the euro interbank offered rate (Euribor). In particular, we will follow originators' planning for a change of benchmarks in existing transactions.

Insurance

|

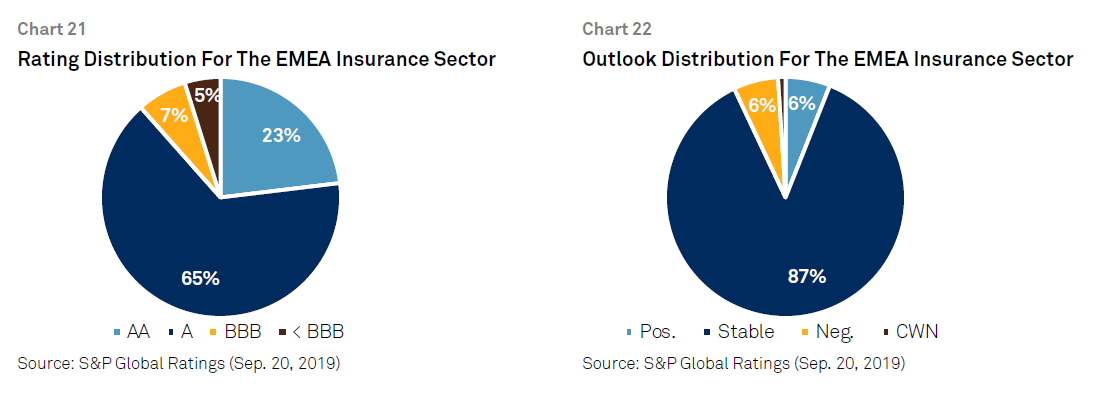

What's changed?

The IASB's consultation period on amendments to its proposed insurance accounting standard IFRS 17 ended on Sept. 26. The change from IFRS 4 Phase II would be fundamental, as well-known accounting metrics would vanish and new ones will be introduced from 2022. We expect insurers to incur some costs for implementation, with a further delay beyond 2022 possibly increasing those costs. However, we do not expect any rating changes as a direct consequence.

Global property/casualty reinsurance prices have been rising for 2019 renewals in reaction to record back-to-back catastrophe years in 2017 and 2018 and the resulting rise in losses, with positive momentum heading into 2020. As a result, we've revised our 2019-2020 earnings forecast slightly upward, with an expected combined ratio of 95%-98% and a return on equity of 7%-9%. The reinsurance sector didn't earn its cost of capital in 2017 and 2018, but 2019 looks more promising. Nevertheless, the sector still faces fundamental competitive trends and ample capacity from traditional and alternative capital.

Key assumptions

- Extended low interest rates in Europe gradually reducing investment income.

- Technical income from non-life insurance in many EMEA markets remaining the key pillar of operating profit.

- Brexit risks continuing to be manageable for EMEA insurers, including in the U.K. in case of a no-deal Brexit.

Key risks

- Long-term interest rates to remain low, further eroding life insurers' investment margins.

- Capital market volatility leading to asset impairments, following a no-deal Brexit or global trade war, for example.

International Public Finance

|

What's changed?

- In the U.K. continuing uncertainty about Brexit is exacerbating risks for public-sector entities. Currently more than one-half of our 45 public ratings on social housing, universities, and local governments have negative outlooks, reflecting a moderate probability of both sovereignrelated and intrinsic downside case scenarios.

English-based social housing providers remain exposed to sales on the open market. With residential property prices stagnating across the country and decreasing in London, many large housing associations face lower-than-previously-expected financial performance and elevated debt burdens. Over the past 12 months, Brexit uncertainty contributed to downgrades and negative outlook revisions on 18 U.K. social housing entities.

We believe that the performance of U.K. universities may weaken unless they implement costsaving measures. Higher pension contributions and salaries, especially for staff from outside the U.K., combined with potentially lower fees or weaker demand, will likely force universities to become more proactive in cost cutting. Even though universities have recently approved a higher contribution to the Universities Superannuation Scheme (USS), the pension deficit may increase again based on updated calculations of the plan's managers.

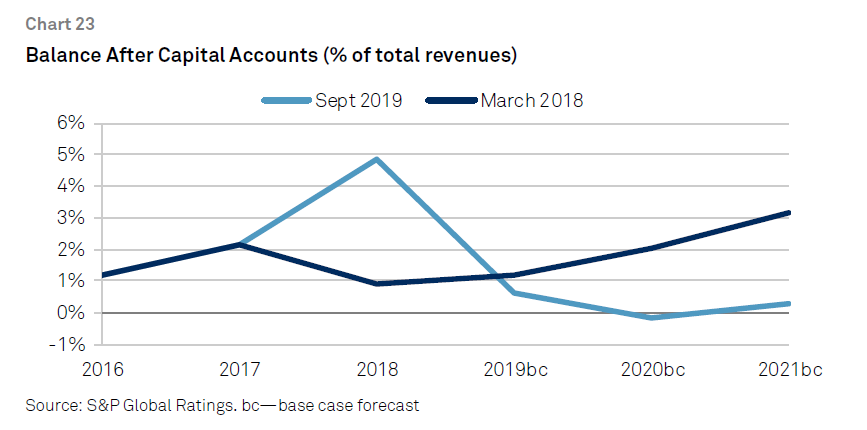

- Germany's economic slowdown, combined with a weaker support for traditional political parties, will likely lead to much lower budget surpluses if any, and larger borrowings for German states. We project real GDP growth will decrease to an average annual 1% in 2019 and 2022. We assume that the combined budget balance of six rated German states would turn slightly negative in 2020 and remain breakeven in 2021 (see chart 23). This marks a material weakening compared with our expectations 18 months ago.

- Spanish LRGs are forming their governments as a result of the latest local, regional, national and European elections. Since fourth-quarter 2018, when Spain's central government defined a procedure for regions to gradually return to market financing, a handful of the country's regions have resumed bond placements. We believe this trend will continue and even strengthen in 2019 despite an anticipated government change as a result of scheduled parliamentary election in May. So far, Andalusia, Asturias, Balearic Islands, Castilla y Leon, and Galicia have successfully returned to the markets, placing bonds with strong demand from domestic and international investors. Madrid and Basque Country have continued to tap the markets as they have done in recent years, including during the economic crisis.

- The Swiss nationwide referendum approved a federal corporate tax reform to make the Swiss tax code compliant with international rules. Cantons have been gradually taking decisions regarding the cantonal parts of the corporate tax. We assume that changes to both federal and cantonal parts of the tax will come into force in 2020 or 2021. We incorporate the anticipated changes in our financial forecasts on Swiss cantons.

What to look for over the next quarter

- The impact of Brexit negotiations on macroeconomic conditions, real estate prices, and demand for higher education in the U.K.

- The financial policy of German states in response to economic slowdown and a relatively weak performance of traditional parties at the latest local elections.

- The financial policy of a new Spanish government formed after the likely parliamentary elections in November.

- The content of the local tax reform, which the French central government will present to parliament in September-October