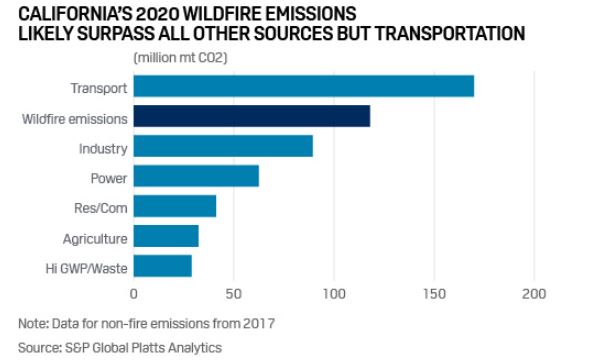

In California, greenhouse gas emissions produced by this year’s record-breaking wildfire season have climbed past the industrial, power and residential emissions categories and could even overtake transportation as the top polluter, according to estimates by S&P Global Platts Analytics.

The scale and devastation of the California wildfires have also added urgency to the state government’s climate priorities, with the latest measure targeting that top emitter, cars.

Governor Gavin Newsom pointed to the fires when announcing an ambitious new target to phase out new sales of gasoline-powered cars within 15 years.

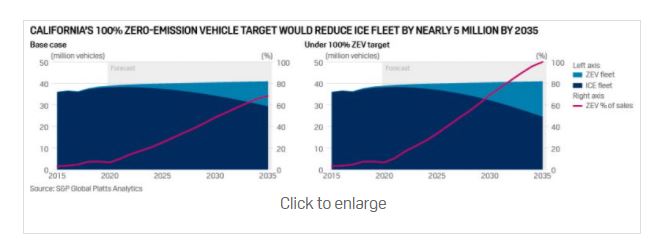

Newsom directed the California Air Resources Board to develop increasing percentage standards that result in zero-emission vehicles reaching 100% of new passenger car sales by 2035. A separate target would require the medium and heavy-duty fleet reach zero emissions by 2045.

While adding to the urgency of reducing emissions, the wildfire season also exposes one of many challenges to the rapid electrification of transportation. California power companies at times this year turned to rolling blackouts to mitigate wildfire risks to lines and meet surging demand during record heat.

“If these vehicles want to plug into the grid, you have to shore up the grid too and make sure the grid is as low carbon as possible,” said Jennifer McIsaac, emissions and clean energy analyst for S&P Global Platts Analytics.

Starting under 10%

ZEVs currently represent less than 10% of California new passenger car sales, but the state did have a pathway for reaching its previous target of 5 million vehicles by 2030, McIsaac said.

“Moving to 100% of passenger car sales by 2035 goes pretty far beyond what we had been assuming,” she said. “Making the goal and then meeting the goal are two different things.”

So how likely is California to meet this 100% ZEV target by 2035?

McIsaac said reaching the target will depend in part on whether the state can continue chipping away at costs to consumers through rebates funded by cap-and-trade revenue, because electric vehicles are not expected to be cost-competitive until later in the decade. Consumer preference, range anxiety, charging infrastructure and fleet turnover will also be challenges, she said.

Current assumptions about a 12-year fleet turnover could stretch longer if the coronavirus pandemic leads drivers to hold onto their cars longer because of tighter budgets, McIsaac said.

Election impacts

A more immediate hurdle centers around the US presidential election.

A second term for President Donald Trump would mean continued legal wrangling between California and the Environmental Protection Agency, with the chief threat being a revocation of the state’s waiver to set tougher-than-federal clean air standards.

However, if Democratic challenger Joe Biden wins the November election, a friendly EPA with strong climate goals could eliminate those near-term policy and legal hurdles.

Rapidan Energy Group analyst Sam Reynolds said two factors are central to the question of whether California can realistically meet the 2035 target.

First, the 100% ZEV goal administered by CARB is a mandate on manufacturers to produce and sell electric vehicles, not a mandate on consumers to buy them.

“This means that the question of whether California will hit this new target is really about enforcement,” Reynolds said. “Will the California government enforce this requirement on vehicle producers in 2035? If there’s a change of heart from state leadership from now until then, we could see the goal rolled back.”

But Reynolds said CARB has consistently been one of the most progressive state agencies in the country on the issue of electric vehicle adoption. And expected steep reductions in battery prices and buildouts of charging infrastructure will only increase the government’s willingness to enforce the target, he predicts.

Compliance credits

Reynolds said the second factor that will determine if the state reaches the target is that “there’s a difference between compliance with the mandate and actually putting plug-in electric vehicles on the road.”

Automakers receive a set number of credits for each car sold, determined by drive train, battery range and other factors, with most ZEVs receiving more than one credit, he said.

“So this means to hit the 100% target, manufacturers might not literally have to sell 100% electric vehicles – they only have to submit credits equal to the number of vehicles they sold that year,” Reynolds said.

But Reynolds cautions that a Biden win and elimination of the EPA fight remain “big, big hypotheticals” for the future of California’s clean car policies.

“The ball is still very much in the air for automakers,” he said. “If Trump wins, we think the Supreme Court would uphold a termination of that waiver and would eliminate the ability of California to enforce that ZEV program.”

Fuel for Thought is a weekly column published first in S&P Global Platts Oilgram News