1. Key benchmarks fall

Dated Brent lost approximately 5% of its value during the course of last week (January 24-31), while copper – seen as a barometer of economic health – saw an even larger slide. However, by the end of the week market participants were seeing the metal as oversold, with some looking to take long positions in anticipation of China returning to the market.

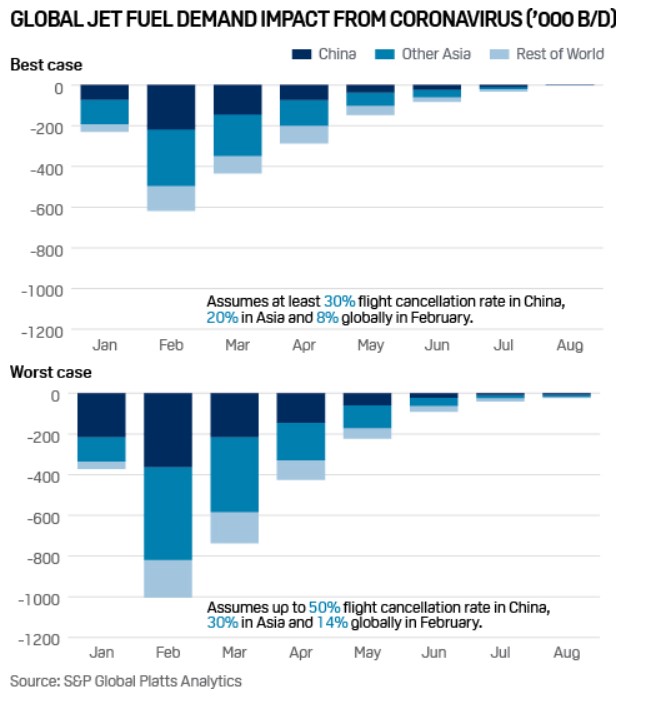

2. No blue skies for jet

Key international airlines including British Airways, Lufthansa, American Airlines, United Airlines, Swiss International Air Lines and Austrian Airlines, suspended or reduced flights due to the outbreak. S&P Global Platts Analytics forecasts show potential for a steep drop in jet fuel demand. In the best case scenario, global demand for jet fuel could fall by 618,000 b/d in February, and in the worst case scenario, by 1 million b/d.

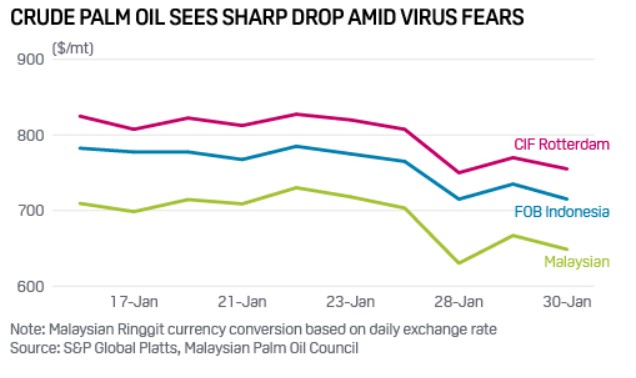

3. Palm oil problems

Prices of crude palm oil, commonly used in food products, fell sharply last week following a three-month long rally, correcting by 10% in a single day, on a combination of a huge selloff worries about lower demand. China, the world’s second-largest palm oil buyer, imported 6.8 million mt of the product in 2018-19 (October-September).

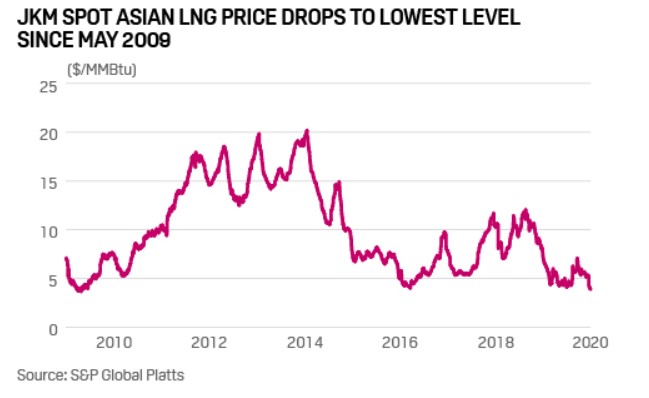

4. Double blow for LNG

The coronavirus outbreak has compounded an already depressed market for LNG. The JKM Asian spot LNG price has fallen below $4/MMBtu to levels not seen since May 2009 on persistent oversupply and weak demand. China has driven global LNG demand growth in recent years, so any slowdown in import growth in the country could have a significant impact. If reduced industrial activity across Hubei Province extends to end-February, S&P Global Platts Analytics estimates it would reduce Chinese LNG demand in the month by 5%-7% relative to its base case, or 11-15 million cu m/d.

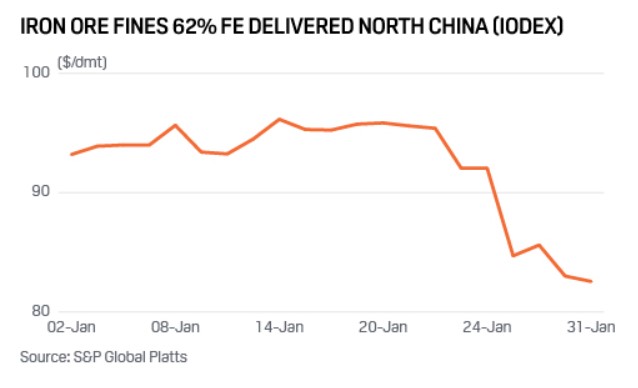

5. Iron ore falls

Prices of iron ore 62% Fe fines delivered to north China (IODEX) fell 10.3% over the past week alone (January 24-31) to $81.65/dmt on Friday, after steel market demand prospects deteriorated. Some steel mills in Shandong and Shanxi provinces have reportedly reduced production by up to 20% in February. Transport restrictions to control the spread of coronavirus have made it difficult to obtain raw material supplies or export steel, while many local construction projects have been halted.

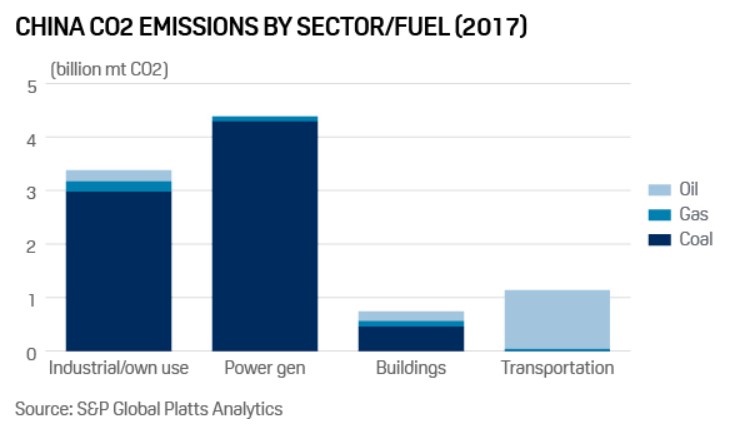

6. Emissions impact

Quantifying the impact of the coronavirus outbreak on China’s carbon emissions is a hugely complicated endeavour. However, the most obvious sector impacted is oil, which dominates China’s transport emissions at 1,094 million mt CO2 in 2017. China’s power sector – which is dominated by coal – generated 4,393 million mt CO2 in 2017, while the industrial sectors emitted 3,380 million mt. A key factor will continue to be the extent of Chinese government curbs on transport and industry. Even a 1% drop in China’s annual CO2 emissions from energy consumption would amount to 96 million mt, , equivalent to France’s annual regulated CO2 emissions.