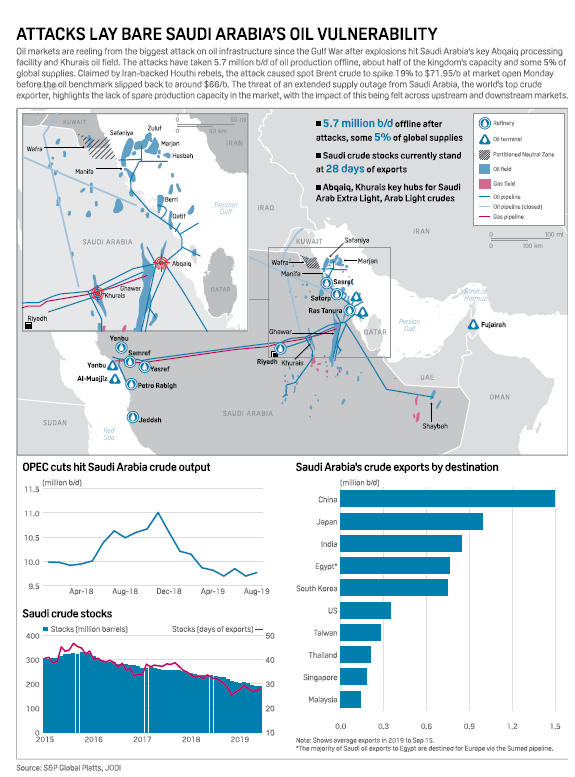

The strike on the state oil producer Saudi Aramco's, Abqaiq oil-processing facility and the Khurais oilfield on Saturday, Sept. 14, won't only trigger higher oil prices but will also heighten geopolitical tensions that have already been ramping up in the Middle East. The Saturday strikes by aerial drones, claimed to have been conducted by the Houthi rebels in Yemen, resulted in Saudi Arabia cutting crude production by 5.7 million barrels per day (bpd).

This direct hit on more than half of Saudi Arabia's total production, and any protracted delays in restoring supplies, will have significant ramifications for oil markets. However, recent updates from Saudi Arabia indicate it's hoping to bring 2.2 million barrels online by the end of the day Monday. Nevertheless, the fact that one combined strike can knock out not just 5% of global supply, but more than double the amount of global spare-production capacity, highlights the concentration risk and oil market vulnerabilities. This is the sixth reported attack conducted on Saudi oil interests and facilities over the past four months, although the previous attacks, believed to have been carried out by Houthi rebels as well as Iran, didn't cause any significant disruptions. The rebels, with Iranian support, have been waging a civil war against groups backed by Saudi Arabia.

Will Commodity Prices Increase And What Is The Impact On Credit Quality?

The question that really concerns the market is what the response will be from Saudi Arabia, the U.S., and many Western nations if it's believed that Iran supported or was behind the attacks. Any escalation or prolonged military conflict would most likely lead to oil prices increasing rapidly toward $100 per barrel. There's no doubt the resulting price increase will be a boost for many oil producers, particularly for U.S. shale producers who have been one of the worst-performing sectors in the S&P 500 and are under the microscope from investors to reign in production, live within cash flow, and improve returns.

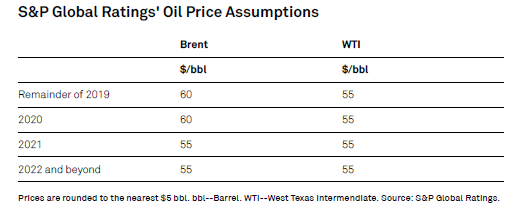

However, it's still too early to tell what the credit impact will be and it will largely depend on how long and how much oil production is off the market. Closing prices for Monday saw an increase in the front-month prompts for West Texas Intermediate of more than $7 to more than $62 per barrel and an $8 increase for Brent to $68.22 per barrel, which in and of itself, is unlikely to move the needle for most global exploration and production (E&P) companies' credit quality. More importantly, the back end of the futures curve has moved up nominally by a few dollars indicating investors are taking a wait-and-see approach.

For reference, see S&P Global Ratings' oil price deck, which we use to assess credit quality for E&P issuers.

Given investor sentiment to keep production at current levels, we would expect E&P companies to maintain production guidance and reap the benefits from increased prices. However, if it appears Aramco's production will be offline for some time, and inventories shrink to critical levels, we expect producers will open the spigot and ramp up production.

Beyond crude oil, local operational disruption may be felt most keenly by petrochemical producers. Local petrochemical producers have reported cuts of about 30%-50% of feedstock supplies, because priority is given to gas supplies to utilities for power generation. We understand there's limited gas available in local storage to act as a cushion, contrary to the position for oil in Saudi Arabia and globally. Saudi Arabia accounts for about 4.5% of global chemicals supply, mainly petrochemicals, and is the world's largest polyethylene exporters. As of today, polyethylene prices were up around 5% from last week.

Abqaiq Production Is Key For Aramco

Just how important is the Abqaiq oil processing facility to Saudi crude production? In a word, very! Saudi Aramco claims Abqaiq is the world's largest stabilization facility and can process up to 7 million bpd of Saudi crude production. It was responsible for processing approximately 50% of the company's crude production last year. The 5.7 million bpd of oil production cuts represents about 5% of global supply. Its main purpose is to convert sour crude into sweet through the removal of hydrogen sulfide as well as making crude safe for crude tankers to transport by reducing vapor pressure.

Abqaiq not only processes oil from the Khurais oilfield but also from the Shaybah and Ghawar fields and is central to transporting crude via pipelines to Saudi's coastal export terminals. The recent attacks and risks to shipping in the Strait of Hormuz serve to underscore that the Middle East remains a hotbed of political tensions and strife. The attacks also highlight just how vulnerable Saudi oil facilities are to attacks. Saudi Arabia, with more than 10 million bpd, accounts for approximately 12% of the global crude oil supply. Moreover, with 265 billion barrels of proved reserves, the country controls approximately 20% of the world's proven oil reserves.

A protracted disruption at Abqaiq could have a significant impact on oil markets and prices. However, at this juncture, it's too early to tell and will depend on how long the facility will be down. If it becomes apparent that Aramco can repair the damage quickly or implement workarounds, market pundits believe oil prices will rise $3-$5 per barrel, reflecting a risk premium regarding market concerns about the Kingdom's ability to protect its oil interests and maintain reliable supplies. If it's revealed the damage was extensive and production will remain offline for a protracted period, oil prices could rise over $10 per barrel as spare-production capacity and stored inventories are utilized. We should also see the light-heavy differential widen a bit due to the loss of light oil production in the market.

The attacks come at a time when both global oil demand estimates are being revised down and OPEC and Russia extended 1.2 million bpd of production cuts into March 2020, in order to stabilize oil prices and the supply/demand balance. By so doing, one of the goals is that global commercial inventories will be drawn to meet any demand needs. This raises the obvious question about what the global inventories look like. The initial response is that traders don't expect severe disruption to global oil trade. According to the International Energy Association (IEA), most developed countries have sufficient inventories of crude with levels the highest they have been since the fall of 2017. Countries of the Organization for Economic Cooperation and Development have approximately 3 billion barrels in storage, enough to meet about two months of demand, with Saudi Arabia having 27 days of inventory to meet obligations. Furthermore, the IEA requires its members to store at least 90 days' worth of oil imports in emergency stocks. In addition, in order to calm markets, President Trump stated he could release inventory if needed from the Strategic Petroleum Reserve, which according to Platt's Analytics contains about 645 million barrels of oil.

Economic Impact

The impact of higher oil prices on an economy depends on a number of factors--how dependent a country is on oil, how much supply it has of its own, either stored for emergencies or from domestic production, and how strong the economy was heading into the oil price jump. Finally, the larger the jump, the bigger the hit: a $10 increase in oil prices will have a smaller impact on an oil-importing economy than a $50 spike. Energy-exporting countries, like Mexico, United Arab Emirates, and Russia would gain from higher oil prices. However, oil demand will fall as higher costs weaken oil-importing economies, cutting into these gains. Oil-importing economies will suffer the most from higher oil prices, depending on how high they go. Asian economies are large oil-importers. After the U.S., China, India, and Japan were the three largest consumers of oil in 2016 according to the EIA. The global slowdown, together with trade tensions between the U.S. and China turning to war, make the regional economies even more vulnerable to higher oil prices. The jump in oil prices would be particularly problematic for smaller oil-importing emerging markets.

Advanced economies tend to use oil less intensively and so they aren't hurt as much by a jump in oil prices. Unlike France, which has 75% nuclear energy in the energy mix, Spain is more dependent on oil imports so will be more affected by higher prices.

Already the U.S. expansion, now the longest in the nation's history, is facing strong headwinds. Increasing trade headwinds and a marked slowdown in growth abroad amid fiscal stimulus filtering out of the economy have already increased the risk of recession to 30%-35% from 10%-15% only a year ago. Higher oil prices will add more stress to an already weakening economy.

Gasoline prices, which have already been creeping higher, will climb higher. The American consumer, which has been a stalwart for this expansion and a stabilizing force for the economy overall, will slow spending, because more money in the gas pump means less to spend for items at the mall. But while a hit to household pocketbooks, the U.S. economy is less vulnerable to oil-price increases than it used to be because household spending on energy as a percentage of GDP has declined as we've become far more energy efficient overall. In addition, higher oil prices mean more contribution to GDP growth from domestic producers. Domestic producers have increased their production of crude oil significantly from where it was a decade ago, which has led to a steady decline in oil imports--in fact, the U.S. is now the largest oil producer in the world (and the largest consumer of oil. The rule of thumb had been that for every $10 increase in a barrel of oil adds 0.25 cents to a gallon of gas, and shaves off 25 basis points (bps) off GDP if it lasts for a year. However, given the U.S. is now the largest oil producer in the world, the gains to energy-related businesses has likely reduced that figure to closer to 20 bps off GDP from 25 bps.

The attacks come at a time when both global oil demand estimates are being revised down and OPEC and Russia extended 1.2 million bpd of production cuts into March 2020, in order to stabilize oil prices and the supply/demand balance. By so doing, one of the goals is that global commercial inventories will be drawn to meet any demand needs. This raises the obvious question about what the global inventories look like. The initial response is that traders don't expect severe disruption to global oil trade. According to the International Energy Association (IEA), most developed countries have sufficient inventories of crude with levels the highest they have been since the fall of 2017. Countries of the Organization for Economic Cooperation and Development have approximately 3 billion barrels in storage, enough to meet about two months of demand, with Saudi Arabia having 27 days of inventory to meet obligations. Furthermore, the IEA requires its members to store at least 90 days' worth of oil imports in emergency stocks. In addition, in order to calm markets, President Trump stated he could release inventory if needed from the Strategic Petroleum Reserve, which according to Platt's Analytics contains about 645 million barrels of oil.