The timeframe for resolving the nature of Britain’s exit from the EU may be truncated yet again with the potential for another round of prorogation of the British parliament, The Scotsman reports. That provides another layer of political complexity which – assuming the Johnson administration abides by the Benn law as outlined in Panjiva’s research of Oct. 1 – could continue through the end of the year at least.

In any event it’s important that any form of Brexit will both increase supply chain operational costs – by as much as £15 billion (or $19.6 billion) for red tape alone according to HM Revenue and Customs – in dealing with the EU. Dealings with the rest of the world will also continue to face existing tariffs that have been applied by non-EU countries.

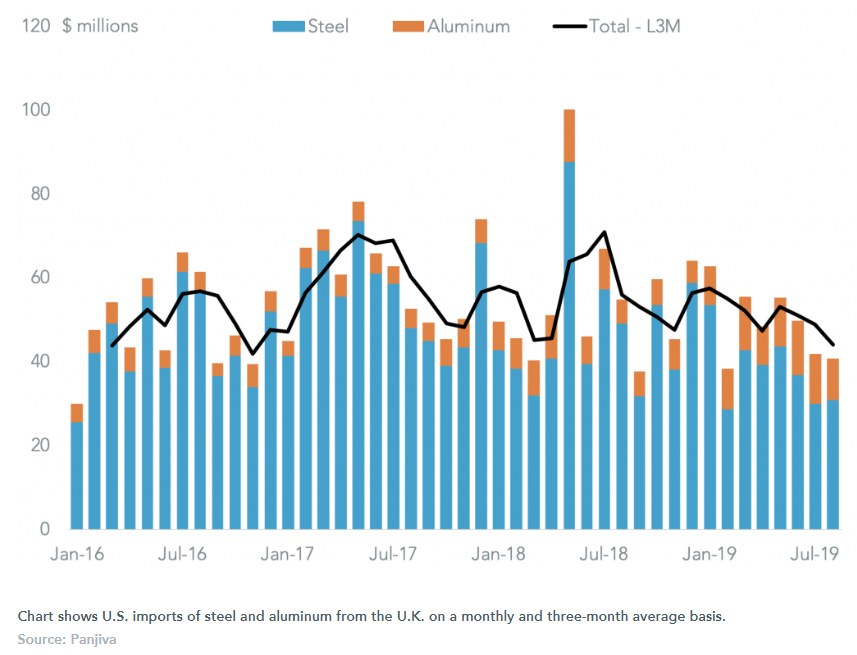

For example, the British steel industry is already exposed to three specific tariffs relating to steel as well as the section 232 tariffs on the steel and aluminum industry, Panjiva’s analysis of government filings show. Panjiva’s data shows British exports of steel and aluminum to the U.S. covered by the section 232 tariffs were worth $599 million in the 12 months to Aug. 31, up 2.1% from 2016.

NO NOTICEABLE IMPACT FROM U.S. TARIFFS ON BRITISH EXPORTS

While, as flagged by Congressional Research Service, the administration of President Donald Trump is supportive of Brexit conceptually and has started negotiations to formulate a new trade deal it’s unlikely that existing tariffs will be removed before a full trade deal is completed.

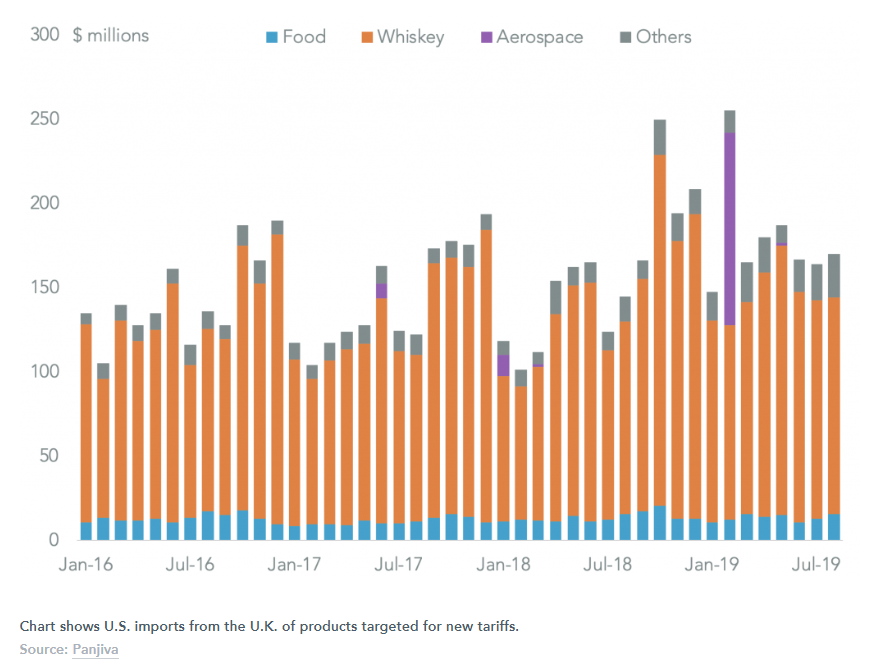

In the meantime the U.K. is also embroiled in the U.S.-EU spat regarding each region’s subsidies for their aircraft industries. The most recent U.S. Trade Representative filing shows that new tariffs at rates of 25% will be applied to British goods including agricultural products, apparel, capital goods and beverages.

Panjiva’s analysis shows these were worth an aggregate $2.25 billion in the 12 months to Aug. 31, or 3.6% of total British exports to the U.S.

WHISKEY THE BIGGEST TARGET FOR NEW U.S. TARIFFS

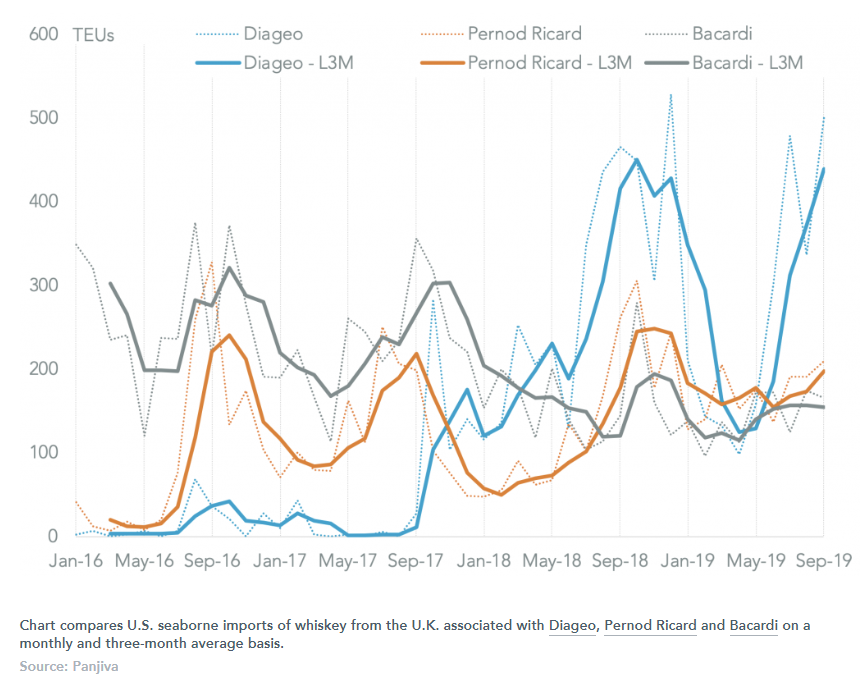

The largest product group covered by the tariff list is whiskey, which alone accounted for 12.4% of the total, or $1.75 billion of exports to the U.S. from the U.K. in the 12 months to Aug. 31. Panjiva’s seaborne data shows the largest seaborne shipper of whiskey was Diageo with 31.2% of shipments associated with the firm in the 12 months to Sept. 31. That was followed by Pernod Ricard with 19.3% and Bacardi with 15.8% of shipments over the same period.

After whiskey and aerospace the next largest category covered was self-propelled construction diggers worth $120 million – shipments of which include those by JCB, Hitachi’s Millar, Sandvik and Caterpillar.

DIAGEO LEADS BRITISH EXPORTS OF WHISKEY TO THE U.S.

Chart compares U.S. seaborne imports of whiskey from the U.K. associated with Diageo, Pernod Ricard and Bacardi on a monthly and three-month average basis.